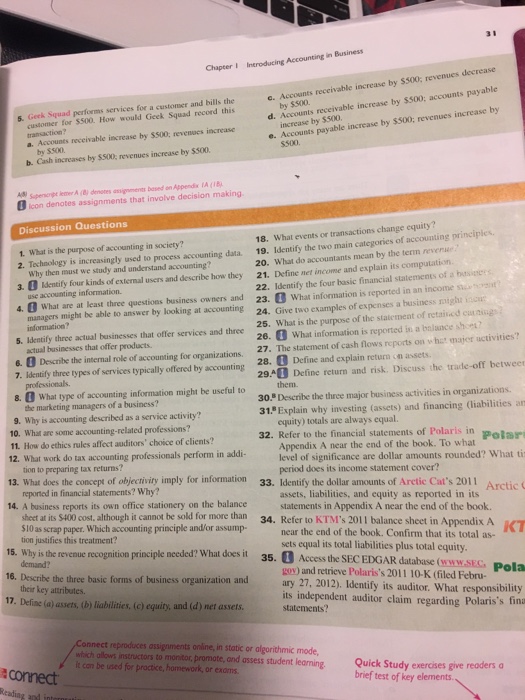

Geek Squad Performs services for a customer and bills the customer for $500. How would Geek Squad record this transaction? Accounts receivable increase by $500; revenues increase by $500. Cash increases by $500; revenues increase by $500. Accounts receivable increase by $500; revenues decrease by $500. Accounts receivable increase by $500; accounts payable increase by $500. Accounts payable increase by $500; revenues increase by $500. What is the purpose of accounting in society? Technology is increasingly used to process accounting data. Why then must we study and understand accounting? Identify four kinds of external users and describe how they use accounting information. What are at least three question business owners and managers might be able to answer by looking at accounting information? Identify three actual businesses that offer services and three actual businesses that offer products. Describe the internal role of accounting for organizations. Identify three types of services typically offered by accounting professionals. What type of accounting information might be useful to the marketing managers of a business? Why is accounting described as a service activity? What are some accounting-related professions? How do ethics rules affect auditors' choice of clients? What work do tax accounting professionals perform in addition to preparing tax returns? What does the concept of objectivity imply for information reported in financial statements? Why? A business reports its own office stationery on the balance sheet at its $400 cost, although it cannot be sold for more than $10 as scrap paper. Which accounting principle and/or assumption justifies this treatment? Why is the revenue recognition principle needed? What does it demand? Describe the three basic forms of business organization and their key attributes. Define (a), assets, (b) Liabilities, (c) equity, and (d) net assets. What events or transaction change equity? Identify the two main categories of accounting principles. What do accountants mean by the term revenue? Define net income and explain its computation. Identify the four basic financial statements of a business. What information is reported is reported in an income statement? Given two examples of expenses a business might mean? Given two examples of expenses a business might What is the purpose of the statement of retained What information is reported to a balance short? The statement of cash flows reports on what major activities? Define and explain return on assets. Define return and risk. Discuss the trade-off between them Describe the three major business activities in organizations. Explain why investing (assets) and financing (liabilities are equity) totals are always equal. Refer to the financial statements of Polaris in Polar Appendix A near the end of the book. To what level of significance are dollar amounts rounded? What period does its income statement cover? Identify the dollar amounts of Arctic Cat's 2011 assets, liabilities, and equity as reported in its statements in Appendix A near the end of the book. Refer to KTM's 2011 balance sheet in Appendix A near the end of the book. Confirm that its total assets equal its total liabilities plus total equity. Access the SEC EDGAR database (www.SEC, gov) and retrieve Polaris's 2011 10-K (filed February 27, 2012.) Identify its auditor. What responsibility its independent auditor claim regarding Polaris's final statements