Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Gately Clothiers have provided you with the below dashboard demonstrating the performance for two of their divisions. They are looking to see if they should

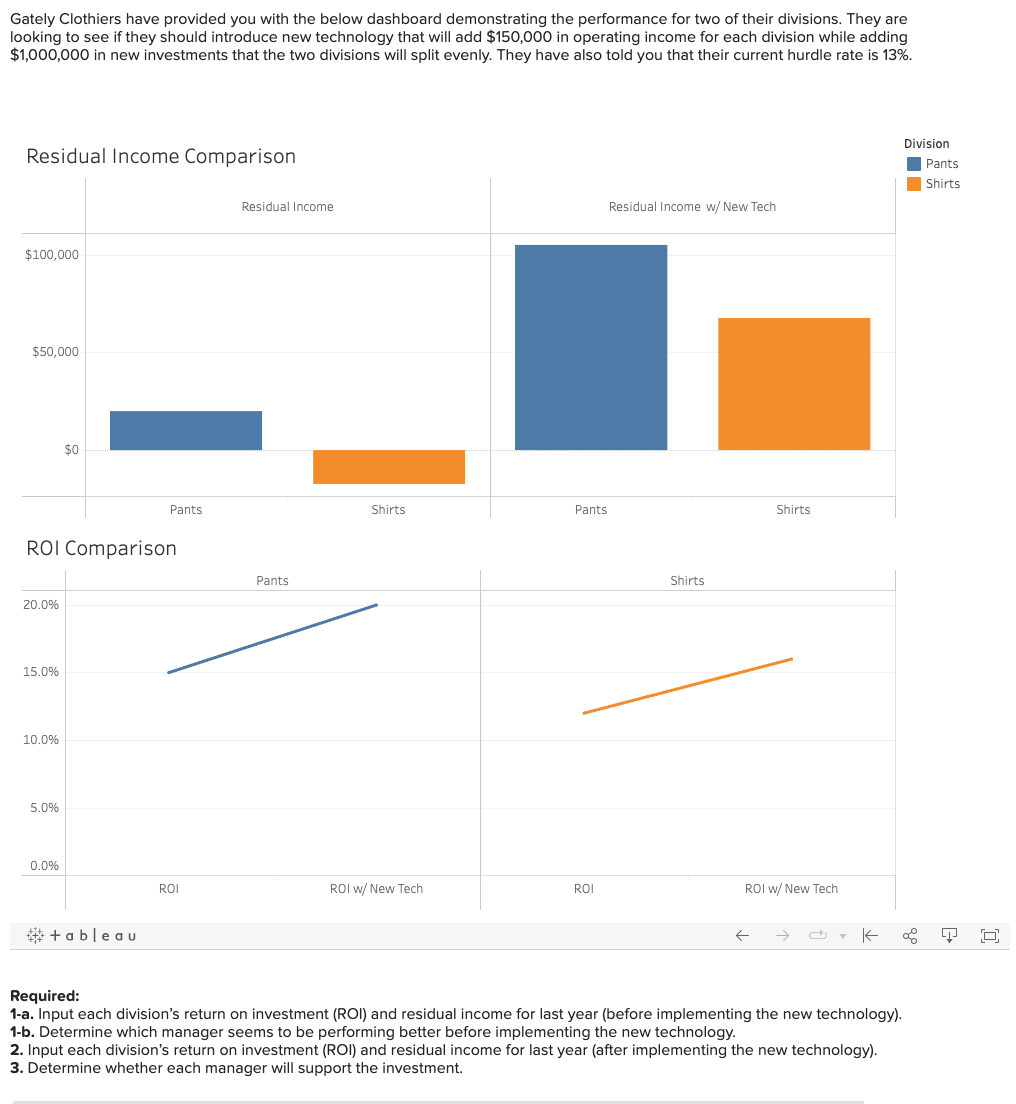

Gately Clothiers have provided you with the below dashboard demonstrating the performance for two of their divisions. They are looking to see if they should introduce new technology that will add $150,000 in operating income for each division while adding $1,000,000 in new investments that the two divisions will split evenly. They have also told you that their current hurdle rate is 13%.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started