Answered step by step

Verified Expert Solution

Question

1 Approved Answer

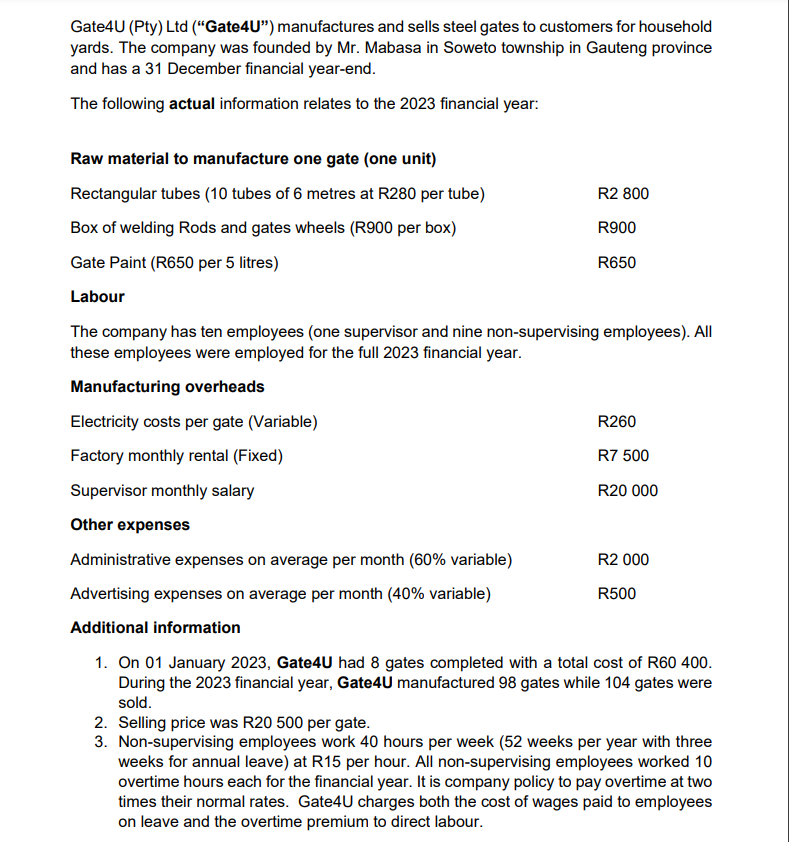

Gate 4 U ( Pty ) Ltd ( Gate 4 U ) manufactures and sells steel gates to customers for household yards. The

GateU Pty Ltd GateU manufactures and sells steel gates to customers for household

yards. The company was founded by Mr Mabasa in Soweto township in Gauteng province

and has a December financial yearend.

The following actual information relates to the financial year:

Raw material to manufacture one gate one unit

Rectangular tubes tubes of metres at R per tube

R

Box of welding Rods and gates wheels R per box

R

Gate Paint R per litres

R

Labour

The company has ten employees one supervisor and nine nonsupervising employees All

these employees were employed for the full financial year.

Manufacturing overheads

Electricity costs per gate Variable

R

Factory monthly rental Fixed

R

Supervisor monthly salary

R

Other expenses

Administrative expenses on average per month variable

R

Advertising expenses on average per month variable

R

Additional information

On January GateU had gates completed with a total cost of R

During the financial year, GateU manufactured gates while gates were

sold.

Selling price was R per gate.

Nonsupervising employees work hours per week weeks per year with three

weeks for annual leave at R per hour. All nonsupervising employees worked

overtime hours each for the financial year. It is company policy to pay overtime at two

times their normal rates. GateU charges both the cost of wages paid to employees

on leave and the overtime premium to direct labour.

Prepare the Actual Statement of Comprehensive Income for the

year ended December using direct costing principles.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started