Answered step by step

Verified Expert Solution

Question

1 Approved Answer

GBH Inc. pays no dividends. Instead, the company reinvests all of its earnings into maintaining fast growth. (Why?) Smart people, however, believe the company's

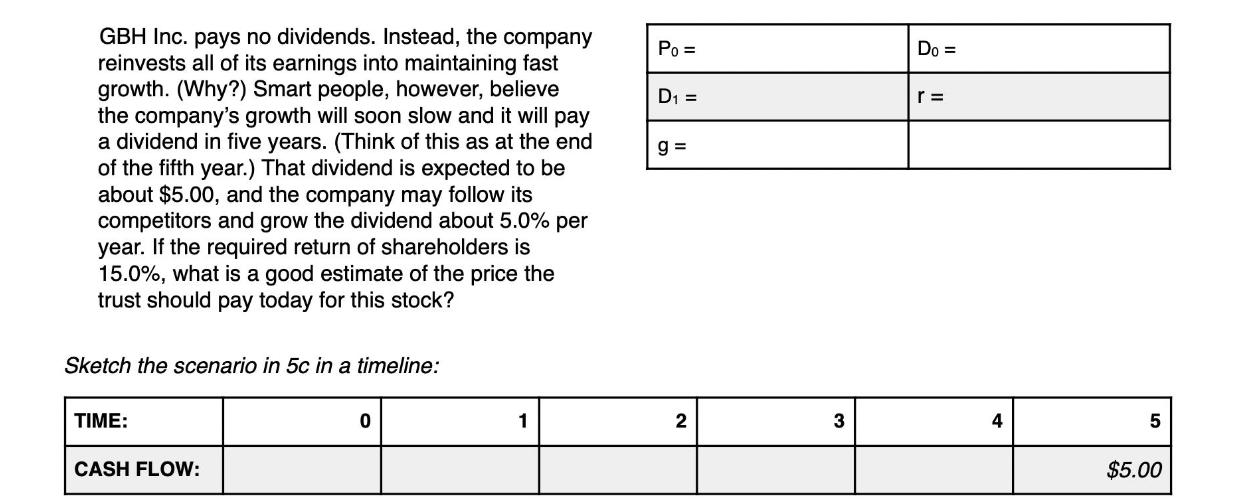

GBH Inc. pays no dividends. Instead, the company reinvests all of its earnings into maintaining fast growth. (Why?) Smart people, however, believe the company's growth will soon slow and it will pay a dividend in five years. (Think of this as at the end of the fifth year.) That dividend is expected to be about $5.00, and the company may follow its competitors and grow the dividend about 5.0% per year. If the required return of shareholders is 15.0%, what is a good estimate of the price the trust should pay today for this stock? Sketch the scenario in 5c in a timeline: TIME: CASH FLOW: 0 Po= D = g= Do = r = 1 2 3 4 5 $5.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer To analyze the advisability of selling the land we need to calculate the nominal and real var...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6642c26b82a89_974461.pdf

180 KBs PDF File

6642c26b82a89_974461.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started