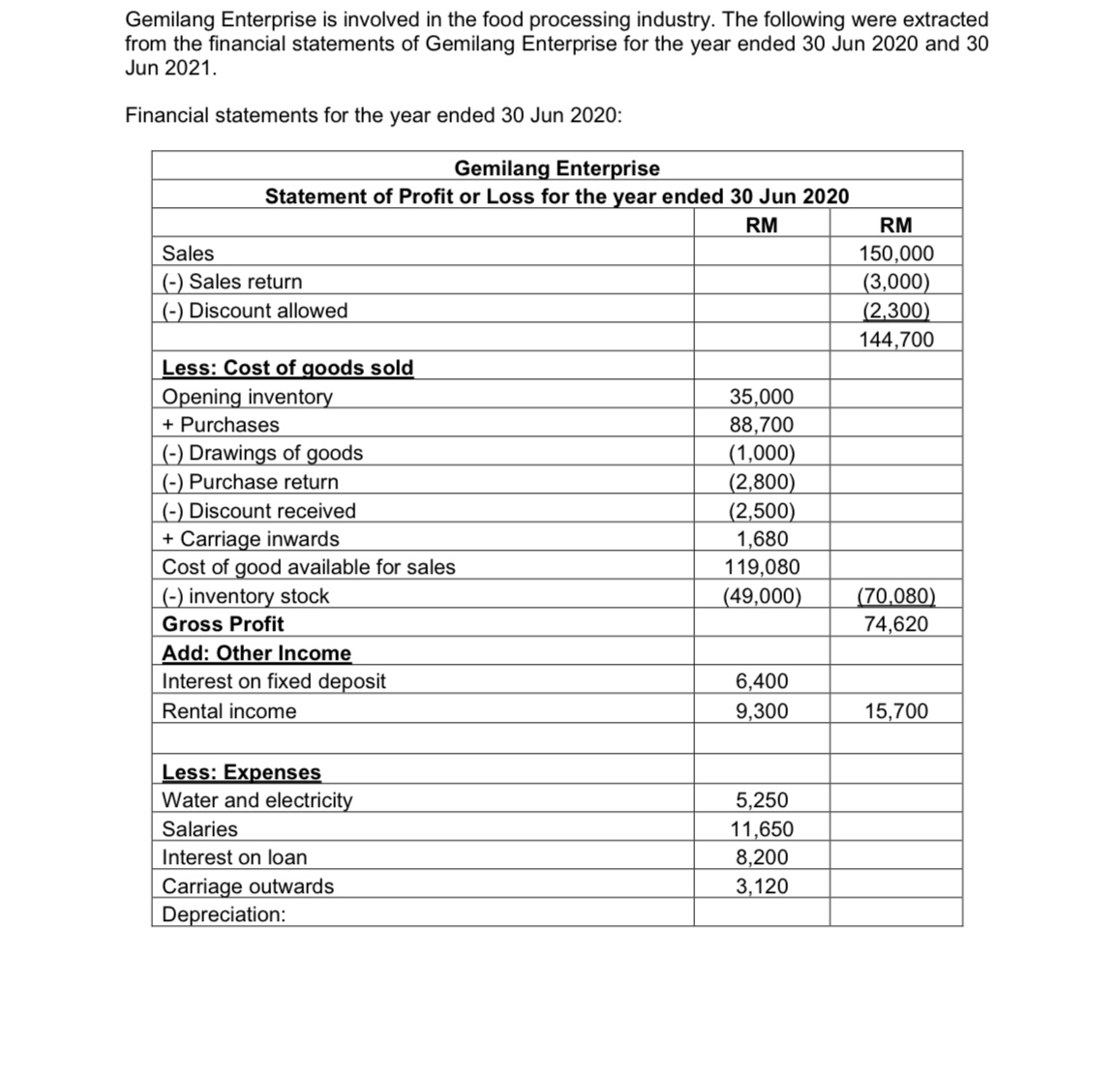

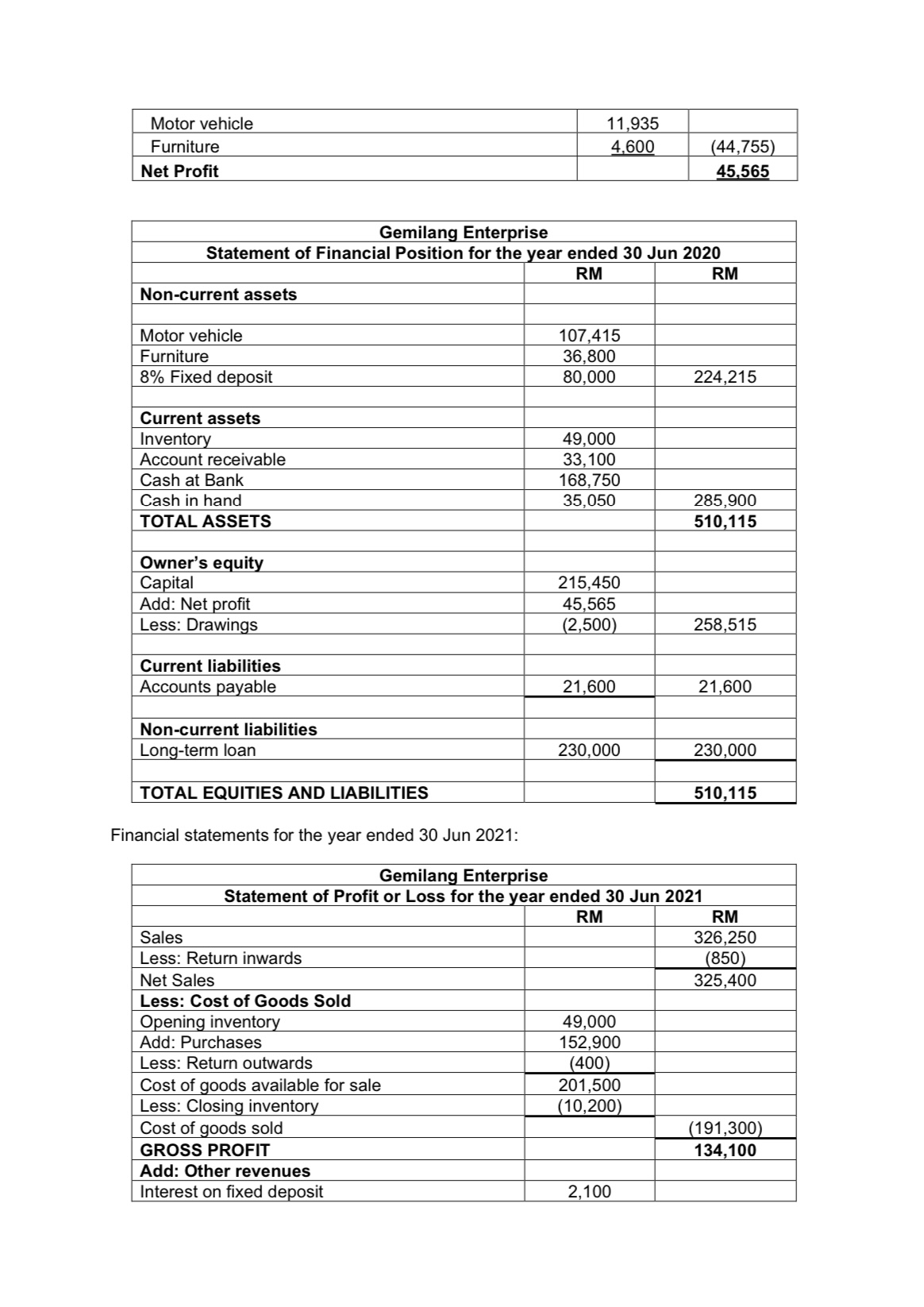

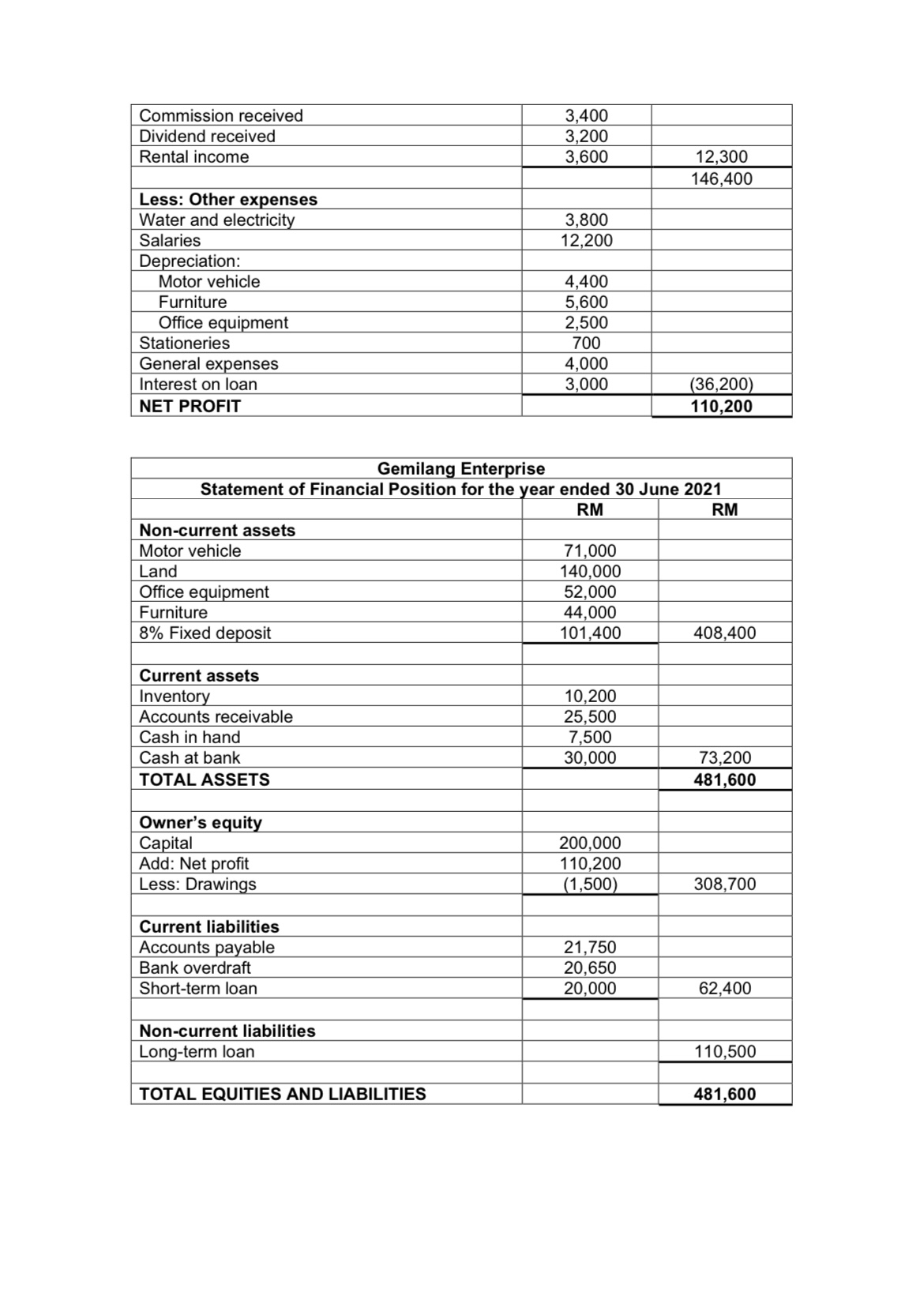

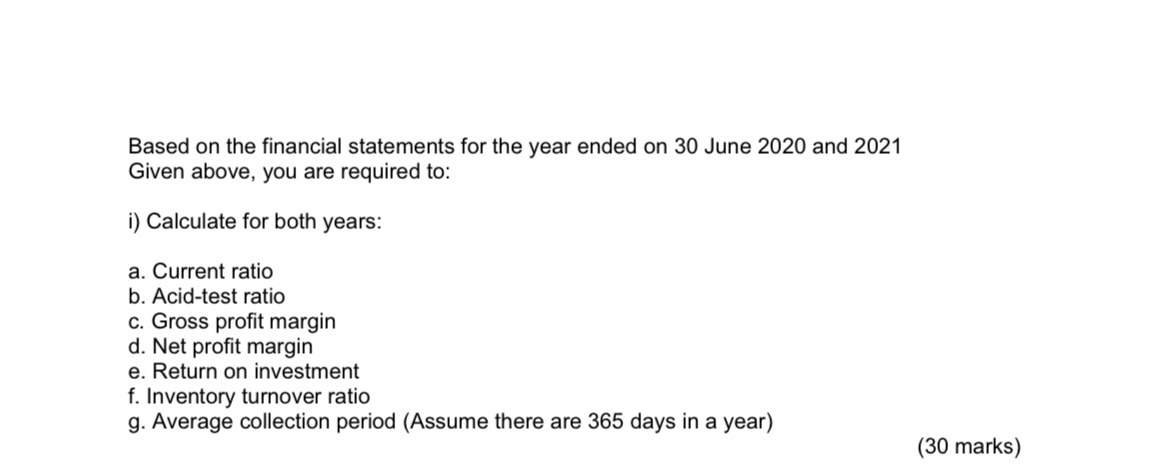

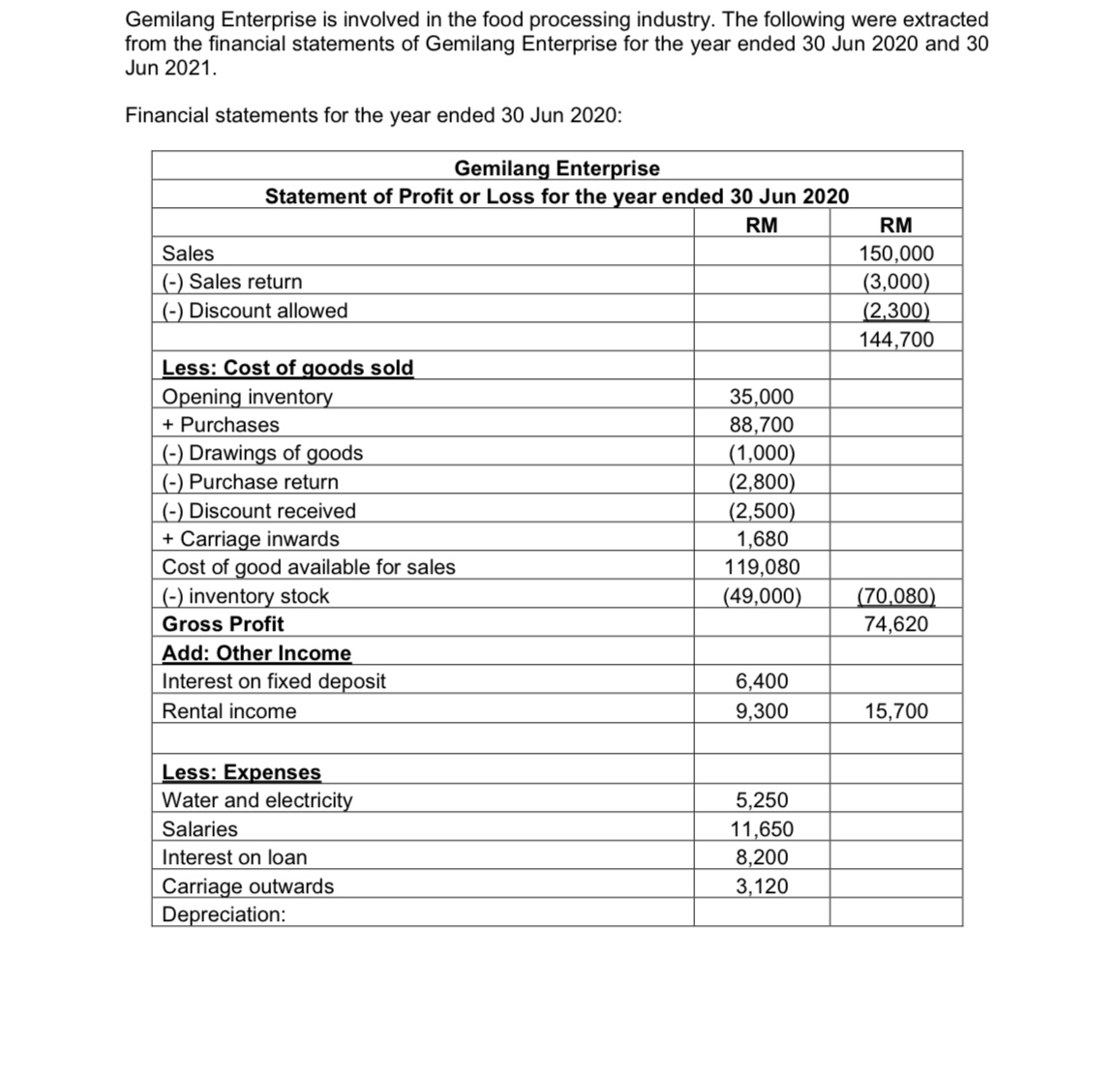

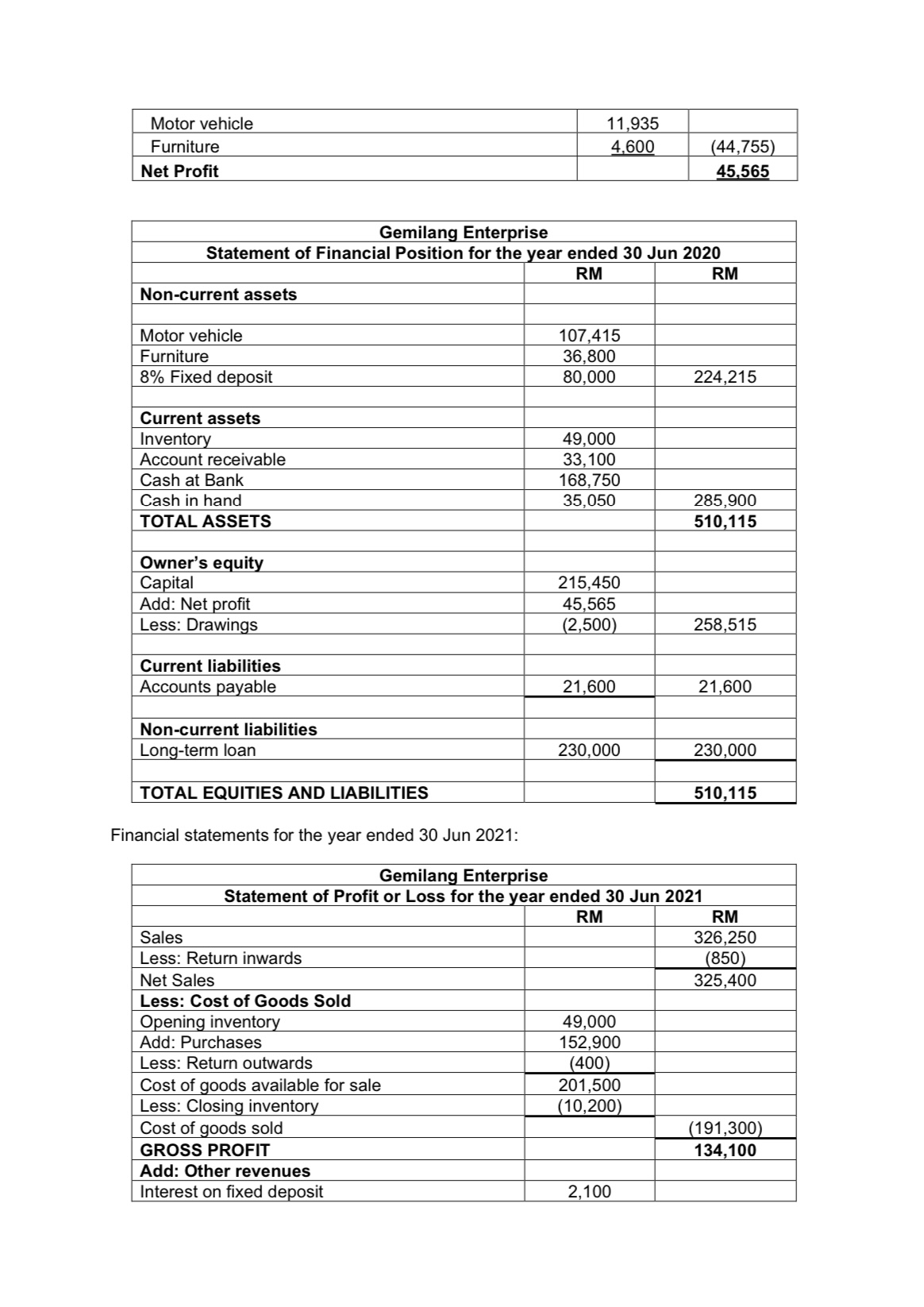

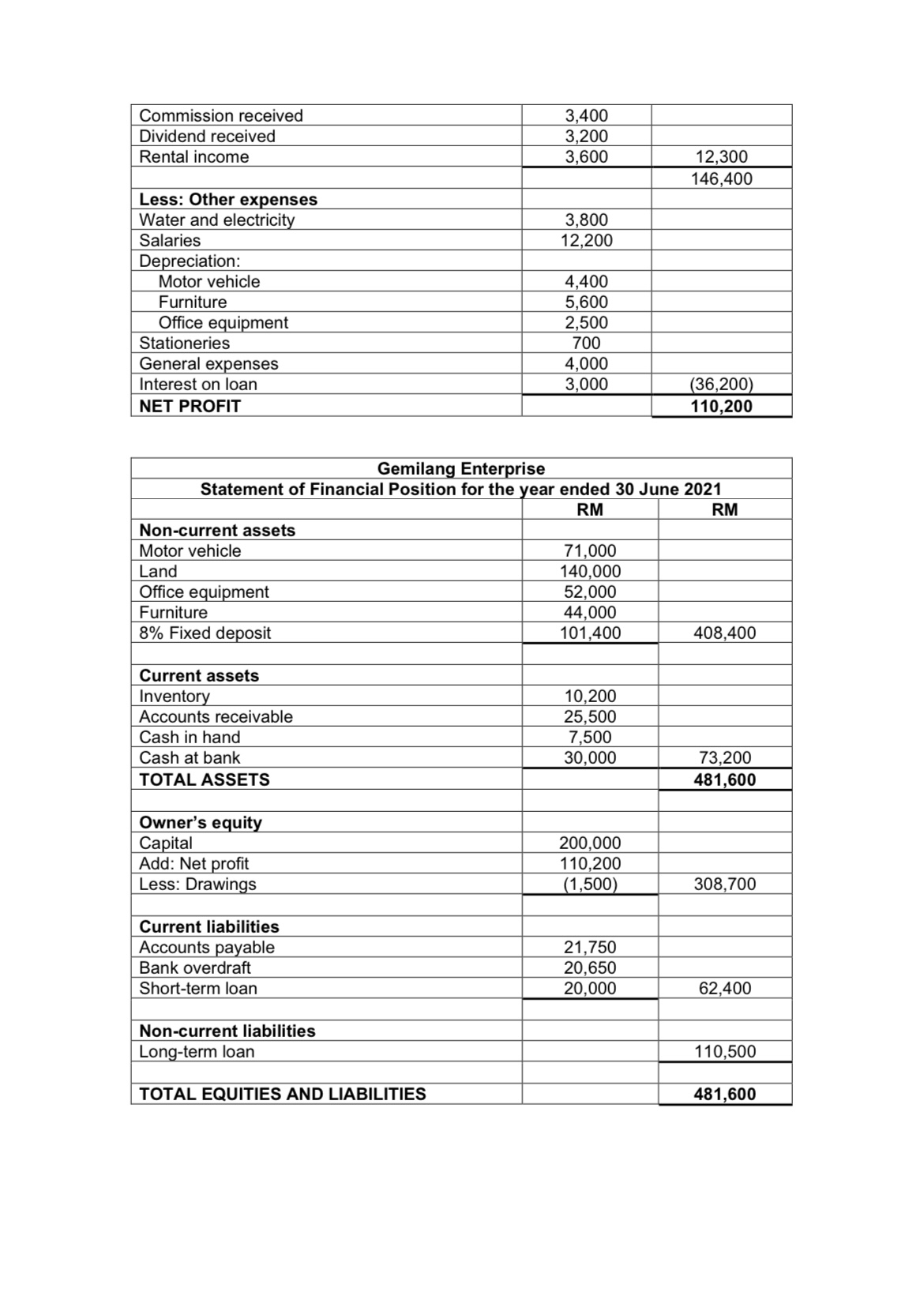

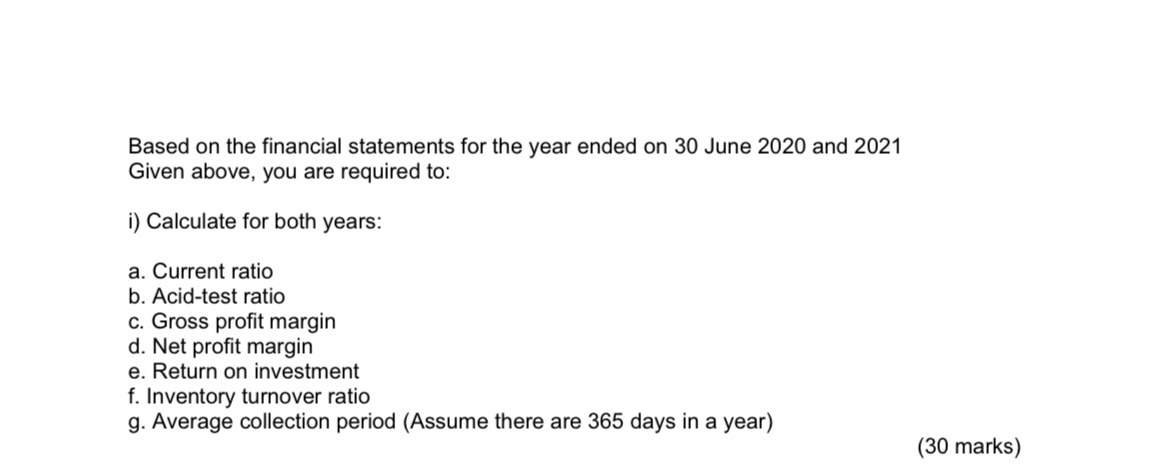

Gemilang Enterprise is involved in the food processing industry. The following were extracted from the financial statements of Gemilang Enterprise for the year ended 30 Jun 2020 and 30 Jun 2021. Financial statements for the year ended 30 Jun 2020: Gemilang Enterprise Statement of Profit or Loss for the year ended 30 Jun 2020 RM RM Sales 150,000 (-) Sales return (3,000) (-) Discount allowed (2.300) 144,700 Less: Cost of goods sold Opening inventory 35,000 + Purchases 88,700 (-) Drawings of goods (1,000) (.) Purchase return (2,800) (-) Discount received (2,500) + Carriage inwards 1,680 Cost of good available for sales 119,080 |(-) inventory stock (49,000) (70,080) Gross Profit 74,620 Add: Other Income Interest on fixed deposit 6,400 Rental income 9,300 15,700 Less: Expenses Water and electricity Salaries Interest on loan Carriage outwards Depreciation: 5,250 11,650 8,200 3,120 Motor vehicle Furniture Net Profit 11,935 4,600 (44,755) 45,565 Gemilang Enterprise Statement of Financial Position for the year ended 30 Jun 2020 RM RM Non-current assets Motor vehicle Furniture 8% Fixed deposit 107,415 36,800 80,000 224,215 Current assets Inventory Account receivable Cash at Bank Cash in hand TOTAL ASSETS 49,000 33, 100 168,750 35,050 285,900 510,115 Owner's equity Capital Add: Net profit Less: Drawings 215,450 45,565 (2,500) 258,515 Current liabilities Accounts payable 21,600 21,600 Non-current liabilities Long-term loan 230,000 230,000 TOTAL EQUITIES AND LIABILITIES 510,115 Financial statements for the year ended 30 Jun 2021: Gemilang Enterprise Statement of Profit or Loss for the year ended 30 Jun 2021 RM RM Sales 326,250 Less: Return inwards (850) Net Sales 325,400 Less: Cost of Goods Sold Opening inventory 49,000 Add: Purchases 152,900 Less: Return outwards (400) Cost of goods available for sale 201,500 Less: Closing inventory (10,200) Cost of goods sold (191,300) GROSS PROFIT 134,100 Add: Other revenues Interest on fixed deposit 2,100 Commission received Dividend received Rental income 3,400 3,200 3,600 12,300 146,400 3,800 12,200 Less: Other expenses Water and electricity Salaries Depreciation: Motor vehicle Furniture Office equipment Stationeries General expenses Interest on loan NET PROFIT 4,400 5,600 2,500 700 4,000 3,000 (36,200) 110,200 Gemilang Enterprise Statement of Financial Position for the year ended 30 June 2021 RM RM Non-current assets Motor vehicle 71,000 Land 140,000 Office equipment 52,000 Furniture 44,000 8% Fixed deposit 101,400 408,400 Current assets Inventory Accounts receivable Cash in hand Cash at bank TOTAL ASSETS 10,200 25,500 7,500 30,000 73,200 481,600 Owner's equity Capital Add: Net profit Less: Drawings 200,000 110,200 (1,500) 308,700 Current liabilities Accounts payable Bank overdraft Short-term loan 21,750 20,650 20,000 62,400 Non-current liabilities Long-term loan 110,500 TOTAL EQUITIES AND LIABILITIES 481,600 Based on the financial statements for the year ended on 30 June 2020 and 2021 Given above, you are required to: i) Calculate for both years: a. Current ratio b. Acid-test ratio c. Gross profit margin d. Net profit margin e. Return on investment f. Inventory turnover ratio g. Average collection period (Assume there are 365 days in a year) (30 marks)