Answered step by step

Verified Expert Solution

Question

1 Approved Answer

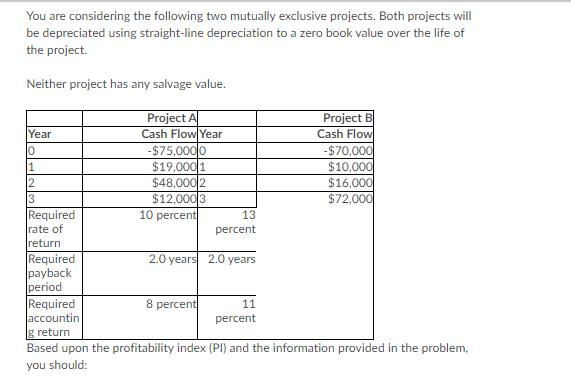

You are considering the following two mutually exclusive projects. Both projects will be depreciated using straight-line depreciation to a zero book value over the

You are considering the following two mutually exclusive projects. Both projects will be depreciated using straight-line depreciation to a zero book value over the life of the project. Neither project has any salvage value. Project A Project B Year 10 1 2 3 Required rate of return Cash Flow Year -$75,0000 Cash Flow -$70,000 $19,0001 $10,000 $48,000 2 $16,000 $12,000 3 $72,000 10 percent 13 percent Required 2.0 years 2.0 years payback period Required accountin 8 percent 11 percent g return Based upon the profitability index (PI) and the information provided in the problem, you should:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer To analyze the advisability of selling the land we need to calculate the nominal and real var...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6642c27662ea4_974460.pdf

180 KBs PDF File

6642c27662ea4_974460.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started