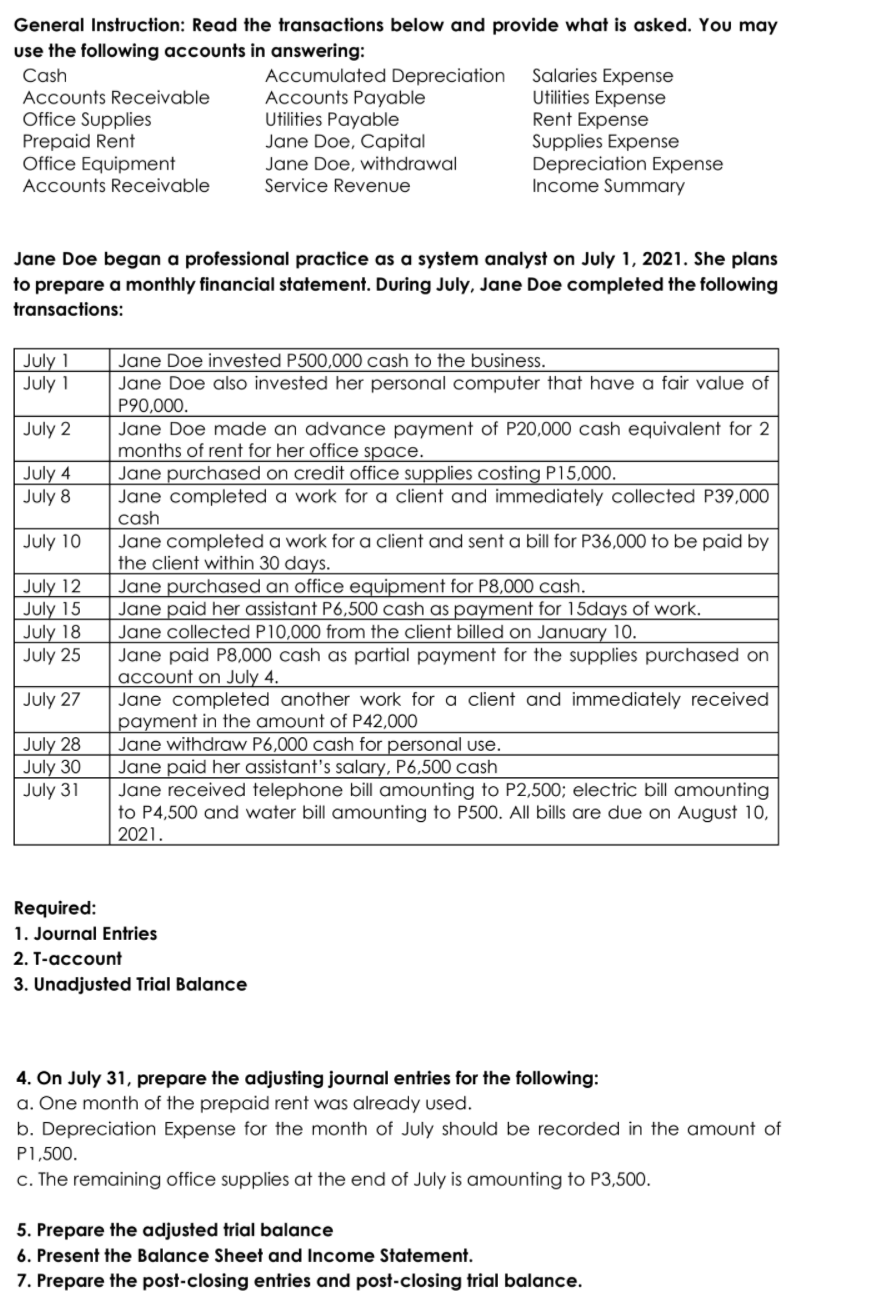

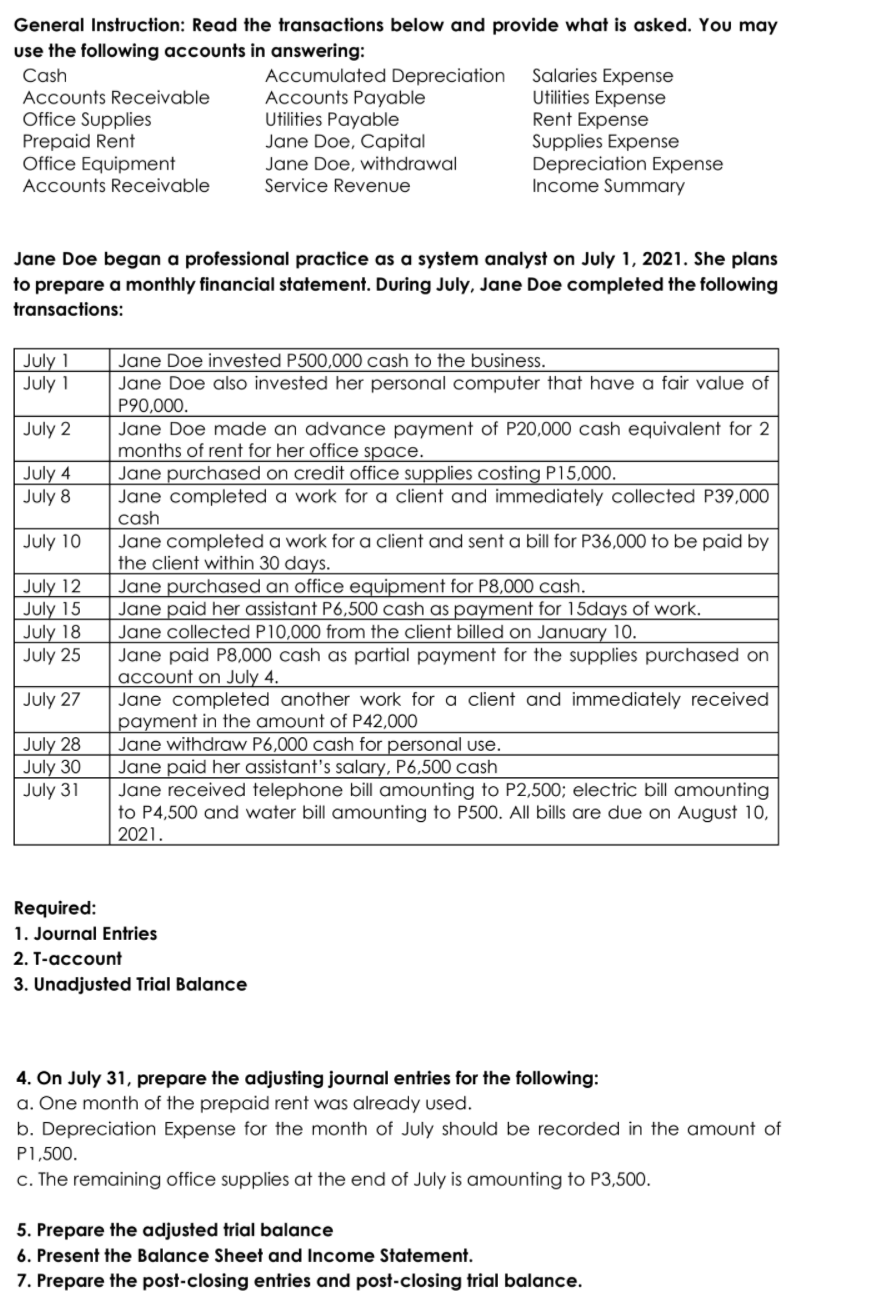

General Instruction: Read the transactions below and provide what is asked. You may use the following accounts in answering: Cash Accumulated Depreciation Salaries Expense Accounts Receivable Accounts Payable Utilities Expense Office Supplies Utilities Payable Rent Expense Prepaid Rent Jane Doe, Capital Supplies Expense Office Equipment Jane Doe, withdrawal Depreciation Expense Accounts Receivable Service Revenue Income Summary Jane Doe began a professional practice as a system analyst on July 1, 2021. She plans to prepare a monthly financial statement. During July, Jane Doe completed the following transactions: July 1 July 1 July 2 July 4 July 8 July 10 July 12 July 15 July 18 July 25 Jane Doe invested P500,000 cash to the business. Jane Doe also invested her personal computer that have a fair value of P90,000. Jane Doe made an advance payment of P20,000 cash equivalent for 2 months of rent for her office space. Jane purchased on credit office supplies costing P15,000. Jane completed a work for a client and immediately collected P39,000 cash Jane completed a work for a client and sent a bill for P36,000 to be paid by the client within 30 days. Jane purchased an office equipment for P8,000 cash. Jane paid her assistant P6,500 cash as payment for 15days of work. Jane collected P10,000 from the client billed on January 10. Jane paid P8,000 cash as partial payment for the supplies purchased on account on July 4. Jane completed another work for a client and immediately received payment in the amount of P42,000 Jane withdraw P6,000 cash for personal use. Jane paid her assistant's salary, P6,500 cash Jane received telephone bill amounting to P2,500; electric bill amounting to P4,500 and water bill amounting to P500. All bills are due on August 10, 2021. July 27 July 28 July 30 July 31 Required: 1. Journal Entries 2. T-account 3. Unadjusted Trial Balance 4. On July 31, prepare the adjusting journal entries for the following: a. One month of the prepaid rent was already used. b. Depreciation Expense for the month of July should be recorded in the amount of P1,500. c. The remaining office supplies at the end of July is amounting to P3,500. 5. Prepare the adjusted trial balance 6. Present the Balance Sheet and Income Statement. 7. Prepare the post-closing entries and post-closing trial balance