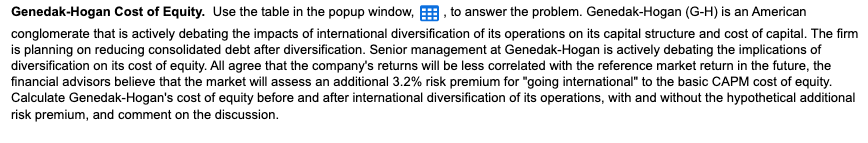

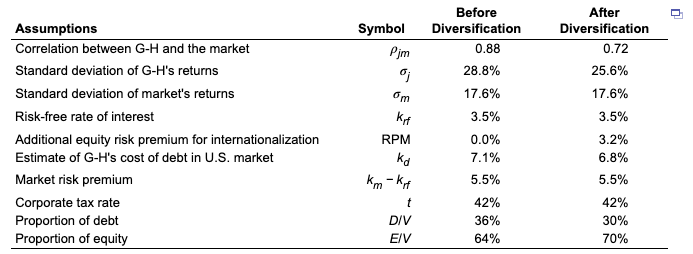

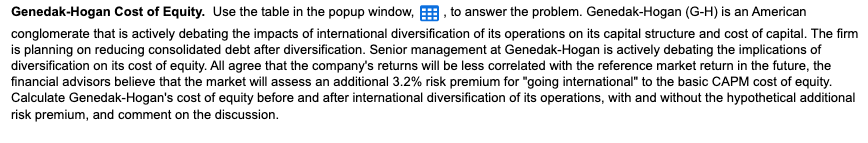

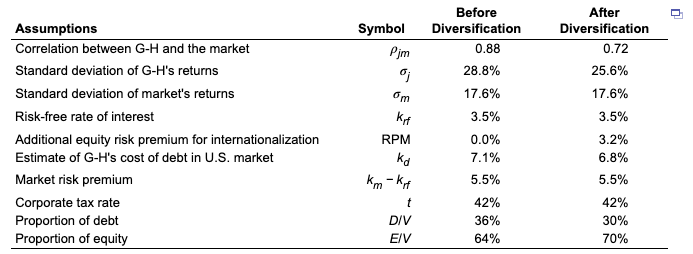

Genedak-Hogan Cost of Equity. Use the table in the popup window, , to answer the problem. Genedak-Hogan (G-H) is an American conglomerate that is actively debating the impacts of international diversification of its operations on its capital stre and diversification on its cost of equity. All agree that the company's returns will be less correlated with the reference market return in the future, the financial advisors believe that the market will assess an additional 3.2% risk premium for "going international" to the basic CAPM cost of equity. Calculate Genedak-Hogan's cost of equity before and after international diversification of its operations, with and without the himalional risk premium, and comment on the discussion. \begin{tabular}{lrrr} Assumptions & Symbol & Before Diversification & Diversification \\ \hline Correlation between G-H and the market & jm & 0.88 & 0.72 \\ Standard deviation of G-H's returns & j & 28.8% & 25.6% \\ Standard deviation of market's returns & m & 17.6% & 17.6% \\ Risk-free rate of interest & krf & 3.5% & 3.5% \\ Additional equity risk premium for internationalization & RPM & 0.0% & 3.2% \\ Estimate of G-H's cost of debt in U.S. market & kd & 7.1% & 6.8% \\ Market risk premium & krf & 5.5% & 5.5% \\ Corporate tax rate & t & 42% & 42% \\ Proportion of debt & D/V & 36% & 30% \\ Proportion of equity & 64% & 70% \\ \hline \end{tabular} Genedak-Hogan Cost of Equity. Use the table in the popup window, , to answer the problem. Genedak-Hogan (G-H) is an American conglomerate that is actively debating the impacts of international diversification of its operations on its capital stre and diversification on its cost of equity. All agree that the company's returns will be less correlated with the reference market return in the future, the financial advisors believe that the market will assess an additional 3.2% risk premium for "going international" to the basic CAPM cost of equity. Calculate Genedak-Hogan's cost of equity before and after international diversification of its operations, with and without the himalional risk premium, and comment on the discussion. \begin{tabular}{lrrr} Assumptions & Symbol & Before Diversification & Diversification \\ \hline Correlation between G-H and the market & jm & 0.88 & 0.72 \\ Standard deviation of G-H's returns & j & 28.8% & 25.6% \\ Standard deviation of market's returns & m & 17.6% & 17.6% \\ Risk-free rate of interest & krf & 3.5% & 3.5% \\ Additional equity risk premium for internationalization & RPM & 0.0% & 3.2% \\ Estimate of G-H's cost of debt in U.S. market & kd & 7.1% & 6.8% \\ Market risk premium & krf & 5.5% & 5.5% \\ Corporate tax rate & t & 42% & 42% \\ Proportion of debt & D/V & 36% & 30% \\ Proportion of equity & 64% & 70% \\ \hline \end{tabular}