Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Gelang Merah, a reservoir located 43 km from Labuan is to be developed by jointly by Garraf Company. You, as a private consultant, is being

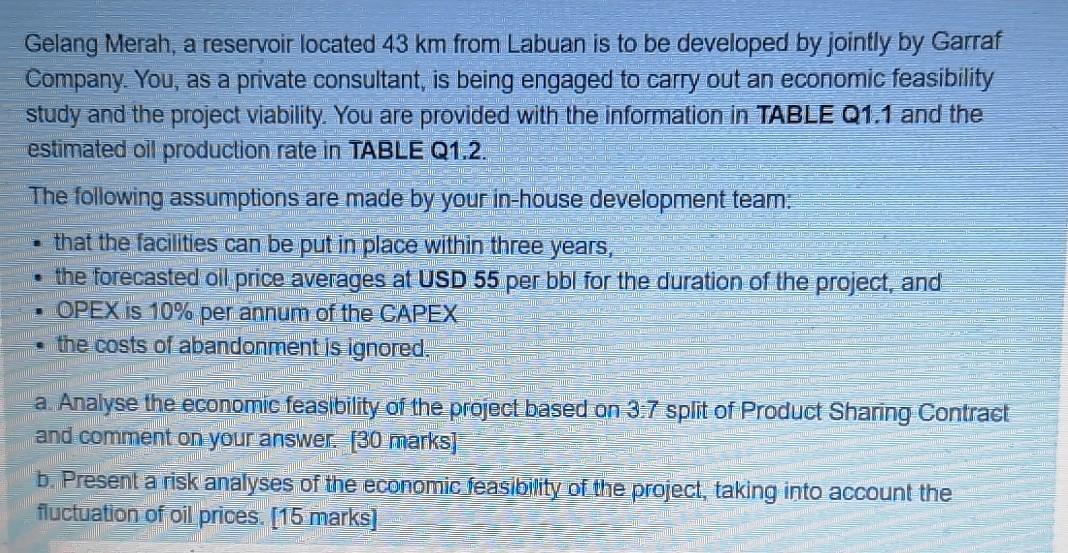

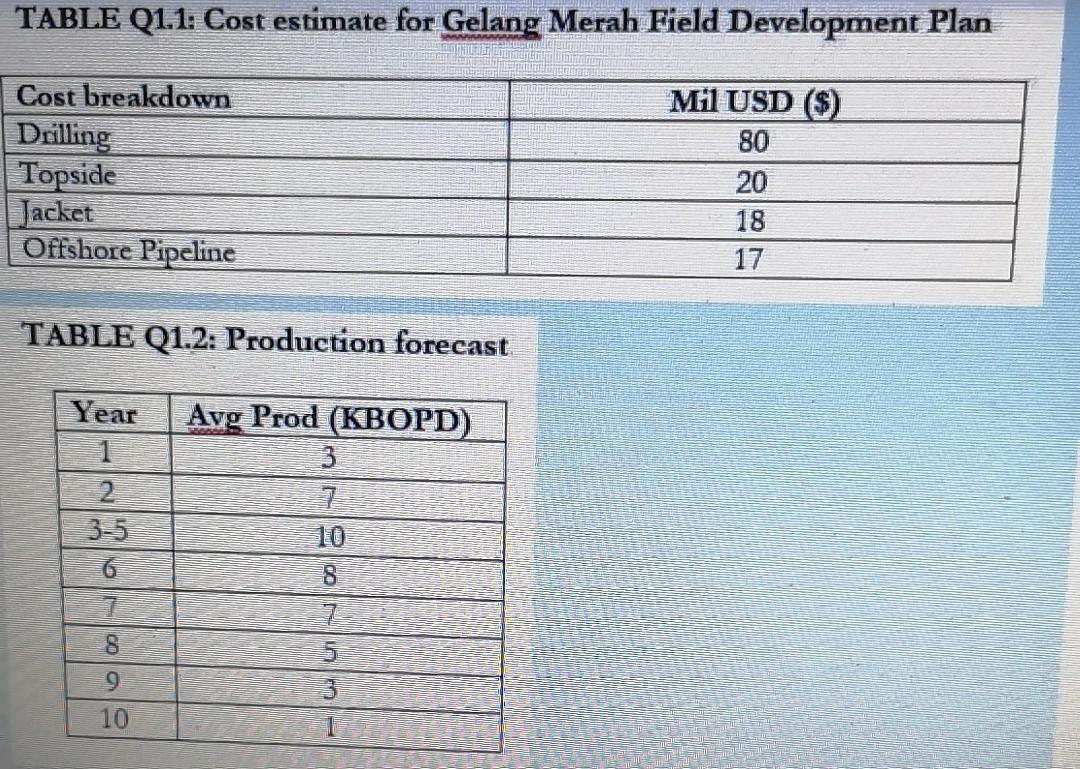

Gelang Merah, a reservoir located 43 km from Labuan is to be developed by jointly by Garraf Company. You, as a private consultant, is being engaged to carry out an economic feasibility study and the project viability. You are provided with the information in TABLE Q1.1 and the estimated oil production rate in TABLE Q1.2. The following assumptions are made by your in-house development team: that the facilities can be put in place within three years, the forecasted oil price averages at USD 55 per bbl for the duration of the project, and OPEX is 10% per annum of the GAPEX the costs of abandonment is ignored. a Analyse the economic feasibility of the project based on 3.7 split of Product Sharing Contract and comment on your answer. [30 marks] b. Present a risk analyses of the economic feasibility of the project, taking into account the fluctuation of oil prices. [15 marks] TABLE Q1.1: Cost estimate for Gelang Merah Field Development Plan Cost breakdown Drilling Topside Jacket Offshore Pipeline Mil USD ($) 80 20 18 17 TABLE Q1.2: Production forecast Year 1 Avg Prod (KBOPD) 3 3-5 8 9 10 1 Gelang Merah, a reservoir located 43 km from Labuan is to be developed by jointly by Garraf Company. You, as a private consultant, is being engaged to carry out an economic feasibility study and the project viability. You are provided with the information in TABLE Q1.1 and the estimated oil production rate in TABLE Q1.2. The following assumptions are made by your in-house development team: that the facilities can be put in place within three years, the forecasted oil price averages at USD 55 per bbl for the duration of the project, and OPEX is 10% per annum of the GAPEX the costs of abandonment is ignored. a Analyse the economic feasibility of the project based on 3.7 split of Product Sharing Contract and comment on your answer. [30 marks] b. Present a risk analyses of the economic feasibility of the project, taking into account the fluctuation of oil prices. [15 marks] TABLE Q1.1: Cost estimate for Gelang Merah Field Development Plan Cost breakdown Drilling Topside Jacket Offshore Pipeline Mil USD ($) 80 20 18 17 TABLE Q1.2: Production forecast Year 1 Avg Prod (KBOPD) 3 3-5 8 9 10 1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started