Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Gateway Corporation issued $600,000 of five year 8% term bonds on January 1, 2022 with interest payable twice annually (each July 1 and January

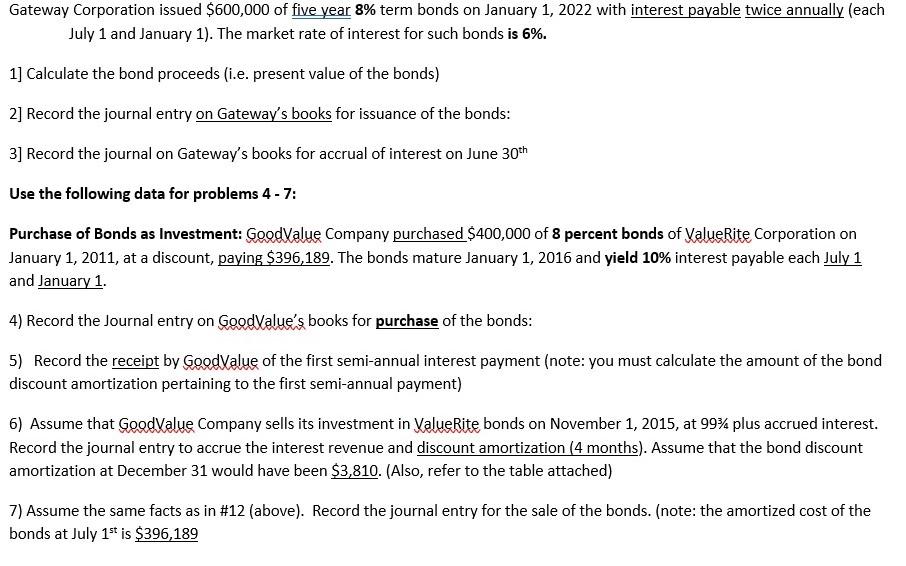

Gateway Corporation issued $600,000 of five year 8% term bonds on January 1, 2022 with interest payable twice annually (each July 1 and January 1). The market rate of interest for such bonds is 6%. 1] Calculate the bond proceeds (i.e. present value of the bonds) 2] Record the journal entry on Gateway's books for issuance of the bonds: 3] Record the journal on Gateway's books for accrual of interest on June 30th Use the following data for problems 4 -7: Purchase of Bonds as Investment: GoodValue Company purchased $400,000 of 8 percent bonds of ValueRite Corporation on January 1, 2011, at a discount, paying $396,189. The bonds mature January 1, 2016 and yield 10% interest payable each July 1 and January 1. 4) Record the Journal entry on GoodValue's books for purchase of the bonds: 5) Record the receipt by GoodValue of the first semi-annual interest payment (note: you must calculate the amount of the bond discount amortization pertaining to the first semi-annual payment) 6) Assume that GoodValue Company sells its investment in ValueRite bonds on November 1, 2015, at 99% plus accrued interest. Record the journal entry to accrue the interest revenue and discount amortization (4 months). Assume that the bond discount amortization at December 31 would have been $3,810. (Also, refer to the table attached) 7) Assume the same facts as in #12 (above). Record the journal entry for the sale of the bonds. (note: the amortized cost of the bonds at July 1st is $396,189

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Okay given the information provided here are the specific steps 1 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started