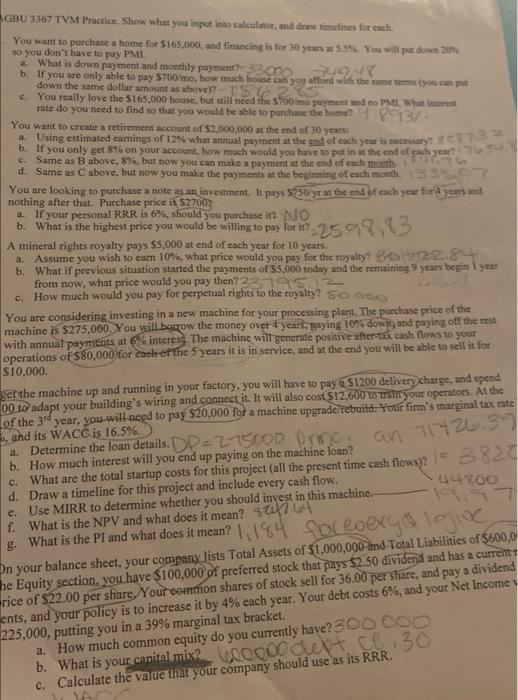

GBU 3367 TVM Practice. Show what you input into calculator, and draw timelines for each You want to purchase a home for $165,000, and financing is for 30 years at 5.5. You will down 20 so you don't have to pay PMI a. What is down payment and monthly payment? 33000 b. If you are only able to pay $700 mo, how much house can you afford with them you can down the same dollar amount as abovers c. You really love the $165,000 house, but still need the $700 mo payment and no PM What rate do you need to find so that you would be able to purchase the home? 0913/ You want to create a retirement account of $2,000,000 at the end of 30 years b. If you only get 8% on your account. how much would you have to put in at the end of each year 70509 year is necessary? 2373 c. Same as B above, 8%, but now you can make a payment at the end of each month d. Same as C above, but now you make the payments at the beginning of each month 3.907 You are looking to purchase a note as an investment. It pays 5750yr at the end of each year for years and nothing after that. Purchase price is $2700) 6purchase 6. What is the highest price you would be willing to pay for ir? 2599.03 A mineral rights royalty pays $5,000 at end of each year for 10 years a. Assume you wish to earn 10%, what price would you pay for the royalty? 30122.84 b. What if previous situation started the payments of $5,000 today and the remaining 9 years begin 1 year from now, what price would you pay then? 237952 c. How much would you pay for perpetual rights to the royalty? So 000 You are considering investing in a new machine for your processing plant. The purchase price of the machine is $275,000. You will becrow the money over years, paying 10% down and paying off the rest with annual payments at 6% interest. The machine will generate positive after-tax cash flows to your operations of $80,000 for each of the 5 years it is in service, and at the end you will be able to sell it for $10,000. ger the machine up and running in your factory, you will have to pay $1200 delivery charge, and spend 00 to adapt your building's wiring and connect it. It will also cost $12.600 to tratat your operators. At the of the 3rd year, you will need to pay $20.000 for a machine upgrade rebuild. Your fim's trurginal tax rate 3. and its WACC is 16.5%. * Determine the loan details. DP=27500D porno, an 71426:39 b. How much interest will you end up paying on the machine loan? c. What are the total startup costs for this project (all the present time cash flows)2 = 3820 44300 d. Draw a timeline for this project and include every cash flow. e. Use MIRR to determine whether you should invest in this machine. f. What is the NPV and what does it mean? 947 8. What is the Pl and what does it mean? 1.184 for every logic On your balance sheet, your company lists Total Assets of $1,000,000 and Total Liabilities of $600.0 he Equity section, you have $100,000 of preferred stock that pays $2.50 dividend and has a current rice of $22.00 per share. Your common shares of stock sell for 36.00 per share, and pay a dividend ents, and your policy is to increase it by 4% each year. Your debt costs 6%, and your Net Income 225,000, putting you in a 39% marginal tax bracket. a. How much common equity do you currently have? 300 DOO b. What is your capital mix? woooo cut 30 c. Calculate the value that your company should use as its RRR. GBU 3367 TVM Practice. Show what you input into calculator, and draw timelines for each You want to purchase a home for $165,000, and financing is for 30 years at 5.5. You will down 20 so you don't have to pay PMI a. What is down payment and monthly payment? 33000 b. If you are only able to pay $700 mo, how much house can you afford with them you can down the same dollar amount as abovers c. You really love the $165,000 house, but still need the $700 mo payment and no PM What rate do you need to find so that you would be able to purchase the home? 0913/ You want to create a retirement account of $2,000,000 at the end of 30 years b. If you only get 8% on your account. how much would you have to put in at the end of each year 70509 year is necessary? 2373 c. Same as B above, 8%, but now you can make a payment at the end of each month d. Same as C above, but now you make the payments at the beginning of each month 3.907 You are looking to purchase a note as an investment. It pays 5750yr at the end of each year for years and nothing after that. Purchase price is $2700) 6purchase 6. What is the highest price you would be willing to pay for ir? 2599.03 A mineral rights royalty pays $5,000 at end of each year for 10 years a. Assume you wish to earn 10%, what price would you pay for the royalty? 30122.84 b. What if previous situation started the payments of $5,000 today and the remaining 9 years begin 1 year from now, what price would you pay then? 237952 c. How much would you pay for perpetual rights to the royalty? So 000 You are considering investing in a new machine for your processing plant. The purchase price of the machine is $275,000. You will becrow the money over years, paying 10% down and paying off the rest with annual payments at 6% interest. The machine will generate positive after-tax cash flows to your operations of $80,000 for each of the 5 years it is in service, and at the end you will be able to sell it for $10,000. ger the machine up and running in your factory, you will have to pay $1200 delivery charge, and spend 00 to adapt your building's wiring and connect it. It will also cost $12.600 to tratat your operators. At the of the 3rd year, you will need to pay $20.000 for a machine upgrade rebuild. Your fim's trurginal tax rate 3. and its WACC is 16.5%. * Determine the loan details. DP=27500D porno, an 71426:39 b. How much interest will you end up paying on the machine loan? c. What are the total startup costs for this project (all the present time cash flows)2 = 3820 44300 d. Draw a timeline for this project and include every cash flow. e. Use MIRR to determine whether you should invest in this machine. f. What is the NPV and what does it mean? 947 8. What is the Pl and what does it mean? 1.184 for every logic On your balance sheet, your company lists Total Assets of $1,000,000 and Total Liabilities of $600.0 he Equity section, you have $100,000 of preferred stock that pays $2.50 dividend and has a current rice of $22.00 per share. Your common shares of stock sell for 36.00 per share, and pay a dividend ents, and your policy is to increase it by 4% each year. Your debt costs 6%, and your Net Income 225,000, putting you in a 39% marginal tax bracket. a. How much common equity do you currently have? 300 DOO b. What is your capital mix? woooo cut 30 c. Calculate the value that your company should use as its RRR