Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Geliga Bhd, a Malaysian incorporated company, acquired a 75% equity interest in an overseas subsidiary, Sabritaz Plc. on 1 October 2019. The consideration was

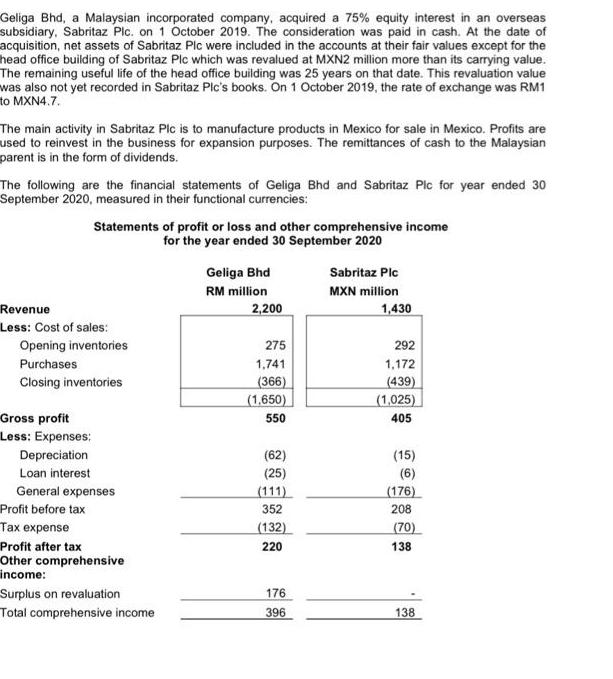

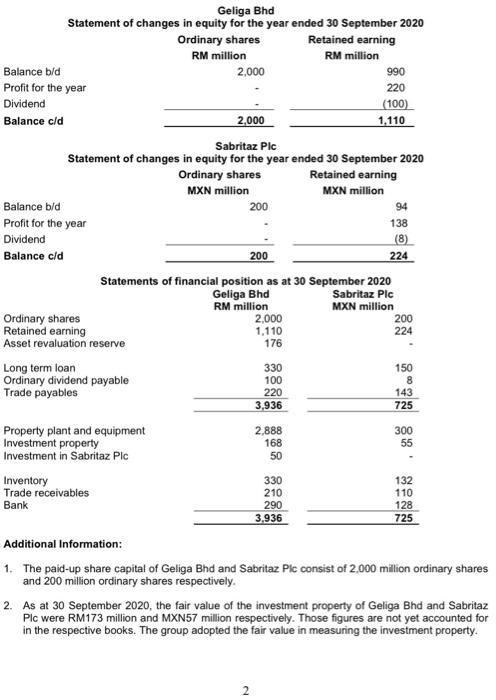

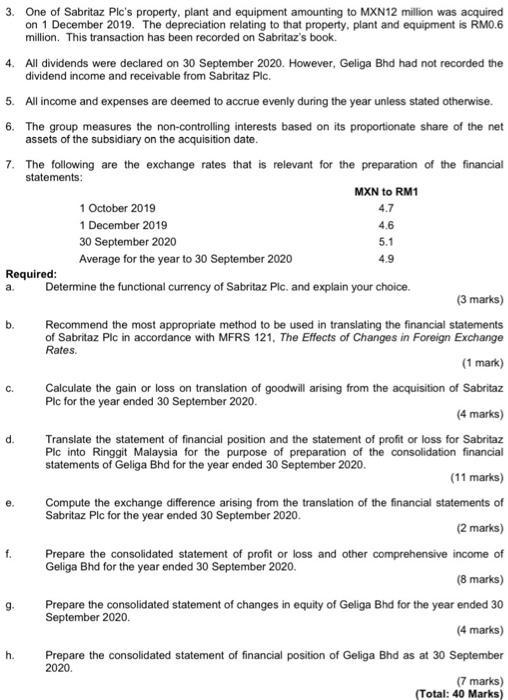

Geliga Bhd, a Malaysian incorporated company, acquired a 75% equity interest in an overseas subsidiary, Sabritaz Plc. on 1 October 2019. The consideration was paid in cash. At the date of acquisition, net assets of Sabritaz Plc were included in the accounts at their fair values except for the head office building of Sabritaz Plc which was revalued at MXN2 million more than its carrying value. The remaining useful life of the head office building was 25 years on that date. This revaluation value was also not yet recorded in Sabritaz Plc's books. On 1 October 2019, the rate of exchange was RM1 to MXN4.7. The main activity in Sabritaz Plc is to manufacture products in Mexico for sale in Mexico. Profits are used to reinvest in the business for expansion purposes. The remittances of cash to the Malaysian parent is in the form of dividends. The following are the financial statements of Geliga Bhd and Sabritaz Plc for year ended 30 September 2020, measured in their functional currencies: Statements of profit or loss and other comprehensive income for the year ended 30 September 2020 Revenue Less: Cost of sales: Opening inventories Purchases Closing inventories Gross profit Less: Expenses: Depreciation Loan interest General expenses Profit before tax Tax expense Profit after tax Other comprehensive income: Surplus on revaluation Total comprehensive income Geliga Bhd RM million 2,200 275 1,741 (366) (1.650) 550 (62) (25) (111) 352 (132) 220 176 396 Sabritaz Plc MXN million 1,430 292 1,172 (439) (1,025) 405 (15) (6) (176) 208 (70) 138 138 Geliga Bhd Statement of changes in equity for the year ended 30 September 2020 Balance b/d Profit for the year Dividend Balance c/d Balance b/d Profit for the year Dividend Balance c/d Ordinary shares Retained earning Asset revaluation reserve Long term loan Ordinary dividend payable Trade payables Ordinary shares RM million 2,000 Sabritaz Plc Statement of changes in equity for the year ended 30 September 2020 Retained earning MXN million Property plant and equipment Investment property Investment in Sabritaz Plc Inventory Trade receivables Bank 2,000 Ordinary shares MXN million 200 200 Statements of financial position as at 30 September 2020 Sabritaz Plc MXN million Geliga Bhd RM million 2,000 1,110 176 330 100 220 3,936 2 Retained earning RM million 2,888 168 50 990 220 330 210 290 3,936 (100) 1,110 94 138 (8) 224 200 224 150 8 143 725 300 55 132 110 128 725 Additional Information: 1. The paid-up share capital of Geliga Bhd and Sabritaz Plc consist of 2,000 million ordinary shares and 200 million ordinary shares respectively. 2. As at 30 September 2020, the fair value of the investment property of Geliga Bhd and Sabritaz Plc were RM173 million and MXN57 million respectively. Those figures are not yet accounted for in the respective books. The group adopted the fair value in measuring the investment property. 3. One of Sabritaz Pic's property, plant and equipment amounting to MXN12 million was acquired on 1 December 2019. The depreciation relating to that property, plant and equipment is RM0.6 million. This transaction has been recorded on Sabritaz's book. 4. All dividends were declared on 30 September 2020. However, Geliga Bhd had not recorded the dividend income and receivable from Sabritaz Plc. 5. All income and expenses are deemed to accrue evenly during the year unless stated otherwise. 6. The group measures the non-controlling interests based on its proportionate share of the net assets of the subsidiary on the acquisition date. 7. The following are the exchange rates that is relevant for the preparation of the financial statements: Required: a. b. C. d. f. 9. h. MXN to RM1 4.7 4.6 5.1 4.9 1 October 2019 1 December 2019 30 September 2020 Average for the year to 30 September 2020 Determine the functional currency of Sabritaz Plc. and explain your choice. (3 marks) Recommend the most appropriate method to be used in translating the financial statements of Sabritaz Plc in accordance with MFRS 121, The Effects of Changes in Foreign Exchange Rates. (1 mark) Calculate the gain or loss on translation of goodwill arising from the acquisition of Sabritaz Plc for the year ended 30 September 2020. (4 marks) Translate the statement of financial position and the statement of profit or loss for Sabritaz Plc into Ringgit Malaysia for the purpose of preparation of the consolidation financial statements of Geliga Bhd for the year ended 30 September 2020. (11 marks) Compute the exchange difference arising from the translation of the financial statements of Sabritaz Plc for the year ended 30 September 2020. (2 marks) Prepare the consolidated statement of profit or loss and other comprehensive income of Geliga Bhd for the year ended 30 September 2020. (8 marks) Prepare the consolidated statement of changes in equity of Geliga Bhd for the year ended 30 September 2020. (4 marks) Prepare the consolidated statement of financial position of Geliga Bhd as at 30 September 2020. (7 marks) (Total: 40 Marks)

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

a The functional currency of Sabritaz Pic is Mexican Peso MXN because The main activity of Sabritaz Pic is to manufacture products in Mexico for sale in Mexico This indicates that the primary economic ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started