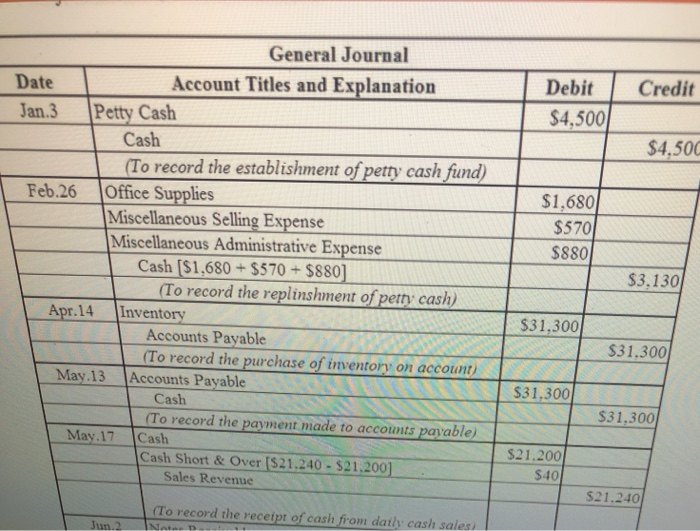

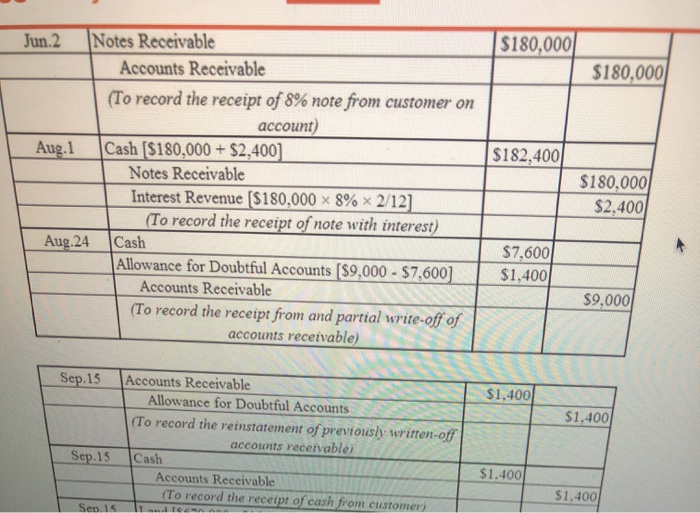

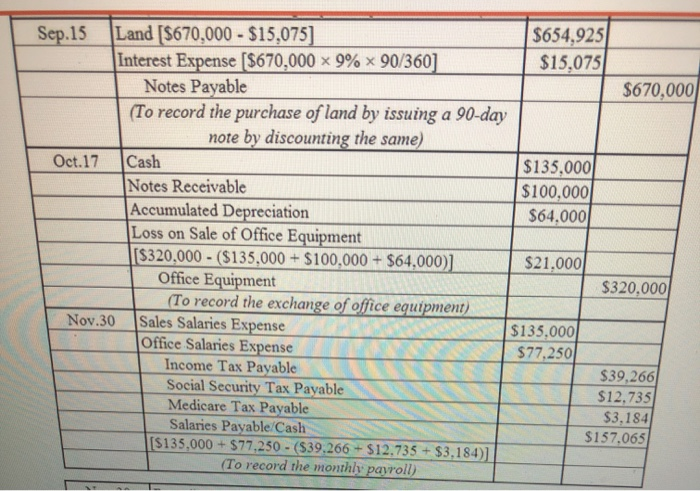

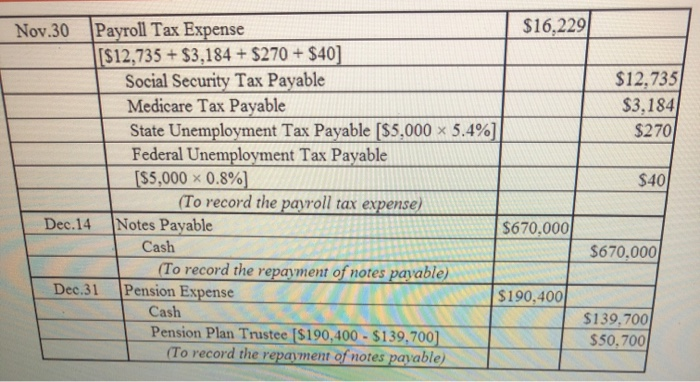

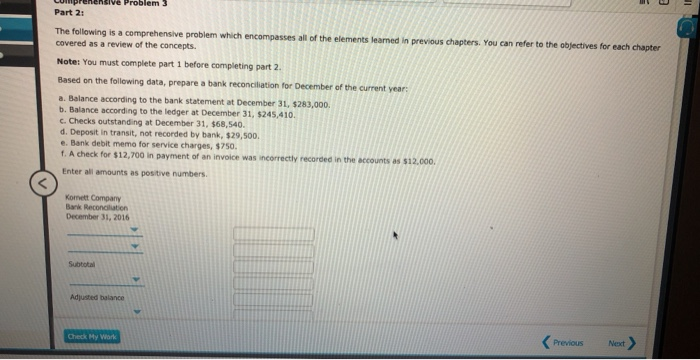

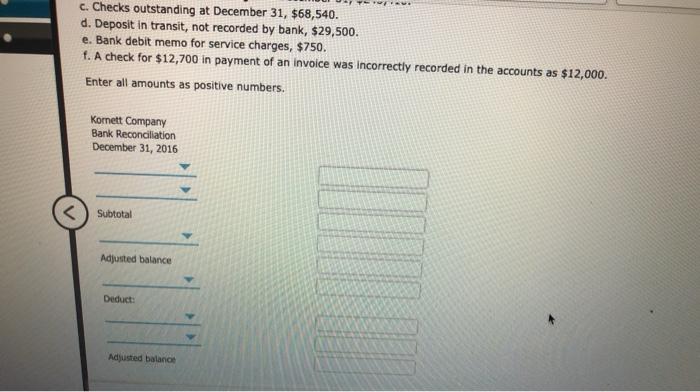

General Journal Debit Credit $4,500 Account Titles and Explanation Date Jan.3 Petty Cash Cash To record the establishment of petty cash fund) S4,50 $1.680 $570 $880 Feb.26 Office Supplies Miscellaneous Seling Expense Miscellaneous Administrative Expense Cash [$1.680+$570 $8801 S3,130 To record the replinshment of pett cash) Apr.14 Inventory $31,300 Accounts Payable To record the purchase of inventory on account) May.13 Accounts Payable 31,300 Cash To record the payment made to accounts pavable) 531,300 May.17 Cash $21.200 $40 Cash Short&Over [$21.240- $21.2001 Sales Revenue S21.240 To record the receipt of cash from dath cash sales un.2 180,000 Jun.2 Notes Receivable $180,000 Accounts Receivable (To record the receipt of 8% note from customer on account) 182,400 $180,000 Aug.1 Cash [$180,000+$2,400 Notes Receivable Interest Revenue [$180,000 8% 2/121 $2,400 To record the receipt of note with interest) Aug.24 Cash $7.600 Allowance for Doubtful Accounts [$9,000- $7,600$1,400 Accounts Receivable $9,000 To record the receipt from and partial write-off of accounts receivable) Sep.15 Accounts Receivable $1.400 Allowance for Doubtful Accounts S1,400 To record the reinstatement of previously written-off accounts receivable) Sep.15Cash S1.400 Accounts Receivable $1.400 To record the receipt of cash from custome Sep.15 Land [5670,000-$15,075 S654,925 $15,075 Interest Expense [$670,000 x 9% x 903601 Notes Payable $670,000 To record the purchase of land by issuing a 90-day note by discounting the same) Oct.17 Cash $135,000 $100,000 $64,000 Notes Receivable Accumulated Depreciation Loss on Sale of Office Equipment $21.000 $320,000 $320,000-($135,000+ $100,000+ $64,000)] Office Equipment To record the exchange of office equipment Nov.30 Sales Salaries Expense Office Salaries Expense $135,000 $77,250 Income Tax Payable Social Security Tax Payable Medicare Tax Payable Salaries Payable Cash S39,266 $12,735 $3,184 $157.065 $135,000+ $77,250-($39.266+ S12.735+ S3,184)] To record the monthly payroll) S16,229 Nov.30 Payroll Tax Expense 1 $12,735+$3,184 $270+$40 $12,735 $3,184 $270 Social Security Tax Payable Medicare Tax Payable State Unemployment Tax Payable [$5,000 x 5.4%) Federal Unemployment Tax Payable 55,000 0.8%) $40 To record the payroll tax expense) Dec.14 Notes Payable $670.000 Cash 5670,000 To record the repayment of notes payable Dec.31 Pension Expense $190,400 Cash $139,700 $50,700 Pension Plan Trustee [$190,400-$139.700 To record the repayment of notes payable blem 3 Part 2 The following is a comprehensive problem which encompas covered as a review of the concepts. ses all of the elements learned in previous chapters. You can refer to the objectives for each chapter Note: You must complete part 1 before completing part 2 Based on the folilowing data, prepare a bank reconciliation for December of the current year: a. Balance according to the bank statement at December 31, $283,000. b. Balance according to the ledger at December 31, $245,410. c. Checks outstanding at December 31, $68,540 d. Deposit in transit, not recorded by bank, $29,500 e. Bank debit memo for service charges, $750. 12,700 in payment of an invoice was incorrectly recordec in the accounts as $12.000. Enter all amounts as positive numbers. Komett Company Bank Reconciliation December 31, 2016 Subtotal Adjusted balance Check My Wark Previous Next c. Checks outstanding at December 31, $68,540. d. Deposit in transit, not recorded by bank, $29,500. e. Bank debit memo for service charges, $750. f. A check for $12,700 in payment of an invoice was incorrectly recorded in the accounts as $12,000. Enter all amounts as positive numbers. Kornett Company Bank Reconciliation December 31, 2016 Subtotal Adjusted balance Deduct: Adjusted balance