Question

General journal options : No Journal Entry Required Accounts Payable Accounts Receivable Accumulated Amortization Accumulated Depreciation Advertising Expense Amortization Expense Bad Debt Expense Bank Charges

![[The following information applies to the questions displayed below.] Laser Delivery Services, Incorporated (LDS), was incorp](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2023/02/63e4b8f976747_1675933940333.png)

General journal options:

No Journal Entry Required

Accounts Payable

Accounts Receivable

Accumulated Amortization

Accumulated Depreciation

Advertising Expense

Amortization Expense

Bad Debt Expense

Bank Charges Expense

Buildings

Cash

Common Stock

Copyrights

Cost of Goods Sold

Deferred Revenue

Delivery Expense

Depreciation Expense

Dividends

Dividends Payable

Donation Revenue

Equipment

Franchise Rights

Goodwill

Income Tax Expense

Income Tax Payable

Insurance Expense

Interest Expense

Interest Payable

Interest Receivable

Interest Revenue

Inventory

Land

Legal Expense

Licensing Rights

Logo and Trademarks

Notes Payable (long-term)

Notes Payable (short-term)

Notes Receivable (long-term)

Notes Receivable (short-term)

Office Expense

Patents

Prepaid Advertising

Prepaid Insurance

Prepaid Rent

Rent Expense

Rent Revenue

Repairs and Maintenance Expenses

Retained Earnings

Salaries and Wages Expense

Salaries and Wages Payable

Sales Revenue

Selling, General, and Administrative Expense

Service Revenue

Short-term Investments

Software

Supplies

Supplies Expense

Travel Expense

Utility Expense

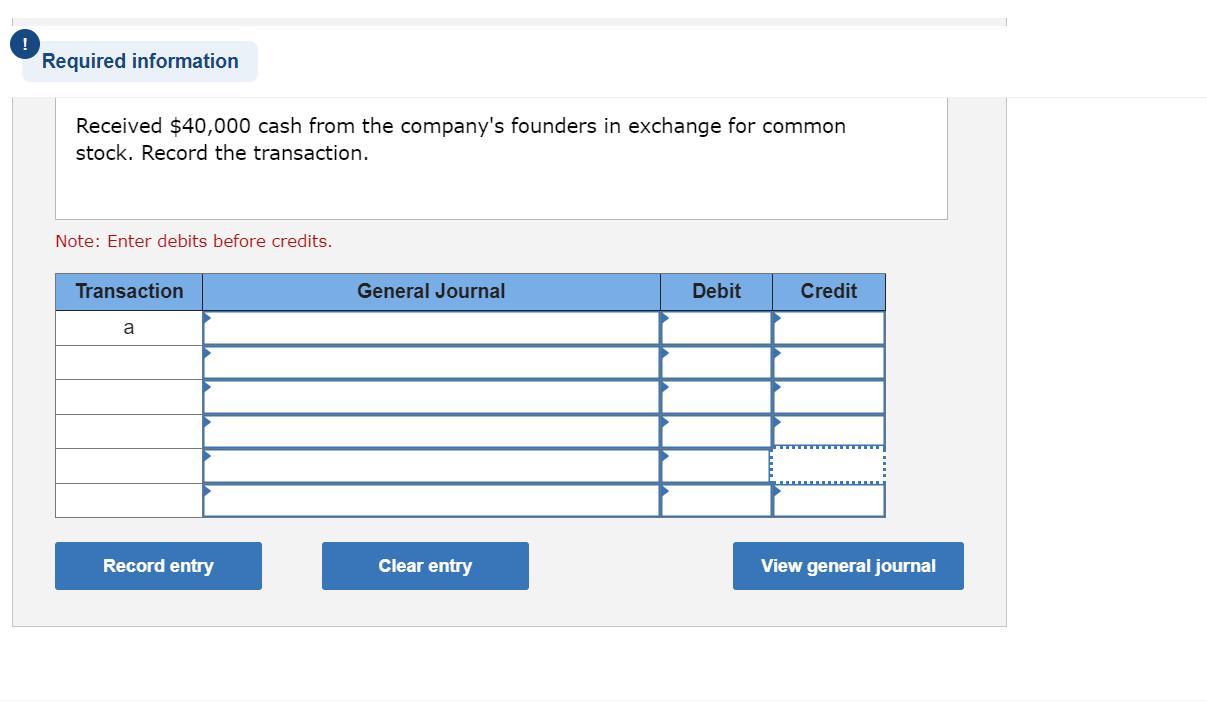

[The following information applies to the questions displayed below.] Laser Delivery Services, Incorporated (LDS), was incorporated January 1. The following transactions occurred during the year: a. Received $40,000 cash from the company's founders in exchange for common stock. b. Purchased land for $12,000, signing a two-year note (ignore interest). c. Bought two used delivery trucks at the start of the year at a cost of $10,000 each; paid $2,000 cash and signed a note due in three years for $18,000 (ignore interest). d. Paid $2,000 cash to a truck repair shop for a new motor, which increased the cost of one of the trucks. e. Stockholder Jonah Lee paid $300,000 cash for a house for his personal use. 2. Record the effects of each item using a journal entry. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.)

Step by Step Solution

3.32 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below ANSW...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started