Question

General Electric and Vintage Soda Company are both interested in borrowing $10,000,000 for capital projects. General Electric wishes to borrow at floating rate and

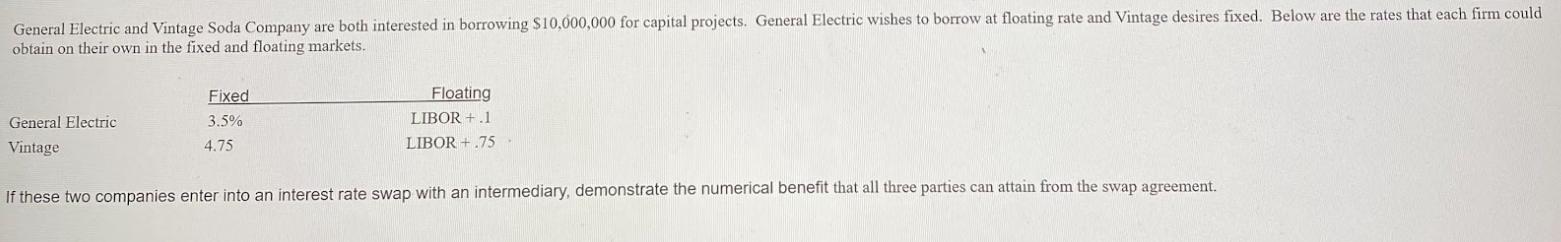

General Electric and Vintage Soda Company are both interested in borrowing $10,000,000 for capital projects. General Electric wishes to borrow at floating rate and Vintage desires fixed. Below are the rates that each firm could obtain on their own in the fixed and floating markets. General Electric Vintage Floating LIBOR +.1 LIBOR +.75 If these two companies enter into an interest rate swap with an intermediary, demonstrate the numerical benefit that all three parties can attain from the swap agreement. Fixed 3.5% 4.75

Step by Step Solution

3.36 Rating (143 Votes )

There are 3 Steps involved in it

Step: 1

To demonstrate the numerical benefit that all three parties can attain from the interest rate swap agreement we need to compare the rates that General ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Reporting Financial Statement Analysis And Valuation A Strategic Perspective

Authors: James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

9th Edition

1337614689, 1337614688, 9781337668262, 978-1337614689

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App