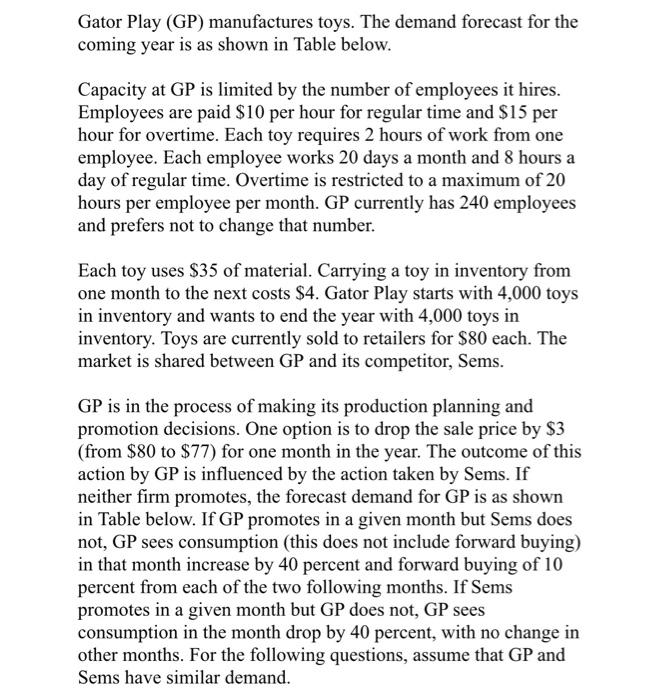

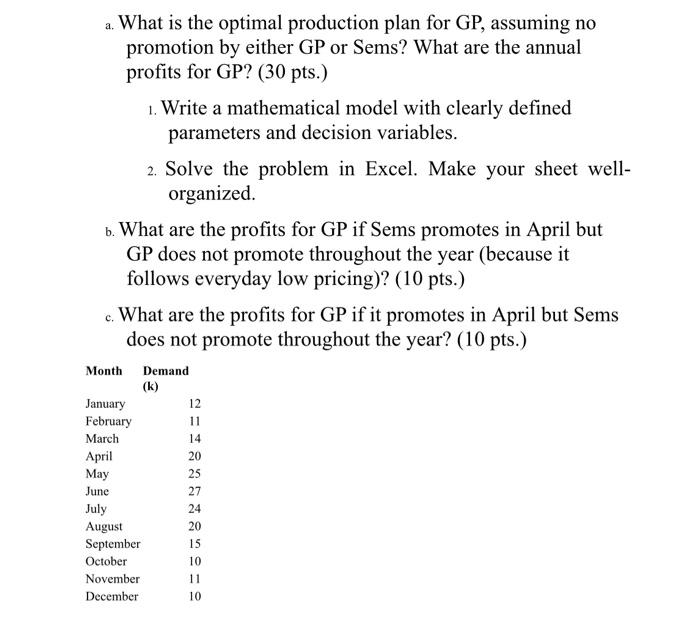

Gator Play (GP) manufactures toys. The demand forecast for the coming year is as shown in Table below. Capacity at GP is limited by the number of employees it hires. Employees are paid $10 per hour for regular time and $15 per hour for overtime. Each toy requires 2 hours of work from one employee. Each employee works 20 days a month and 8 hours a day of regular time. Overtime is restricted to a maximum of 20 hours per employee per month. GP currently has 240 employees and prefers not to change that number. Each toy uses $35 of material. Carrying a toy in inventory from one month to the next costs $4. Gator Play starts with 4,000 toys in inventory and wants to end the year with 4,000 toys in inventory. Toys are currently sold to retailers for $80 each. The market is shared between GP and its competitor, Sems. GP is in the process of making its production planning and promotion decisions. One option is to drop the sale price by $3 (from $80 to $77) for one month in the year. The outcome of this action by GP is influenced by the action taken by Sems. If neither firm promotes, the forecast demand for GP is as shown in Table below. If GP promotes in a given month but Sems does not, GP sees consumption (this does not include forward buying) in that month increase by 40 percent and forward buying of 10 percent from each of the two following months. If Sems promotes in a given month but GP does not, GP sees consumption in the month drop by 40 percent, with no change in other months. For the following questions, assume that GP and Sems have similar demand. a. What is the optimal production plan for GP, assuming no promotion by either GP or Sems? What are the annual profits for GP? (30 pts.) 1. Write a mathematical model with clearly defined parameters and decision variables. 2. Solve the problem in Excel. Make your sheet well- organized. b. What are the profits for GP if Sems promotes in April but GP does not promote throughout the year (because it follows everyday low pricing)? (10 pts.) c. What are the profits for GP if it promotes in April but Sems does not promote throughout the year? (10 pts.) Month Demand (k) January 12 February 11 March April 20 May June 27 July 24 August 20 September 15 October November December 14 25 10 11 10 Gator Play (GP) manufactures toys. The demand forecast for the coming year is as shown in Table below. Capacity at GP is limited by the number of employees it hires. Employees are paid $10 per hour for regular time and $15 per hour for overtime. Each toy requires 2 hours of work from one employee. Each employee works 20 days a month and 8 hours a day of regular time. Overtime is restricted to a maximum of 20 hours per employee per month. GP currently has 240 employees and prefers not to change that number. Each toy uses $35 of material. Carrying a toy in inventory from one month to the next costs $4. Gator Play starts with 4,000 toys in inventory and wants to end the year with 4,000 toys in inventory. Toys are currently sold to retailers for $80 each. The market is shared between GP and its competitor, Sems. GP is in the process of making its production planning and promotion decisions. One option is to drop the sale price by $3 (from $80 to $77) for one month in the year. The outcome of this action by GP is influenced by the action taken by Sems. If neither firm promotes, the forecast demand for GP is as shown in Table below. If GP promotes in a given month but Sems does not, GP sees consumption (this does not include forward buying) in that month increase by 40 percent and forward buying of 10 percent from each of the two following months. If Sems promotes in a given month but GP does not, GP sees consumption in the month drop by 40 percent, with no change in other months. For the following questions, assume that GP and Sems have similar demand. a. What is the optimal production plan for GP, assuming no promotion by either GP or Sems? What are the annual profits for GP? (30 pts.) 1. Write a mathematical model with clearly defined parameters and decision variables. 2. Solve the problem in Excel. Make your sheet well- organized. b. What are the profits for GP if Sems promotes in April but GP does not promote throughout the year (because it follows everyday low pricing)? (10 pts.) c. What are the profits for GP if it promotes in April but Sems does not promote throughout the year? (10 pts.) Month Demand (k) January 12 February 11 March April 20 May June 27 July 24 August 20 September 15 October November December 14 25 10 11 10