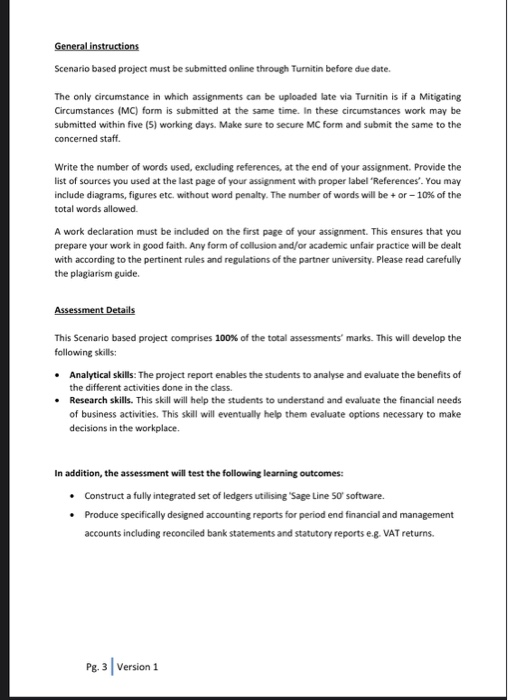

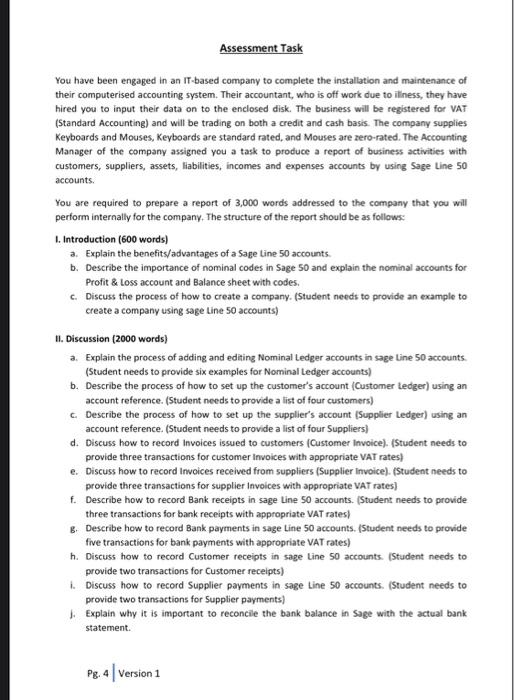

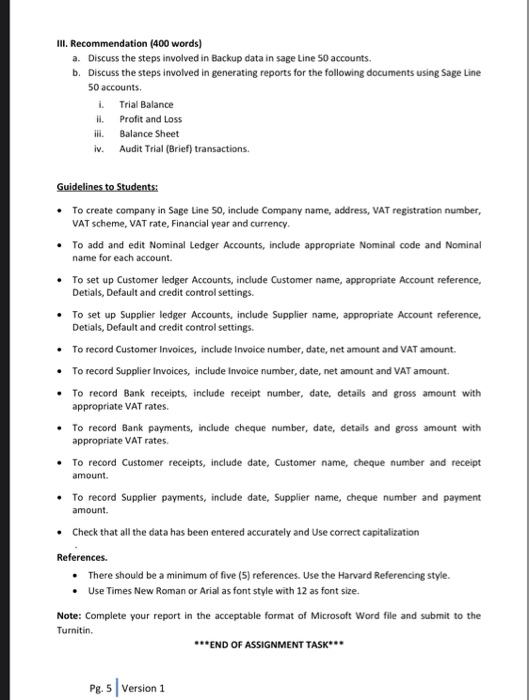

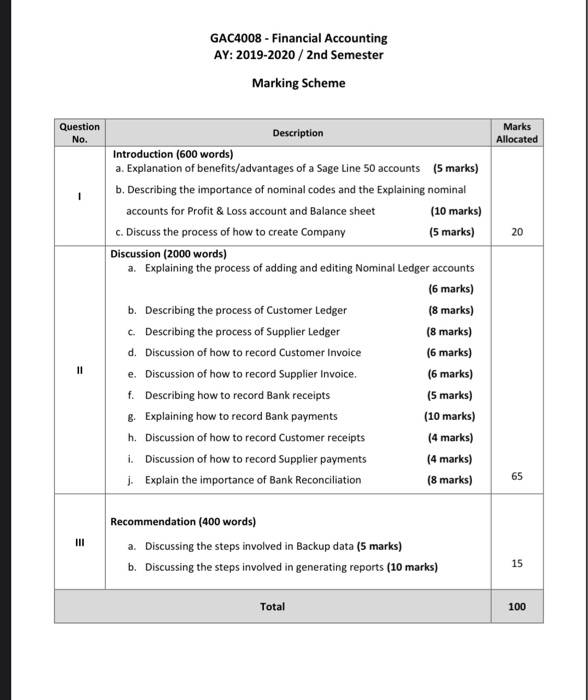

General instructions Scenario based project must be submitted online through Turnitin before due date. The only circumstance in which assignments can be uploaded late via Turnitin is if a Mitigating Circumstances (MC) form is submitted at the same time. In these circumstances work may be submitted within five (5) working days. Make sure to secure MC form and submit the same to the concerned staft. Write the number of words used, excluding references, at the end of your assignment. Provide the list of sources you used at the last page of your assignment with proper label "References'. You may include diagrams, figures etc. without word penalty. The number of words will be + or -10% of the total words allowed A work declaration must be included on the first page of your assignment. This ensures that you prepare your work in good faith. Any form of collusion and/or academic unfair practice will be dealt with according to the pertinent rules and regulations of the partner university. Please read carefully the plagiarism guide Assessment Details This Scenario based project comprises 100% of the total assessments marks. This will develop the following skills: Analytical skills: The project report enables the students to analyse and evaluate the benefits of the different activities done in the class. Research skills. This skill will help the students to understand and evaluate the financial needs of business activities. This skill will eventually help them evaluate options necessary to make decisions in the workplace. In addition, the assessment will test the following learning outcomes: Construct a fully integrated set of ledgers utilising 'Sage Line 50' software. . Produce specifically designed accounting reports for period end financial and management accounts including reconciled bank statements and statutory reports e.g VAT returns. Pg. 3 Version 1 Assessment Task You have been engaged in an IT-based company to complete the installation and maintenance of their computerised accounting system. Their accountant, who is off work due to illness, they have hired you to input their data on to the enclosed disk. The business will be registered for VAT (Standard Accounting) and will be trading on both a credit and cash basis. The company supplies Keyboards and Mouses, Keyboards are standard rated, and Mouses are zero-rated. The Accounting Manager of the company assigned you a task to produce a report of business activities with customers, suppliers, assets, liabilities, incomes and expenses accounts by using Sage Line 50 accounts. You are required to prepare a report of 3,000 words addressed to the company that you will perform internally for the company. The structure of the report should be as follows: I. Introduction (600 words) a. Explain the benefits/advantages of a Sage Line 50 accounts b. Describe the importance of nominal codes in Sage 50 and explain the nominal accounts for Profit & Loss account and Balance sheet with codes. c. Discuss the process of how to create a company. (Student needs to provide an example to create a company using sage Line 50 accounts) II. Discussion (2000 words) a. Explain the process of adding and editing Nominal Ledger accounts in sage Line 50 accounts. (Student needs to provide six examples for Nominal Ledger accounts) b. Describe the process of how to set up the customer's account (Customer Ledger) using an account reference. (Student needs to provide a list of four customers) c. Describe the process of how to set up the supplier's account (Supplier Ledger) using an account reference. (Student needs to provide a list of four Suppliers) d. Discuss how to record Invoices issued to customers (Customer Invoice) (Student needs to provide three transactions for customer invoices with appropriate VAT rates) e. Discuss how to record Invoices received from suppliers (Supplier invoice). (Student needs to provide three transactions for supplier invoices with appropriate VAT rates) f. Describe how to record Bank receipts in sage Line 50 accounts. (Student needs to provide three transactions for bank receipts with appropriate VAT rates) 8. Describe how to record Bank payments in sage Line 50 accounts. (Student needs to provide five transactions for bank payments with appropriate VAT rates) h. Discuss how to record Customer receipts in sage Line 50 accounts. (Student needs to provide two transactions for Customer receipts) 1. Discuss how to record Supplier payments in sage Line 50 accounts. (Student needs to provide two transactions for Supplier payments) 1. Explain why it is important to reconcile the bank balance in Sage with the actual bank statement Pg. 4 Version 1 III. Recommendation (400 words) a. Discuss the steps involved in Backup data in sage Line 50 accounts. b. Discuss the steps involved in generating reports for the following documents using Sage Line 50 accounts. Trial Balance Profit and Loss Balance Sheet iv. Audit Trial (Brief) transactions. ii. Guidelines to Students To create company in Sage Line 50, include company name, address, VAT registration number, VAT Scheme, VAT rate, Financial year and currency To add and edit Nominal Ledger Accounts, include appropriate Nominal code and Nominal name for each account. To set up Customer ledger Accounts, include Customer name, appropriate Account reference, Detials, Default and credit control settings. . To set up Supplier ledger Accounts, include Supplier name, appropriate Account reference, Detials, Default and credit control settings. To record Customer Invoices, include Invoice number, date, net amount and VAT amount. To record Supplier Invoices, include Invoice number, date, net amount and VAT amount To record Bank receipts, include receipt number, date, details and gross amount with appropriate VAT rates. To record Bank payments, include cheque number, date, details and gross amount with appropriate VAT rates. To record Customer receipts, include date, Customer name, cheque number and receipt amount. To record Supplier payments, include date, Supplier name, cheque number and payment amount. Check that all the data has been entered accurately and Use correct capitalization References. There should be a minimum of five (5) references. Use the Harvard Referencing style. Use Times New Roman or Arial as font style with 12 as font size. Note: Complete your report in the acceptable format of Microsoft Word file and submit to the Turnitin. ***END OF ASSIGNMENT TASK Pg. 5 Version 1 GAC4008 - Financial Accounting AY: 2019-2020 / 2nd Semester Marking Scheme Question No. Marks Allocated 20 Description Introduction (600 words) a. Explanation of benefits/advantages of a Sage Line 50 accounts (5 marks) b. Describing the importance of nominal codes and the Explaining nominal accounts for Profit & Loss account and Balance sheet (10 marks) c. Discuss the process of how to create Company (5 marks) Discussion (2000 words) a. Explaining the process of adding and editing Nominal Ledger accounts (6 marks) b. Describing the process of Customer Ledger (8 marks) c. Describing the process of Supplier Ledger (8 marks) d. Discussion of how to record Customer Invoice (6 marks) e. Discussion of how to record Supplier Invoice. (6 marks) f. Describing how to record Bank receipts (5 marks) 8. Explaining how to record Bank payments (10 marks) h. Discussion of how to record Customer receipts (4 marks) i. Discussion of how to record Supplier payments (4 marks) Explain the importance of Bank Reconciliation (8 marks) 11 65 III Recommendation (400 words) a. Discussing the steps involved in Backup data (5 marks) b. Discussing the steps involved in generating reports (10 marks) 15 Total 100 Plagiarism 1. Plagiarism, which can be defined as using without acknowledgement another person's words or ideas and submitting them for assessment as though it were one's own work, for instance by copying translating from one language to another or unacknowledged paraphrasing. Further examples of plagiarism are given below: Use of any quotation(s) from the published or unpublished work of other persons, whether published in textbooks, articles, the Web, or in any other format, which quotations have not been clearly identified as such by being placed in quotation marks and acknowledged. Use of another person's words or ideas that have been slightly changed or paraphrased to make it look different from the original Summarising another person's ideas, judgments, diagrams, figures, or computer programmes without reference to that person in the text and the source in a bibliography or reference list. Use of services of essay banks and/or any other agencies. Use of unacknowledged material downloaded from the Internet. Re-use of one's own material except as authorised by the department. 2. Collusion, which can be defined as when work that has been undertaken by or with others is submitted and passed off as solely as the work of one person. This also applies where the work of one candidate is submitted in the name of another. Where this is done with the knowledge of the originator both parties can be considered to be at fault. 3. Fabrication of data, making false claims to have carried out experiments, observations, interviews or other forms of data collection and analysis, or acting dishonestly in any other way. Plagiarism Detection Software (PDS) - Turnitin As part of its commitment to quality and the maintenance of academic standards, the University reserves the right to use Plagiarism Detection Software (PDS), including Turnitin. Such software makes no judgment as to whether a plece of work has been plagiarised; it simply highlights sections of text that have been found in other sources. The use of plagiarism detection software fulfills two functions. The first is to enhance student learning (ie, as a developmental tool); the second is to guard against and identify unfair practice in assessment. Further information and guidance can be found in the University's policy on the Use of Plagiarism Detection Software (Turnitin). Pg. 7|Version 1 General instructions Scenario based project must be submitted online through Turnitin before due date. The only circumstance in which assignments can be uploaded late via Turnitin is if a Mitigating Circumstances (MC) form is submitted at the same time. In these circumstances work may be submitted within five (5) working days. Make sure to secure MC form and submit the same to the concerned staft. Write the number of words used, excluding references, at the end of your assignment. Provide the list of sources you used at the last page of your assignment with proper label "References'. You may include diagrams, figures etc. without word penalty. The number of words will be + or -10% of the total words allowed A work declaration must be included on the first page of your assignment. This ensures that you prepare your work in good faith. Any form of collusion and/or academic unfair practice will be dealt with according to the pertinent rules and regulations of the partner university. Please read carefully the plagiarism guide Assessment Details This Scenario based project comprises 100% of the total assessments marks. This will develop the following skills: Analytical skills: The project report enables the students to analyse and evaluate the benefits of the different activities done in the class. Research skills. This skill will help the students to understand and evaluate the financial needs of business activities. This skill will eventually help them evaluate options necessary to make decisions in the workplace. In addition, the assessment will test the following learning outcomes: Construct a fully integrated set of ledgers utilising 'Sage Line 50' software. . Produce specifically designed accounting reports for period end financial and management accounts including reconciled bank statements and statutory reports e.g VAT returns. Pg. 3 Version 1 Assessment Task You have been engaged in an IT-based company to complete the installation and maintenance of their computerised accounting system. Their accountant, who is off work due to illness, they have hired you to input their data on to the enclosed disk. The business will be registered for VAT (Standard Accounting) and will be trading on both a credit and cash basis. The company supplies Keyboards and Mouses, Keyboards are standard rated, and Mouses are zero-rated. The Accounting Manager of the company assigned you a task to produce a report of business activities with customers, suppliers, assets, liabilities, incomes and expenses accounts by using Sage Line 50 accounts. You are required to prepare a report of 3,000 words addressed to the company that you will perform internally for the company. The structure of the report should be as follows: I. Introduction (600 words) a. Explain the benefits/advantages of a Sage Line 50 accounts b. Describe the importance of nominal codes in Sage 50 and explain the nominal accounts for Profit & Loss account and Balance sheet with codes. c. Discuss the process of how to create a company. (Student needs to provide an example to create a company using sage Line 50 accounts) II. Discussion (2000 words) a. Explain the process of adding and editing Nominal Ledger accounts in sage Line 50 accounts. (Student needs to provide six examples for Nominal Ledger accounts) b. Describe the process of how to set up the customer's account (Customer Ledger) using an account reference. (Student needs to provide a list of four customers) c. Describe the process of how to set up the supplier's account (Supplier Ledger) using an account reference. (Student needs to provide a list of four Suppliers) d. Discuss how to record Invoices issued to customers (Customer Invoice) (Student needs to provide three transactions for customer invoices with appropriate VAT rates) e. Discuss how to record Invoices received from suppliers (Supplier invoice). (Student needs to provide three transactions for supplier invoices with appropriate VAT rates) f. Describe how to record Bank receipts in sage Line 50 accounts. (Student needs to provide three transactions for bank receipts with appropriate VAT rates) 8. Describe how to record Bank payments in sage Line 50 accounts. (Student needs to provide five transactions for bank payments with appropriate VAT rates) h. Discuss how to record Customer receipts in sage Line 50 accounts. (Student needs to provide two transactions for Customer receipts) 1. Discuss how to record Supplier payments in sage Line 50 accounts. (Student needs to provide two transactions for Supplier payments) 1. Explain why it is important to reconcile the bank balance in Sage with the actual bank statement Pg. 4 Version 1 III. Recommendation (400 words) a. Discuss the steps involved in Backup data in sage Line 50 accounts. b. Discuss the steps involved in generating reports for the following documents using Sage Line 50 accounts. Trial Balance Profit and Loss Balance Sheet iv. Audit Trial (Brief) transactions. ii. Guidelines to Students To create company in Sage Line 50, include company name, address, VAT registration number, VAT Scheme, VAT rate, Financial year and currency To add and edit Nominal Ledger Accounts, include appropriate Nominal code and Nominal name for each account. To set up Customer ledger Accounts, include Customer name, appropriate Account reference, Detials, Default and credit control settings. . To set up Supplier ledger Accounts, include Supplier name, appropriate Account reference, Detials, Default and credit control settings. To record Customer Invoices, include Invoice number, date, net amount and VAT amount. To record Supplier Invoices, include Invoice number, date, net amount and VAT amount To record Bank receipts, include receipt number, date, details and gross amount with appropriate VAT rates. To record Bank payments, include cheque number, date, details and gross amount with appropriate VAT rates. To record Customer receipts, include date, Customer name, cheque number and receipt amount. To record Supplier payments, include date, Supplier name, cheque number and payment amount. Check that all the data has been entered accurately and Use correct capitalization References. There should be a minimum of five (5) references. Use the Harvard Referencing style. Use Times New Roman or Arial as font style with 12 as font size. Note: Complete your report in the acceptable format of Microsoft Word file and submit to the Turnitin. ***END OF ASSIGNMENT TASK Pg. 5 Version 1 GAC4008 - Financial Accounting AY: 2019-2020 / 2nd Semester Marking Scheme Question No. Marks Allocated 20 Description Introduction (600 words) a. Explanation of benefits/advantages of a Sage Line 50 accounts (5 marks) b. Describing the importance of nominal codes and the Explaining nominal accounts for Profit & Loss account and Balance sheet (10 marks) c. Discuss the process of how to create Company (5 marks) Discussion (2000 words) a. Explaining the process of adding and editing Nominal Ledger accounts (6 marks) b. Describing the process of Customer Ledger (8 marks) c. Describing the process of Supplier Ledger (8 marks) d. Discussion of how to record Customer Invoice (6 marks) e. Discussion of how to record Supplier Invoice. (6 marks) f. Describing how to record Bank receipts (5 marks) 8. Explaining how to record Bank payments (10 marks) h. Discussion of how to record Customer receipts (4 marks) i. Discussion of how to record Supplier payments (4 marks) Explain the importance of Bank Reconciliation (8 marks) 11 65 III Recommendation (400 words) a. Discussing the steps involved in Backup data (5 marks) b. Discussing the steps involved in generating reports (10 marks) 15 Total 100 Plagiarism 1. Plagiarism, which can be defined as using without acknowledgement another person's words or ideas and submitting them for assessment as though it were one's own work, for instance by copying translating from one language to another or unacknowledged paraphrasing. Further examples of plagiarism are given below: Use of any quotation(s) from the published or unpublished work of other persons, whether published in textbooks, articles, the Web, or in any other format, which quotations have not been clearly identified as such by being placed in quotation marks and acknowledged. Use of another person's words or ideas that have been slightly changed or paraphrased to make it look different from the original Summarising another person's ideas, judgments, diagrams, figures, or computer programmes without reference to that person in the text and the source in a bibliography or reference list. Use of services of essay banks and/or any other agencies. Use of unacknowledged material downloaded from the Internet. Re-use of one's own material except as authorised by the department. 2. Collusion, which can be defined as when work that has been undertaken by or with others is submitted and passed off as solely as the work of one person. This also applies where the work of one candidate is submitted in the name of another. Where this is done with the knowledge of the originator both parties can be considered to be at fault. 3. Fabrication of data, making false claims to have carried out experiments, observations, interviews or other forms of data collection and analysis, or acting dishonestly in any other way. Plagiarism Detection Software (PDS) - Turnitin As part of its commitment to quality and the maintenance of academic standards, the University reserves the right to use Plagiarism Detection Software (PDS), including Turnitin. Such software makes no judgment as to whether a plece of work has been plagiarised; it simply highlights sections of text that have been found in other sources. The use of plagiarism detection software fulfills two functions. The first is to enhance student learning (ie, as a developmental tool); the second is to guard against and identify unfair practice in assessment. Further information and guidance can be found in the University's policy on the Use of Plagiarism Detection Software (Turnitin). Pg. 7|Version 1