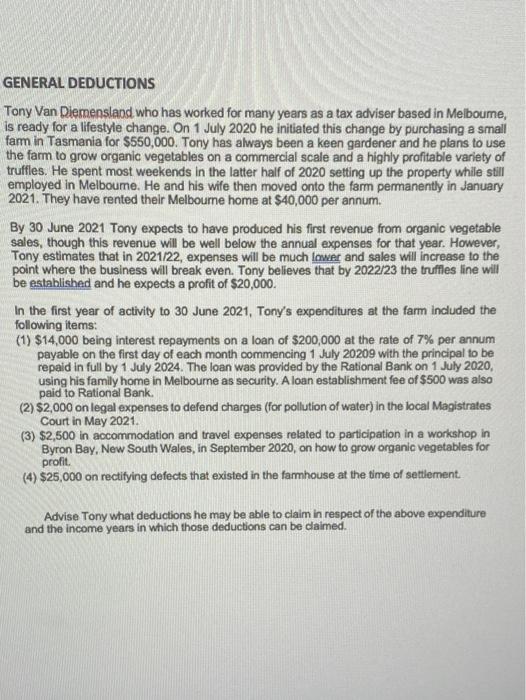

GENERAL DEDUCTIONS Tony Van Diemensland who has worked for many years as a tax adviser based in Melboume, is ready for a lifestyle change. On 1 July 2020 he initiated this change by purchasing a small fam in Tasmania for $550,000. Tony has always been a keen gardener and he plans to use the farm to grow organic vegetables on a commercial scale and a highly profitable variety of truffles. He spent most weekends in the latter half of 2020 setting up the property while still employed in Melboume. He and his wife then moved onto the farm permanently in January 2021. They have rented their Melbourne home at $40,000 per annum. By 30 June 2021 Tony expects to have produced his first revenue from organic vegetable sales, though this revenue will be well below the annual expenses for that year. However, Tony estimates that in 2021/22, expenses will be much lower and sales will increase to the point where the business will break even. Tony believes that by 2022/23 the truffles line will be established and he expects a profit of $20,000. In the first year of activity to 30 June 2021, Tony's expenditures at the farm included the following items: (1) $14,000 being interest repayments on a loan of $200,000 at the rate of 7% per annum payable on the first day of each month commencing 1 July 20209 with the principal to be repaid in full by 1 July 2024. The loan was provided by the Rational Bank on 1 July 2020, using his family home in Melboume as security. A loan establishment fee of $500 was also paid to Rational Bank. (2) $2,000 on legal expenses to defend charges (for pollution of water) in the local Magistrates Court in May 2021. (3) $2,500 in accommodation and travel expenses related to participation in a workshop in Byron Bay, New South Wales, in September 2020, on how to grow organic vegetables for profit. (4) $25,000 on rectifying defects that existed in the farmhouse at the time of settlement Advise Tony what deductions he may be able to claim in respect of the above expenditure and the income years in which those deductions can be claimed. GENERAL DEDUCTIONS Tony Van Diemensland who has worked for many years as a tax adviser based in Melboume, is ready for a lifestyle change. On 1 July 2020 he initiated this change by purchasing a small fam in Tasmania for $550,000. Tony has always been a keen gardener and he plans to use the farm to grow organic vegetables on a commercial scale and a highly profitable variety of truffles. He spent most weekends in the latter half of 2020 setting up the property while still employed in Melboume. He and his wife then moved onto the farm permanently in January 2021. They have rented their Melbourne home at $40,000 per annum. By 30 June 2021 Tony expects to have produced his first revenue from organic vegetable sales, though this revenue will be well below the annual expenses for that year. However, Tony estimates that in 2021/22, expenses will be much lower and sales will increase to the point where the business will break even. Tony believes that by 2022/23 the truffles line will be established and he expects a profit of $20,000. In the first year of activity to 30 June 2021, Tony's expenditures at the farm included the following items: (1) $14,000 being interest repayments on a loan of $200,000 at the rate of 7% per annum payable on the first day of each month commencing 1 July 20209 with the principal to be repaid in full by 1 July 2024. The loan was provided by the Rational Bank on 1 July 2020, using his family home in Melboume as security. A loan establishment fee of $500 was also paid to Rational Bank. (2) $2,000 on legal expenses to defend charges (for pollution of water) in the local Magistrates Court in May 2021. (3) $2,500 in accommodation and travel expenses related to participation in a workshop in Byron Bay, New South Wales, in September 2020, on how to grow organic vegetables for profit. (4) $25,000 on rectifying defects that existed in the farmhouse at the time of settlement Advise Tony what deductions he may be able to claim in respect of the above expenditure and the income years in which those deductions can be claimed