Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Geading/previewin Window.html Calculator Admitting New Partner Brian Caldwell and Adriana Estrada have operated a success for many years, sharing net income and losses equally, Kris

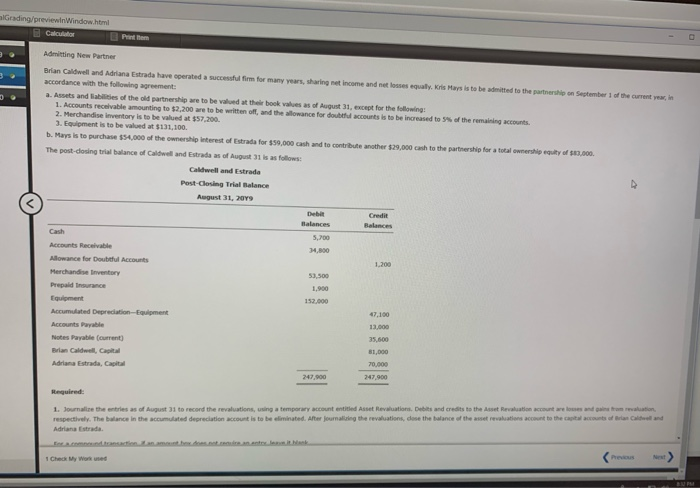

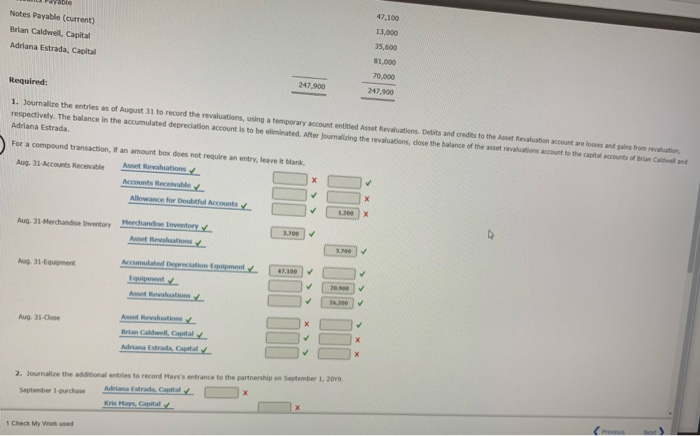

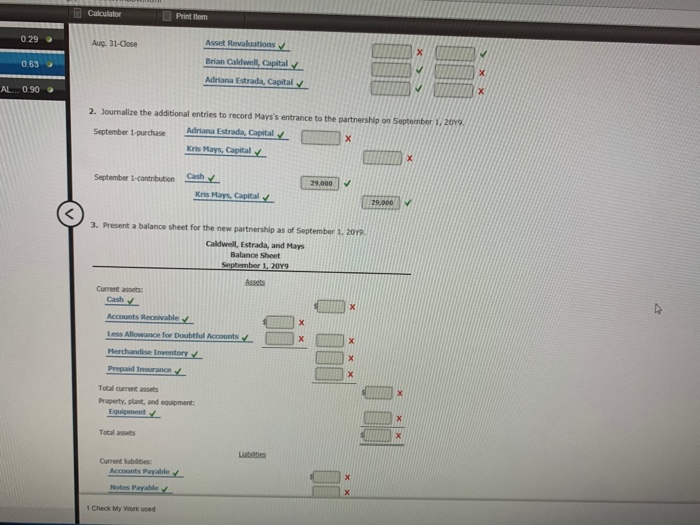

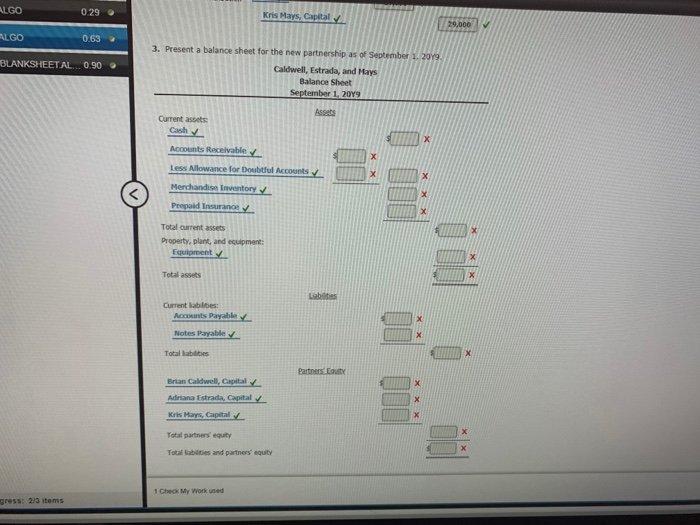

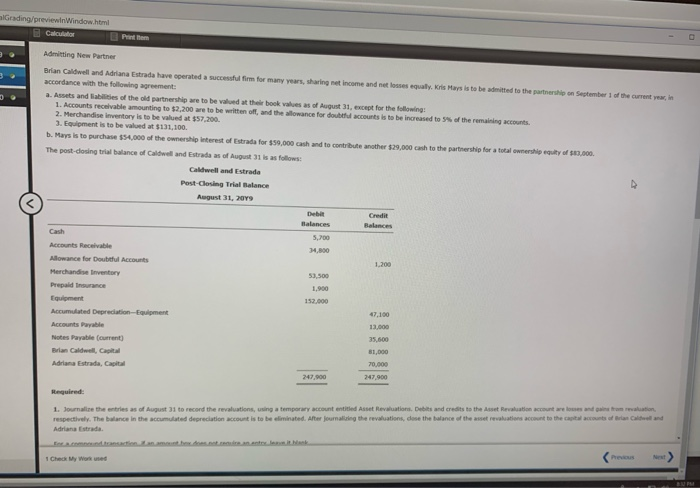

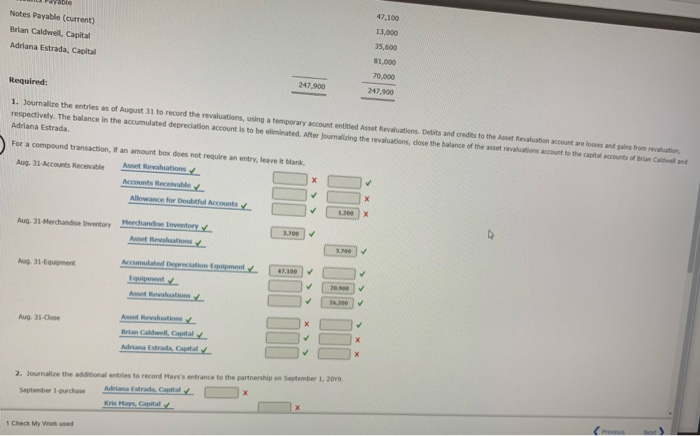

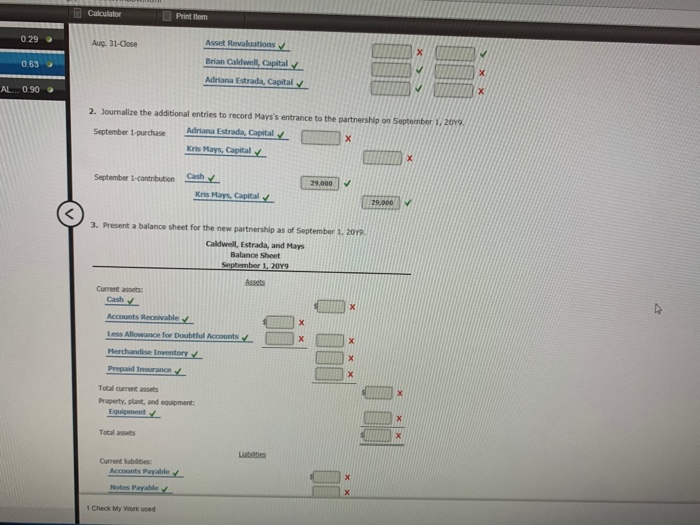

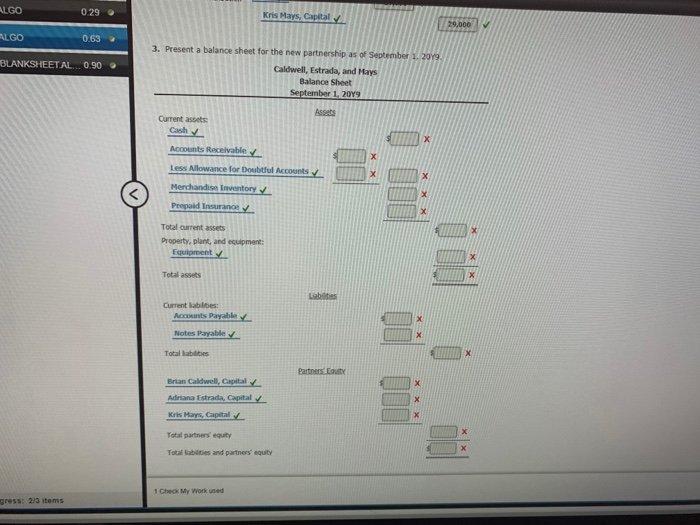

Geading/previewin Window.html Calculator Admitting New Partner Brian Caldwell and Adriana Estrada have operated a success for many years, sharing net income and losses equally, Kris Mars is to be admitted to the partnership on September of the current yw, in accordance with the following agreement: a. Assets and liabilities of the old partnership are to be valued at the book values of August 31, wept for the following 1. Accounts receivable amounting to $2,200 are to be written oft, and the allowance for ou is to be increased to other counts 2. Merchandise inventory is to be valued at $57,200 3. Equipment is to be valued at $131,100. b. Marys is to purchase $54,000 of the ownership interest of Estrada for $59.000 cash and to contribute another $29.000 ch to the partnership for a total o u t of The post-dosing trial balance of Caldwell and Estrada as of August 31 is as follows Caldwell and Estrada Post Closing Trial Balance August 31, 2019 Debit Balances 34.800 53,500 1.900 Cash Accounts Receivable Allowance for Doubtful Accounts Merchandise Inventory Prepaid insurance Equipment Accumulated Depreciation Equipment Accounts Payable Notes Payable (current Brian Caldwell, Capital Adriana Estrada, Capital 152.000 47,100 13,000 35,600 247 900 Required: s and toma o ntr a Ch tion and 1. Journalte the entries as of August 31 to record the evaluations, using a temporary account entitled Asset Revaluation. Debits and credits to the Asset Revaluation account respectively. The balance in the accumulated depreciation account is to be eliminated Arter journaling the evaluations, des the balance of the revolution account to the c Adriana Estrada transaction th a t it E Check My Word Feye 47.100 13,000 lotes Payable (current) Brian Caldwell, Capital mdriana Estrada, Capital 247.900 247.000 Required: 1. Journame the entries as of August 31 to record the evaluations, using a temporary account and st o ne s and credits to the respectively. The balance in the counted depreciation account is to be limited. After journaling the evaluations, des the balance of the Adriana Estrada Revolution account are losses and gain from revolution revolutions to the capital of Brian Calelland For a compound transaction, an amount box does not require an entry leave it Bank Aug. 11 Accounts Recevable Au Revation Account Revale Allowance for Doubtful Merchander er Aug 31 Merchandise Inventory Autos ust quel trance to the partnership on September 1, 2013 2. Jou the e s to record Mars' on Mas Capital Calculator Print item 0.29 Aug. 31-Close Asset Revaluations 0.63 Brian Caldwell, Capital Adriana Estrada, Capital AL 0.90 2. Journalize the additional entries to record Mays's entrance to the partnership on September 1, 2019 September 1-ourchase Adriana Estrada, Capital Kris Mays. Capital September 1-Contribution Cash Kris Mays. Capital 29.000 29,000 3. Present a balance sheet for the new partnership as of September 1, 2049 Caldwell, Estrada, and Mays Balance Sheet September 1, 2019 Current assets Cash Accounts Receivable Less Allowance for Doubtful Accounts Merchandise ventory Prepaid Insurance Total current assets Property, plant, and equipment: Equipment Totalsts Current abilities Mens Payable Notes Payable 1 Check My Work used 0.29 ALGO ALGO Kris Mays, Capital 0.63 BLANKSHEETAL... 0.90 3. Present a balance sheet for the new partnership as of September 1, 2019 Caldwell, Estrada, and Mays Balance Sheet September 1, 2019 Current assets Cash Accounts Receivable Less Allowance for Doubtful Accounts Merchandise Inventory Prepold Insurans Total current assets Property, plant, and equipment: Equipment Total assets DODO 00 DO ODRO Current abilities: Accounts Payable Notes Payable Total abilities Partners Equity Brian Caldwell, Capital Adriana Estrada, Capital Kris Marys, Capital Total partners equity Total e s and partners' equity 1 Check My Work used gress: 213 items Geading/previewin Window.html Calculator Admitting New Partner Brian Caldwell and Adriana Estrada have operated a success for many years, sharing net income and losses equally, Kris Mars is to be admitted to the partnership on September of the current yw, in accordance with the following agreement: a. Assets and liabilities of the old partnership are to be valued at the book values of August 31, wept for the following 1. Accounts receivable amounting to $2,200 are to be written oft, and the allowance for ou is to be increased to other counts 2. Merchandise inventory is to be valued at $57,200 3. Equipment is to be valued at $131,100. b. Marys is to purchase $54,000 of the ownership interest of Estrada for $59.000 cash and to contribute another $29.000 ch to the partnership for a total o u t of The post-dosing trial balance of Caldwell and Estrada as of August 31 is as follows Caldwell and Estrada Post Closing Trial Balance August 31, 2019 Debit Balances 34.800 53,500 1.900 Cash Accounts Receivable Allowance for Doubtful Accounts Merchandise Inventory Prepaid insurance Equipment Accumulated Depreciation Equipment Accounts Payable Notes Payable (current Brian Caldwell, Capital Adriana Estrada, Capital 152.000 47,100 13,000 35,600 247 900 Required: s and toma o ntr a Ch tion and 1. Journalte the entries as of August 31 to record the evaluations, using a temporary account entitled Asset Revaluation. Debits and credits to the Asset Revaluation account respectively. The balance in the accumulated depreciation account is to be eliminated Arter journaling the evaluations, des the balance of the revolution account to the c Adriana Estrada transaction th a t it E Check My Word Feye 47.100 13,000 lotes Payable (current) Brian Caldwell, Capital mdriana Estrada, Capital 247.900 247.000 Required: 1. Journame the entries as of August 31 to record the evaluations, using a temporary account and st o ne s and credits to the respectively. The balance in the counted depreciation account is to be limited. After journaling the evaluations, des the balance of the Adriana Estrada Revolution account are losses and gain from revolution revolutions to the capital of Brian Calelland For a compound transaction, an amount box does not require an entry leave it Bank Aug. 11 Accounts Recevable Au Revation Account Revale Allowance for Doubtful Merchander er Aug 31 Merchandise Inventory Autos ust quel trance to the partnership on September 1, 2013 2. Jou the e s to record Mars' on Mas Capital Calculator Print item 0.29 Aug. 31-Close Asset Revaluations 0.63 Brian Caldwell, Capital Adriana Estrada, Capital AL 0.90 2. Journalize the additional entries to record Mays's entrance to the partnership on September 1, 2019 September 1-ourchase Adriana Estrada, Capital Kris Mays. Capital September 1-Contribution Cash Kris Mays. Capital 29.000 29,000 3. Present a balance sheet for the new partnership as of September 1, 2049 Caldwell, Estrada, and Mays Balance Sheet September 1, 2019 Current assets Cash Accounts Receivable Less Allowance for Doubtful Accounts Merchandise ventory Prepaid Insurance Total current assets Property, plant, and equipment: Equipment Totalsts Current abilities Mens Payable Notes Payable 1 Check My Work used 0.29 ALGO ALGO Kris Mays, Capital 0.63 BLANKSHEETAL... 0.90 3. Present a balance sheet for the new partnership as of September 1, 2019 Caldwell, Estrada, and Mays Balance Sheet September 1, 2019 Current assets Cash Accounts Receivable Less Allowance for Doubtful Accounts Merchandise Inventory Prepold Insurans Total current assets Property, plant, and equipment: Equipment Total assets DODO 00 DO ODRO Current abilities: Accounts Payable Notes Payable Total abilities Partners Equity Brian Caldwell, Capital Adriana Estrada, Capital Kris Marys, Capital Total partners equity Total e s and partners' equity 1 Check My Work used gress: 213 items

Geading/previewin Window.html Calculator Admitting New Partner Brian Caldwell and Adriana Estrada have operated a success for many years, sharing net income and losses equally, Kris Mars is to be admitted to the partnership on September of the current yw, in accordance with the following agreement: a. Assets and liabilities of the old partnership are to be valued at the book values of August 31, wept for the following 1. Accounts receivable amounting to $2,200 are to be written oft, and the allowance for ou is to be increased to other counts 2. Merchandise inventory is to be valued at $57,200 3. Equipment is to be valued at $131,100. b. Marys is to purchase $54,000 of the ownership interest of Estrada for $59.000 cash and to contribute another $29.000 ch to the partnership for a total o u t of The post-dosing trial balance of Caldwell and Estrada as of August 31 is as follows Caldwell and Estrada Post Closing Trial Balance August 31, 2019 Debit Balances 34.800 53,500 1.900 Cash Accounts Receivable Allowance for Doubtful Accounts Merchandise Inventory Prepaid insurance Equipment Accumulated Depreciation Equipment Accounts Payable Notes Payable (current Brian Caldwell, Capital Adriana Estrada, Capital 152.000 47,100 13,000 35,600 247 900 Required: s and toma o ntr a Ch tion and 1. Journalte the entries as of August 31 to record the evaluations, using a temporary account entitled Asset Revaluation. Debits and credits to the Asset Revaluation account respectively. The balance in the accumulated depreciation account is to be eliminated Arter journaling the evaluations, des the balance of the revolution account to the c Adriana Estrada transaction th a t it E Check My Word Feye 47.100 13,000 lotes Payable (current) Brian Caldwell, Capital mdriana Estrada, Capital 247.900 247.000 Required: 1. Journame the entries as of August 31 to record the evaluations, using a temporary account and st o ne s and credits to the respectively. The balance in the counted depreciation account is to be limited. After journaling the evaluations, des the balance of the Adriana Estrada Revolution account are losses and gain from revolution revolutions to the capital of Brian Calelland For a compound transaction, an amount box does not require an entry leave it Bank Aug. 11 Accounts Recevable Au Revation Account Revale Allowance for Doubtful Merchander er Aug 31 Merchandise Inventory Autos ust quel trance to the partnership on September 1, 2013 2. Jou the e s to record Mars' on Mas Capital Calculator Print item 0.29 Aug. 31-Close Asset Revaluations 0.63 Brian Caldwell, Capital Adriana Estrada, Capital AL 0.90 2. Journalize the additional entries to record Mays's entrance to the partnership on September 1, 2019 September 1-ourchase Adriana Estrada, Capital Kris Mays. Capital September 1-Contribution Cash Kris Mays. Capital 29.000 29,000 3. Present a balance sheet for the new partnership as of September 1, 2049 Caldwell, Estrada, and Mays Balance Sheet September 1, 2019 Current assets Cash Accounts Receivable Less Allowance for Doubtful Accounts Merchandise ventory Prepaid Insurance Total current assets Property, plant, and equipment: Equipment Totalsts Current abilities Mens Payable Notes Payable 1 Check My Work used 0.29 ALGO ALGO Kris Mays, Capital 0.63 BLANKSHEETAL... 0.90 3. Present a balance sheet for the new partnership as of September 1, 2019 Caldwell, Estrada, and Mays Balance Sheet September 1, 2019 Current assets Cash Accounts Receivable Less Allowance for Doubtful Accounts Merchandise Inventory Prepold Insurans Total current assets Property, plant, and equipment: Equipment Total assets DODO 00 DO ODRO Current abilities: Accounts Payable Notes Payable Total abilities Partners Equity Brian Caldwell, Capital Adriana Estrada, Capital Kris Marys, Capital Total partners equity Total e s and partners' equity 1 Check My Work used gress: 213 items Geading/previewin Window.html Calculator Admitting New Partner Brian Caldwell and Adriana Estrada have operated a success for many years, sharing net income and losses equally, Kris Mars is to be admitted to the partnership on September of the current yw, in accordance with the following agreement: a. Assets and liabilities of the old partnership are to be valued at the book values of August 31, wept for the following 1. Accounts receivable amounting to $2,200 are to be written oft, and the allowance for ou is to be increased to other counts 2. Merchandise inventory is to be valued at $57,200 3. Equipment is to be valued at $131,100. b. Marys is to purchase $54,000 of the ownership interest of Estrada for $59.000 cash and to contribute another $29.000 ch to the partnership for a total o u t of The post-dosing trial balance of Caldwell and Estrada as of August 31 is as follows Caldwell and Estrada Post Closing Trial Balance August 31, 2019 Debit Balances 34.800 53,500 1.900 Cash Accounts Receivable Allowance for Doubtful Accounts Merchandise Inventory Prepaid insurance Equipment Accumulated Depreciation Equipment Accounts Payable Notes Payable (current Brian Caldwell, Capital Adriana Estrada, Capital 152.000 47,100 13,000 35,600 247 900 Required: s and toma o ntr a Ch tion and 1. Journalte the entries as of August 31 to record the evaluations, using a temporary account entitled Asset Revaluation. Debits and credits to the Asset Revaluation account respectively. The balance in the accumulated depreciation account is to be eliminated Arter journaling the evaluations, des the balance of the revolution account to the c Adriana Estrada transaction th a t it E Check My Word Feye 47.100 13,000 lotes Payable (current) Brian Caldwell, Capital mdriana Estrada, Capital 247.900 247.000 Required: 1. Journame the entries as of August 31 to record the evaluations, using a temporary account and st o ne s and credits to the respectively. The balance in the counted depreciation account is to be limited. After journaling the evaluations, des the balance of the Adriana Estrada Revolution account are losses and gain from revolution revolutions to the capital of Brian Calelland For a compound transaction, an amount box does not require an entry leave it Bank Aug. 11 Accounts Recevable Au Revation Account Revale Allowance for Doubtful Merchander er Aug 31 Merchandise Inventory Autos ust quel trance to the partnership on September 1, 2013 2. Jou the e s to record Mars' on Mas Capital Calculator Print item 0.29 Aug. 31-Close Asset Revaluations 0.63 Brian Caldwell, Capital Adriana Estrada, Capital AL 0.90 2. Journalize the additional entries to record Mays's entrance to the partnership on September 1, 2019 September 1-ourchase Adriana Estrada, Capital Kris Mays. Capital September 1-Contribution Cash Kris Mays. Capital 29.000 29,000 3. Present a balance sheet for the new partnership as of September 1, 2049 Caldwell, Estrada, and Mays Balance Sheet September 1, 2019 Current assets Cash Accounts Receivable Less Allowance for Doubtful Accounts Merchandise ventory Prepaid Insurance Total current assets Property, plant, and equipment: Equipment Totalsts Current abilities Mens Payable Notes Payable 1 Check My Work used 0.29 ALGO ALGO Kris Mays, Capital 0.63 BLANKSHEETAL... 0.90 3. Present a balance sheet for the new partnership as of September 1, 2019 Caldwell, Estrada, and Mays Balance Sheet September 1, 2019 Current assets Cash Accounts Receivable Less Allowance for Doubtful Accounts Merchandise Inventory Prepold Insurans Total current assets Property, plant, and equipment: Equipment Total assets DODO 00 DO ODRO Current abilities: Accounts Payable Notes Payable Total abilities Partners Equity Brian Caldwell, Capital Adriana Estrada, Capital Kris Marys, Capital Total partners equity Total e s and partners' equity 1 Check My Work used gress: 213 items

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started