Answered step by step

Verified Expert Solution

Question

1 Approved Answer

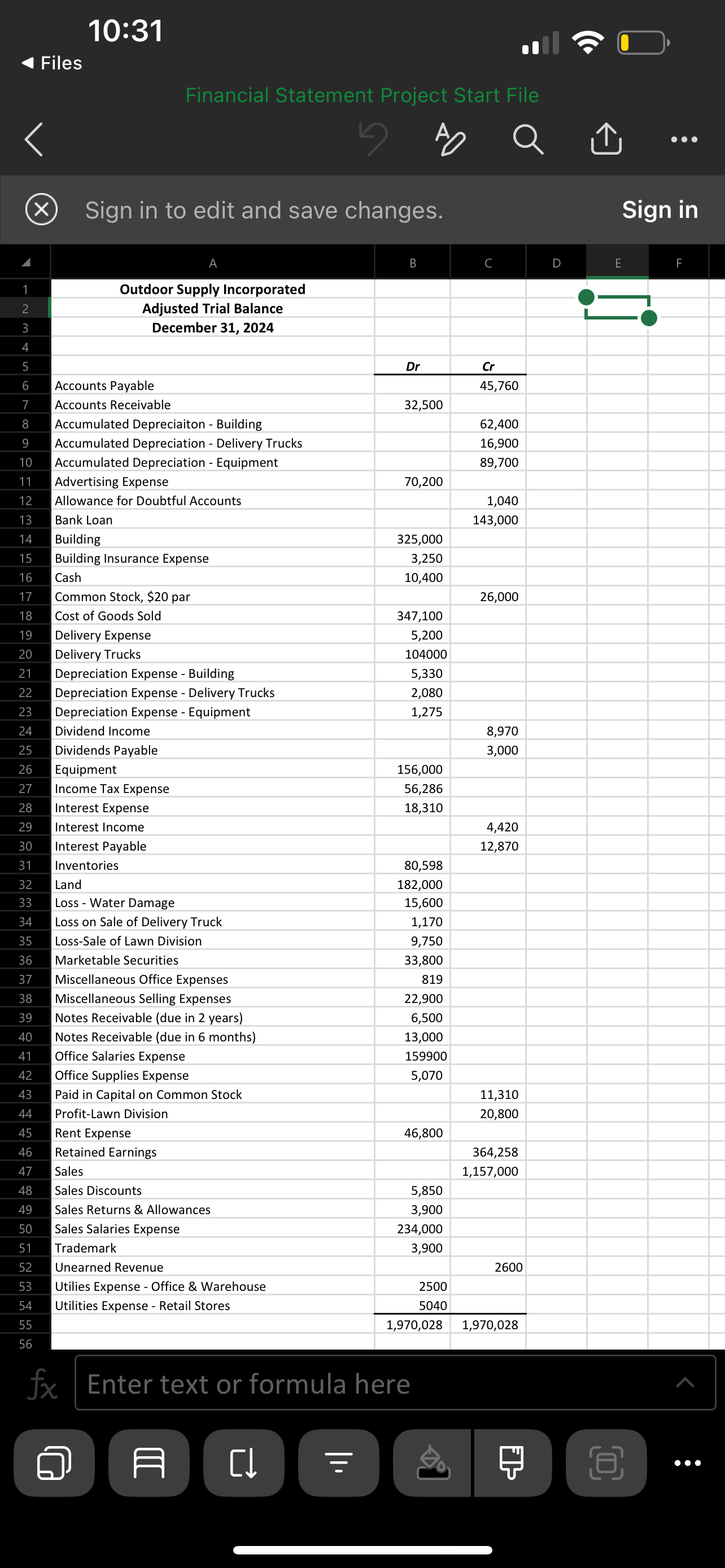

General Instructions: The goal of this assignment is to prepare and interpret year - end financial statements for Outdoor Supply, Incorporated ( or OSI )

General Instructions: The goal of this assignment is to prepare and interpret yearend financial statements for Outdoor Supply, Incorporated or OSI OSI sells products for outdoor activities, such as camping, hunting, fishing, etc. All financial statements must be prepared in good form and be professional in appearance. Assume you are going to present the statements to the company CEO and board of directors. Include proper headings. Use columns logically to show account balances, totals and subtotals. Format numbers for readability include commas but no decimal places Format the first number in each column and significant totals for dollar signs. Place underlines above totals and subtotals. Use indentation or fonts to identify section headings and totals. In summary, make the statements easy to read.You are given a adjusted trial balance in an Excel file as a starting point. The trial balance lists the accounts in alphabetical order. Feel free to make a copy of the trial balance and rearrange the order of the accounts if it would be helpful for you. All accounts on that trial balance should appear on a financial statement. That means show all the detail; do not summarize several accounts into one number. And, of course, follow GAAP.Prepare the following financial statements each on a separate tab sheet in your Excel file:A A multiple step income statement with all appropriate sections and subtotals. You must categorize operating expenses into the following categories: Selling Expenses and Administrative Expenses.B A statement of retained earnings.C A classified balance sheet. All appropriate asset and liability categories must be labeled and subtotaled. This includes Current Assets, Plant Assets, Intangible Assets, LongTerm Investments, Other LongTerm Assets, Current Liabilities, and LongTerm Liabilities.D Compute the following financial statement ratios presented in your textbook in Chapters and : Acid Test Ratio, Debt to Equity Ratio, Profit Margin on Sales and Return on Assets. Next to each ratio, write a one or two sentence description of what the answer means to OSI. That is not a generic definition of the ratio. Your description should state the number calculated and how that specific number is to be interpreted. You can assume OSIs total assets for were $ Additional Information. You may assume all these items have already been recorded correctly and account balances on the trial balance are accurate.

The company owns the land and buildings where its office and warehouse are located. The companys retail stores are rented.

Delivery trucks are used to deliver orders to customers.

The assets in the equipment category are office and warehouse equipment.

The balance in the Marketable Securities accounts represents stock investments held by OSI. All the stock is readily marketable. The VP of Finance for OSI strives to keep all cash not immediately needed for operations in investments that will generate a return through dividends and share appreciation. Included in the Marketable Securities account is an investment in Jade Industries stock that cost $ Jade Industries was started by a friend of OSIs founder and president Jason Wright. Jason has asked the VP of Finance not to sell the Jade stock at any time in the foreseeable future.

During a sprinkler malfunction in the warehouse caused some inventory to be damaged. The cost of the inventory lost was $

This year, OSI purchased land adjacent to its current warehouse location for $ OSI plans to expand its warehouse in the future. The land purchase will provide the grounds needed to enlarge the warehouse.

A few years back, OSI decided to sell lawn care equipment. Although the Lawn Division was returning a small profit, company management felt that the warranty repairs related to lawn equipment was distracting from the companys primary sales areas. As a result, the Lawn Division was sold during The Lawn Division qualified as a separate, identifiable business segment.

On January OSI borrowed $ to finance several muchneeded projects, including new warehouse equipment, an additional delivery truck and repairs to the office building. The loan will be repaid with annual installments with the st payment due OSIs accountant prepared the following loan amortization schedule

: The Notes Receivable due in months represents a note accepted from a customer for a large order of fishing equipment. The fishing equipment was sold to a nonprofit organization seeking to provide healthy activities for atrisk youth. The nonprofit recently received news that they have been awarded a grant to pay for the fishing equipment, so OSI is confident the nonprofit will be able to pay the note when it is due in months.

The Notes Receivable due in years represents a loan to OSIs CEO. The full amount of the loan will be paid in payment when it is due During a delivery truck with an original cost of $ and a book value of $ was sold for $ Dividends totaling $ were declared during the year. The Retained Earnings account was debited when these dividends were declared. The last quarterly declaration of dividends occurred on December That $ dividend will be paid on January The income tax expense account balance is the total income taxes for both continuing and discontinued operations. Use a income tax rate when determining the taxes applicable to discontinued operations.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started