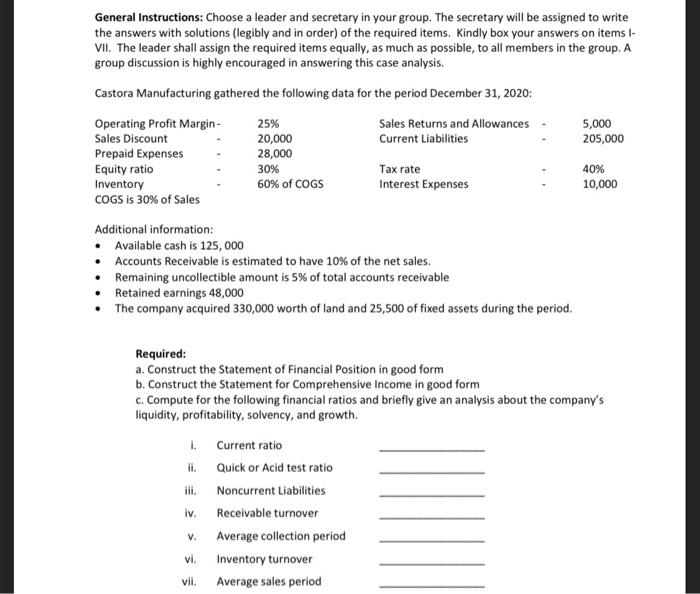

General Instructions: Choose a leader and secretary in your group. The secretary will be assigned to write the answers with solutions (legibly and in order) of the required items. Kindly box your answers on items IVII. The leader shall assign the required items equally, as much as possible, to all members in the group. A group discussion is highly encouraged in answering this case analysis. Castora Manufacturing gathered the following data for the period December 31, 2020: Additional information: - Available cash is 125, 000 - Accounts Receivable is estimated to have 10% of the net sales. - Remaining uncollectible amount is 5% of total accounts receivable - Retained earnings 48,000 - The company acquired 330,000 worth of land and 25,500 of fixed assets during the period. Required: a. Construct the Statement of Financial Position in good form b. Construct the Statement for Comprehensive Income in good form c. Compute for the following financial ratios and briefly give an analysis about the company's liquidity, profitability, solvency, and growth. i. Current ratio ii. Quick or Acid test ratio iii. Noncurrent Liabilities iv. Receivable turnover v. Average collection period vi. Inventory turnover vii. Average sales period General Instructions: Choose a leader and secretary in your group. The secretary will be assigned to write the answers with solutions (legibly and in order) of the required items. Kindly box your answers on items IVII. The leader shall assign the required items equally, as much as possible, to all members in the group. A group discussion is highly encouraged in answering this case analysis. Castora Manufacturing gathered the following data for the period December 31, 2020: Additional information: - Available cash is 125, 000 - Accounts Receivable is estimated to have 10% of the net sales. - Remaining uncollectible amount is 5% of total accounts receivable - Retained earnings 48,000 - The company acquired 330,000 worth of land and 25,500 of fixed assets during the period. Required: a. Construct the Statement of Financial Position in good form b. Construct the Statement for Comprehensive Income in good form c. Compute for the following financial ratios and briefly give an analysis about the company's liquidity, profitability, solvency, and growth. i. Current ratio ii. Quick or Acid test ratio iii. Noncurrent Liabilities iv. Receivable turnover v. Average collection period vi. Inventory turnover vii. Average sales period