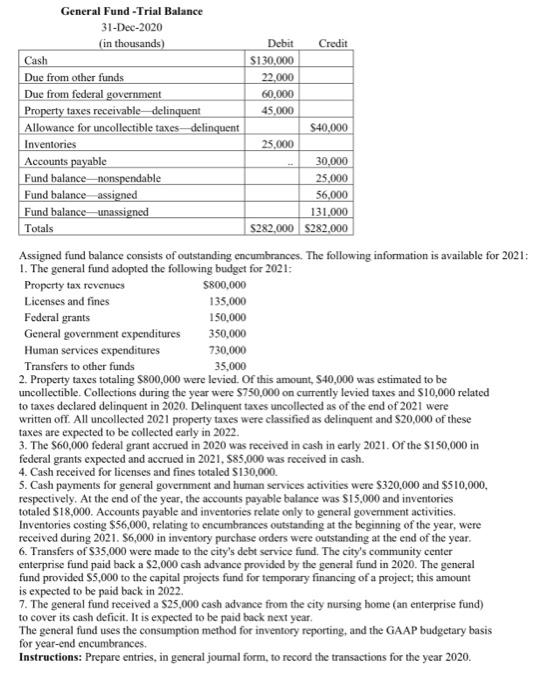

General Fund -Trial Balance 31-Dec-2020 Assigned fund balance consists of outstanding encumbrances. The following information is available for 2021: 1. The general fund adopted the following budget for 2021 : 2. Property taxes totaling $800,000 were levied. Of this amount, $40,000 was estimated to be uncollectible. Collections during the year were $750,000 on currently levied taxes and $10,000 related to taxes declared delinquent in 2020. Delinquent taxes uncollected as of the end of 2021 were written off. All uncollected 2021 property taxes were classified as delinquent and $20,000 of these taxes are expected to be collected early in 2022. 3. The $60,000 federal grant accrued in 2020 was received in cash in early 2021. Of the $150,000 in federal grants expected and accrued in 2021, $85,000 was received in cash. 4. Cash received for licenses and fines totaled $130,000. 5. Cash payments for general government and human services activities were $320,000 and $510,000, respectively. At the end of the year, the accounts payable balance was $15,000 and inventories totaled $18,000. Accounts payable and inventories relate only to general government activities. Inventories costing $56,000, relating to encumbrances outstanding at the beginning of the year, were received during 2021. $6,000 in inventory purchase orders were outstanding at the end of the year. 6. Transfers of $35,000 were made to the city's debt service fund. The city's community center enterprise fund paid back a $2,000 cash advance provided by the general fund in 2020 . The general fund provided $5,000 to the capital projects fund for temporary financing of a project; this amount is expected to be paid back in 2022 . 7. The general fund received a $25,000 cash advance from the city nursing bome (an enterprise fund) to cover its cash deficit. It is expected to be paid back next year. The general fund uses the consumption merhod for inventory reporting, and the GAAP budgetary basis for year-end encumbrances. Instructions: Prepare entries, in general joumal form, to record the transactions for the year 2020. General Fund -Trial Balance 31-Dec-2020 Assigned fund balance consists of outstanding encumbrances. The following information is available for 2021: 1. The general fund adopted the following budget for 2021 : 2. Property taxes totaling $800,000 were levied. Of this amount, $40,000 was estimated to be uncollectible. Collections during the year were $750,000 on currently levied taxes and $10,000 related to taxes declared delinquent in 2020. Delinquent taxes uncollected as of the end of 2021 were written off. All uncollected 2021 property taxes were classified as delinquent and $20,000 of these taxes are expected to be collected early in 2022. 3. The $60,000 federal grant accrued in 2020 was received in cash in early 2021. Of the $150,000 in federal grants expected and accrued in 2021, $85,000 was received in cash. 4. Cash received for licenses and fines totaled $130,000. 5. Cash payments for general government and human services activities were $320,000 and $510,000, respectively. At the end of the year, the accounts payable balance was $15,000 and inventories totaled $18,000. Accounts payable and inventories relate only to general government activities. Inventories costing $56,000, relating to encumbrances outstanding at the beginning of the year, were received during 2021. $6,000 in inventory purchase orders were outstanding at the end of the year. 6. Transfers of $35,000 were made to the city's debt service fund. The city's community center enterprise fund paid back a $2,000 cash advance provided by the general fund in 2020 . The general fund provided $5,000 to the capital projects fund for temporary financing of a project; this amount is expected to be paid back in 2022 . 7. The general fund received a $25,000 cash advance from the city nursing bome (an enterprise fund) to cover its cash deficit. It is expected to be paid back next year. The general fund uses the consumption merhod for inventory reporting, and the GAAP budgetary basis for year-end encumbrances. Instructions: Prepare entries, in general joumal form, to record the transactions for the year 2020