Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Gas fired kilns had nice features that offset the electric kilns' problems. For one thing the heat was much more uniform within the kiln, creating

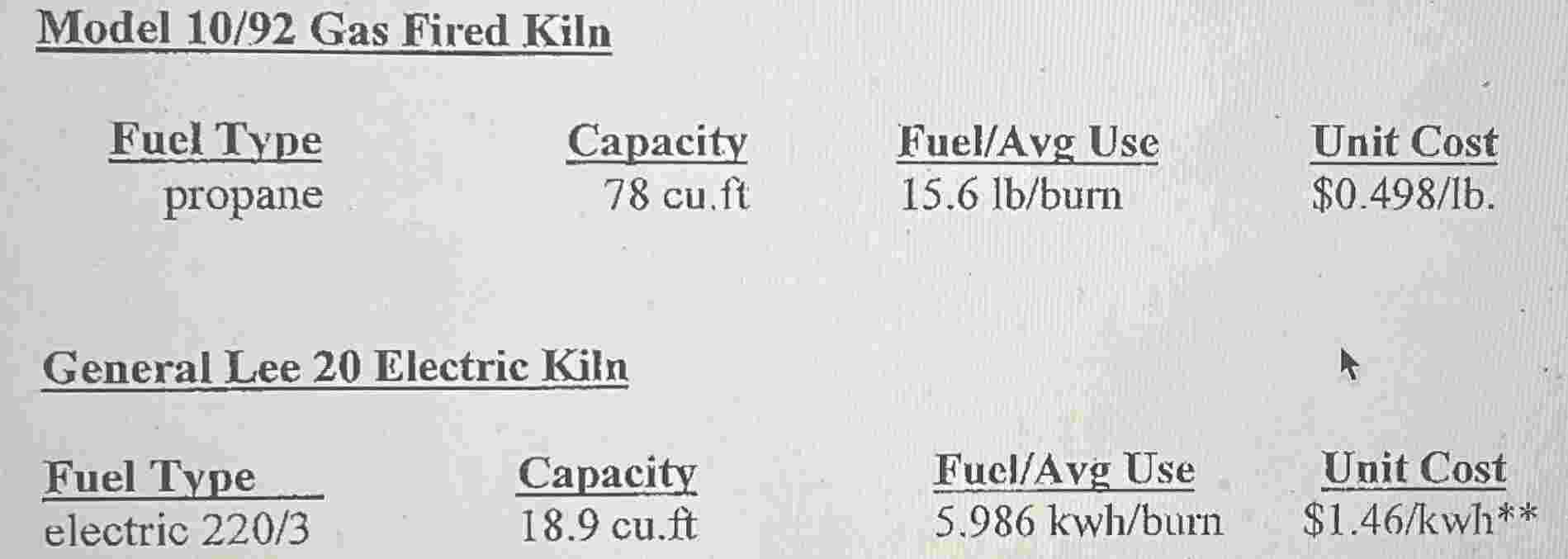

Gas fired kilns had nice features that offset the electric kilns' problems. For one thing the heat was much more uniform within the kiln, creating more consistency of the product. Temperature control was easier, and quickly adjusted. Certain glazing colors were possible with fire that were not possible with electric heating. Gas kilns typically were available in a wider variety of sizes, and large production kilns could yield large quantities of product quickly. One of the best features of gas was that it was cheap to operate. One of Julian's fellow artists in Richmond said that he ran his cubic foot kiln for only $ per burn on average. The kiln was about a foot cube, with shelves inside for layering items. What Julian was considering was a bank of three units, each having a cubic foot capacity. Julian reasoned that small production runs could be handled by one or two kilns, but could also run all three for large jobs. The gas kilns were $ each a total investment of $ plus around $ for installation and expert testing. Julian figured that if he went to gas firing, he certainly wanted them to be as safe as possible. The same volume capacity could be accomplished with twelve electric units, costing $ each. The installation would only be $ for an industrial electric service. The balance sheet and income statement were made by an artist and not an accountant and are incorrect, can you correct them and awnser all questions Bentley Custom Ceramics

Income Statements Liabilities

Accounts Payable

Notes Payable

Total Liabilities

Owner's Equity

Bentley Capital

Total Liab. and Equity Exhibit Sales and Cost Projections.

Productivity and capacity assumed to be approximately the same for either project

electric units versus propane gas units

Project's useful life: years

year asset depreciation range ADR midpoint

Sales Projection: Additional $ per year $ per extra job on average

Total annual number of extra capacity firings per year over and above his current

production:

Incremental Cash Operating Expenses projections:

Cost of goods sold: $ more per year

No additional cartruck expense, professional fees, or office expenses

$ more in advertising per year

$ more insurance per year

$ more repair expense per year

Increase in interest expensc because of the loan Julian was unable to estimate this

cost

No change in rent still seven years left on ten year lease Higher utilities electric OR

gas which had to be estimated based on PTS data

Higher depreciation expense, because of the new equipment. Julian would get his

accountant to estimate this using the MACRS standard.

Supplies expense higher by $ per year

Wages expense higher by $ per yearEvaluate both alternatives using appropriate capital budgeting decision criteria.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started