Answered step by step

Verified Expert Solution

Question

1 Approved Answer

General Conditional Format as Cell $ , % , 0 . 0 0 Formatting Table Styles Number x 2 Styles Cells More 2 . (

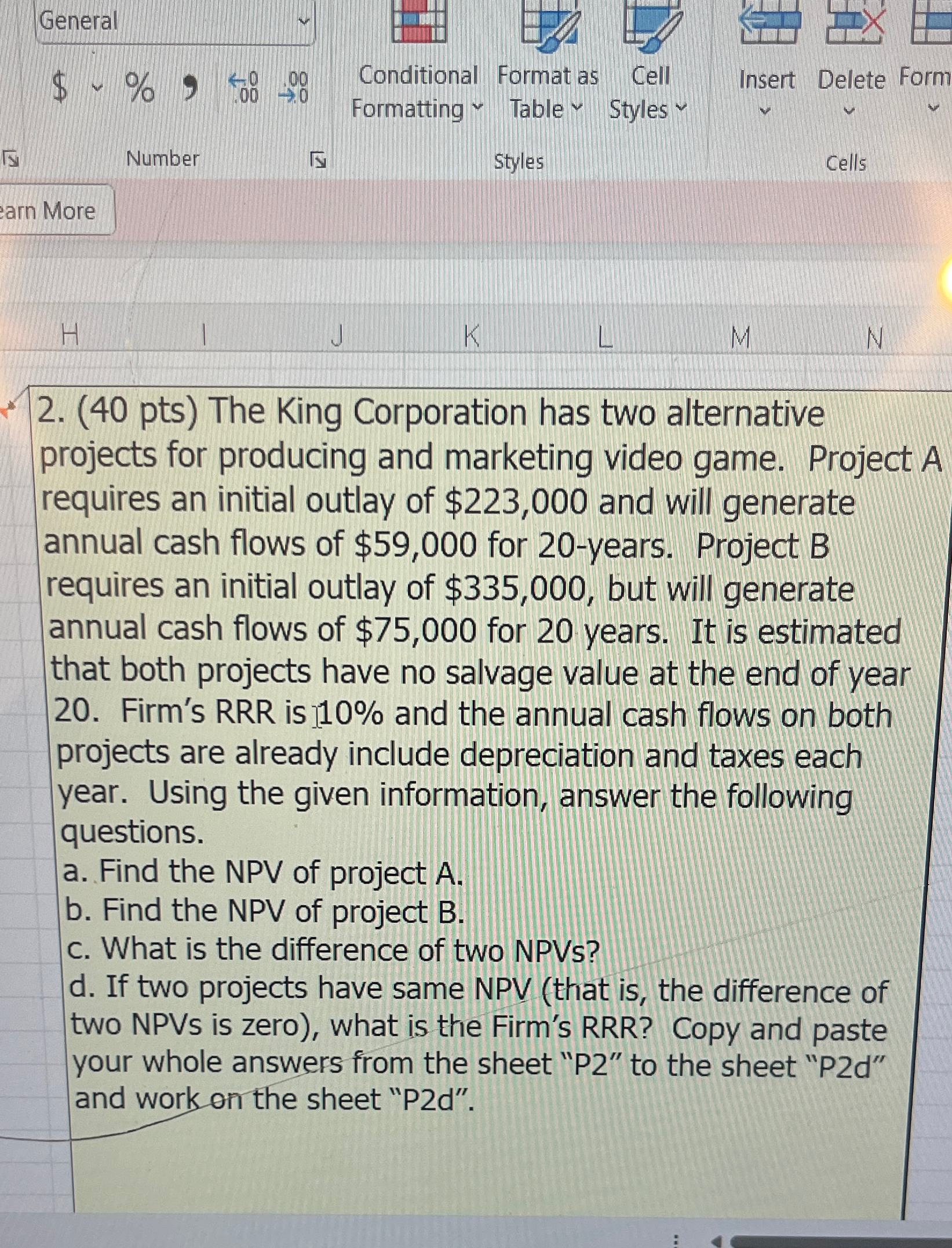

General Conditional Format as Cell $ Formatting Table Styles Number Styles Cells More pts The King Corporation has two alternative projects for producing and marketing video game. Project A requires an initial outlay of $ and will generate annual cash flows of $ for years. Project B requires an initial outlay of $ but will generate annual cash flows of $ for years. It is estimated that both projects have no salvage value at the end of year Firm's RRR is and the annual cash flows on both projects are already include depreciation and taxes each year. Using the given information, answer the following questions. a Find the NPV of project A b Find the NPV of project B c What is the difference of two NPVs d If two projects have same NPV that is the difference of two NPVs is zero what is the Firm's RRR Copy and paste your whole answers from the sheet P to the sheet Pd and work on the sheet Pd

General

Conditional Format as Cell

$

Formatting

Table

Styles

Number

Styles

Cells

More

pts The King Corporation has two alternative projects for producing and marketing video game. Project A requires an initial outlay of $ and will generate annual cash flows of $ for years. Project B requires an initial outlay of $ but will generate annual cash flows of $ for years. It is estimated that both projects have no salvage value at the end of year Firm's RRR is and the annual cash flows on both projects are already include depreciation and taxes each year. Using the given information, answer the following questions.

a Find the NPV of project A

b Find the NPV of project B

c What is the difference of two NPVs

d If two projects have same NPV that is the difference of two NPVs is zero what is the Firm's RRR Copy and paste your whole answers from the sheet P to the sheet Pd and work on the sheet Pd

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started