Answered step by step

Verified Expert Solution

Question

1 Approved Answer

General Electric (GE) has outstanding $1000-par-value bonds with a 4.125% annual coupon paid semi-annually. The bonds, which are due in exactly 21 years, currently

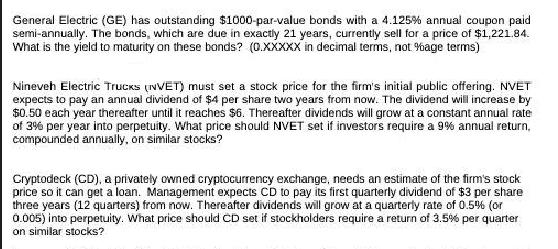

General Electric (GE) has outstanding $1000-par-value bonds with a 4.125% annual coupon paid semi-annually. The bonds, which are due in exactly 21 years, currently sell for a price of $1,221.84. What is the yield to maturity on these bonds? (0.XXXXX in decimal terms, not %age terms) Nineveh Electric Trucks (NVET) must set a stock price for the firm's initial public offering. NVET expects to pay an annual dividend of $4 per share two years from now. The dividend will increase by $0.50 each year thereafter until it reaches $6. Thereafter dividends will grow at a constant annual rate of 3% per year into perpetuity. What price should NVET set if investors require a 9% annual return, compounded annually, on similar stocks? Cryptodeck (CD), a privately owned cryptocurrency exchange, needs an estimate of the firm's stock price so it can get a loan. Management expects CD to pay its first quarterly dividend of $3 per share three years (12 quarters) from now. Thereafter dividends will grow at a quarterly rate of 0.5% (or 0.005) into perpetuity. What price should CD set if stockholders require a return of 3.5 % per quarter on similar stocks?

Step by Step Solution

★★★★★

3.33 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Problem 1 General Electric GE Bonds Yield to Maturity YTM To calculate the yield to maturity YTM for ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started