Answered step by step

Verified Expert Solution

Question

1 Approved Answer

GDZ, a Norwegian firm, has systematic risk of 0.95 when measured against the MSCI World Market Index. Its systematic risk is 1.15 when measured against

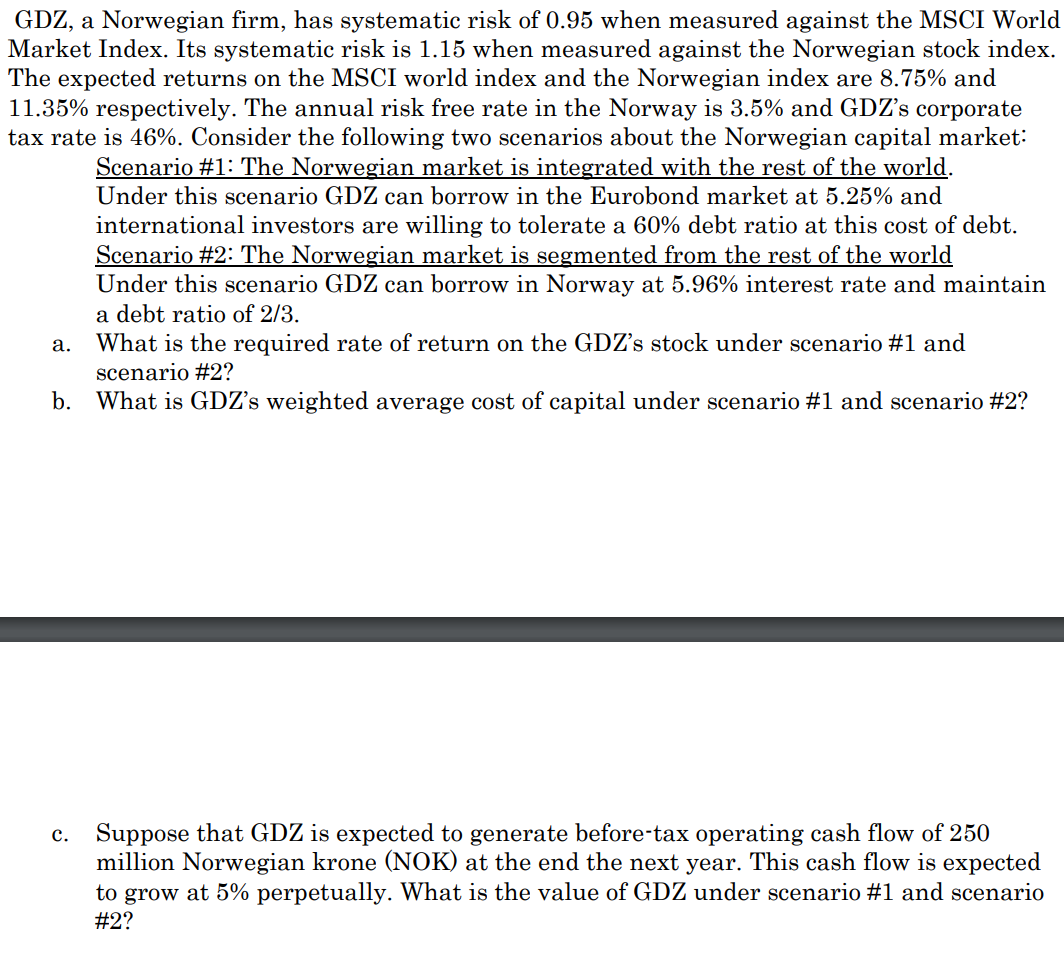

GDZ, a Norwegian firm, has systematic risk of 0.95 when measured against the MSCI World Market Index. Its systematic risk is 1.15 when measured against the Norwegian stock index. The expected returns on the MSCI world index and the Norwegian index are 8.75% and 11.35% respectively. The annual risk free rate in the Norway is 3.5% and GDZ's corporate tax rate is 46%. Consider the following two scenarios about the Norwegian capital market: Scenario #1 : The Norwegian market is integrated with the rest of the world. Under this scenario GDZ can borrow in the Eurobond market at 5.25% and international investors are willing to tolerate a 60% debt ratio at this cost of debt. Scenario \#2: The Norwegian market is segmented from the rest of the world Under this scenario GDZ can borrow in Norway at 5.96% interest rate and maintain a debt ratio of 2/3. a. What is the required rate of return on the GDZ's stock under scenario \#1 and scenario #2 ? b. What is GDZ's weighted average cost of capital under scenario \#1 and scenario #2 ? c. Suppose that GDZ is expected to generate before-tax operating cash flow of 250 million Norwegian krone (NOK) at the end the next year. This cash flow is expected to grow at 5% perpetually. What is the value of GDZ under scenario #1 and scenario #2

GDZ, a Norwegian firm, has systematic risk of 0.95 when measured against the MSCI World Market Index. Its systematic risk is 1.15 when measured against the Norwegian stock index. The expected returns on the MSCI world index and the Norwegian index are 8.75% and 11.35% respectively. The annual risk free rate in the Norway is 3.5% and GDZ's corporate tax rate is 46%. Consider the following two scenarios about the Norwegian capital market: Scenario #1 : The Norwegian market is integrated with the rest of the world. Under this scenario GDZ can borrow in the Eurobond market at 5.25% and international investors are willing to tolerate a 60% debt ratio at this cost of debt. Scenario \#2: The Norwegian market is segmented from the rest of the world Under this scenario GDZ can borrow in Norway at 5.96% interest rate and maintain a debt ratio of 2/3. a. What is the required rate of return on the GDZ's stock under scenario \#1 and scenario #2 ? b. What is GDZ's weighted average cost of capital under scenario \#1 and scenario #2 ? c. Suppose that GDZ is expected to generate before-tax operating cash flow of 250 million Norwegian krone (NOK) at the end the next year. This cash flow is expected to grow at 5% perpetually. What is the value of GDZ under scenario #1 and scenario #2 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started