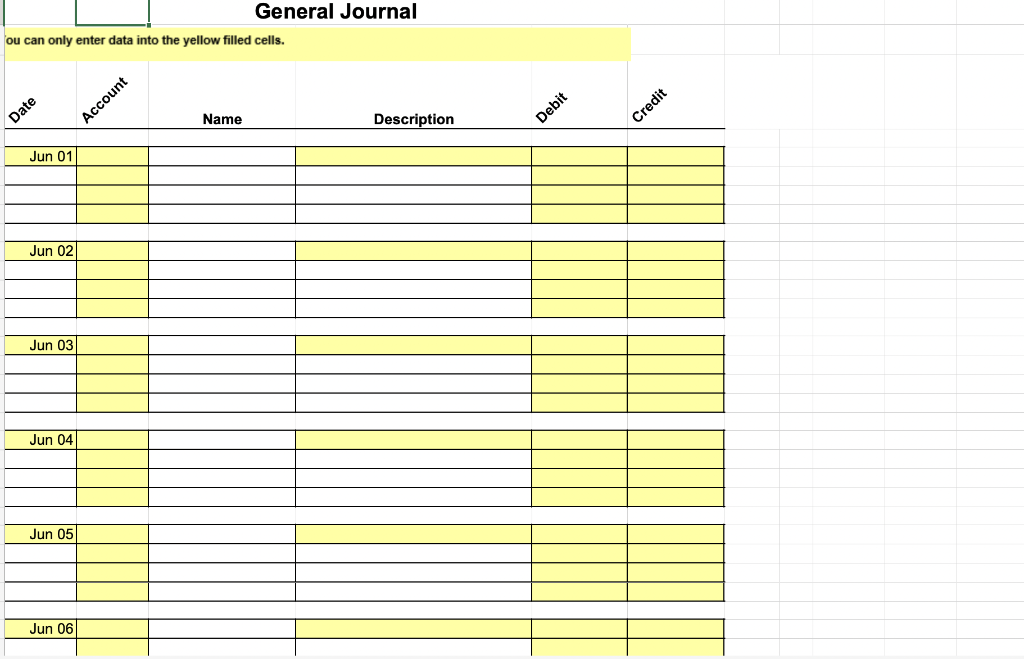

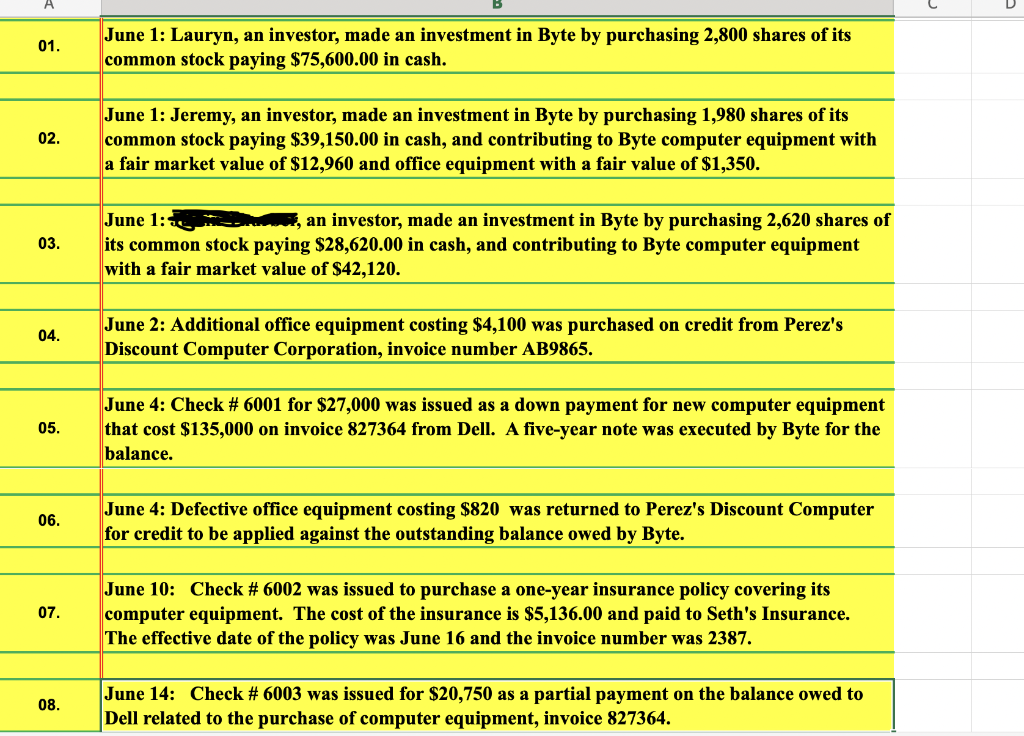

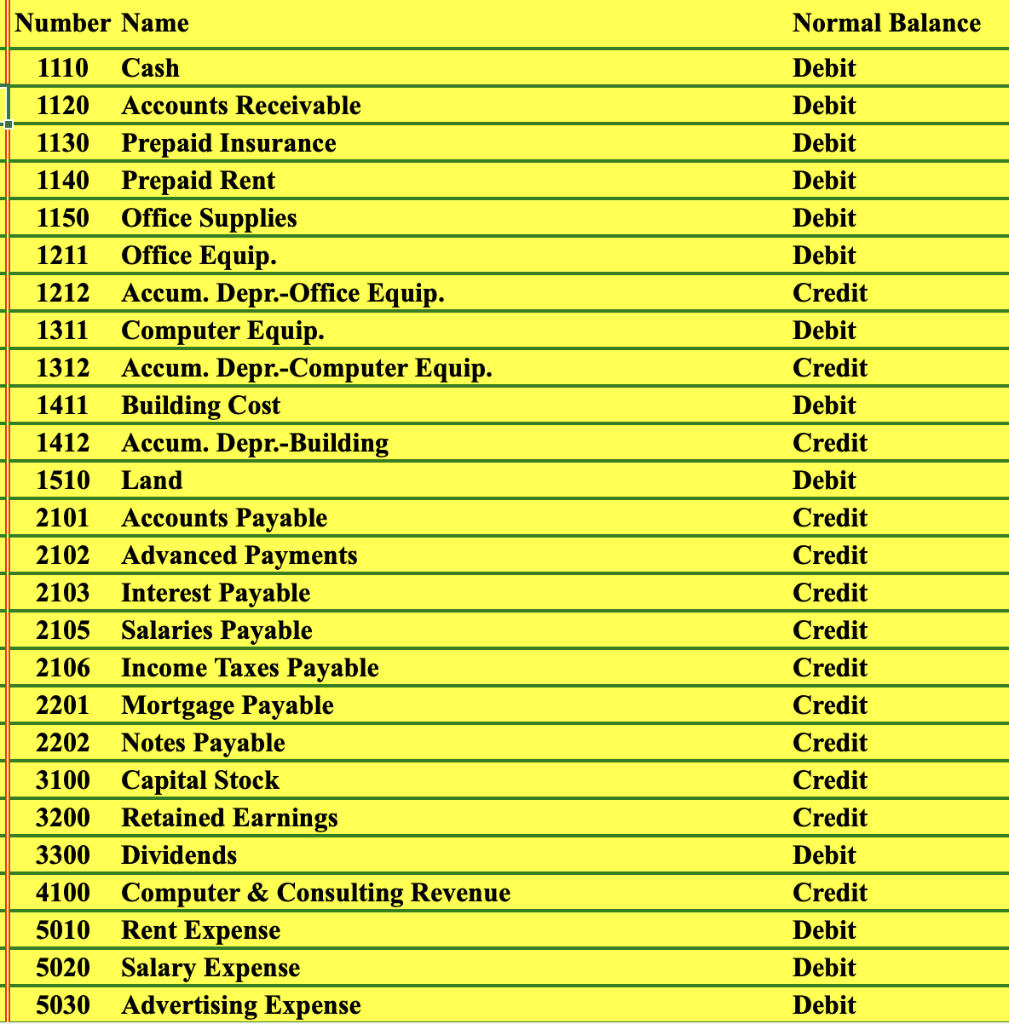

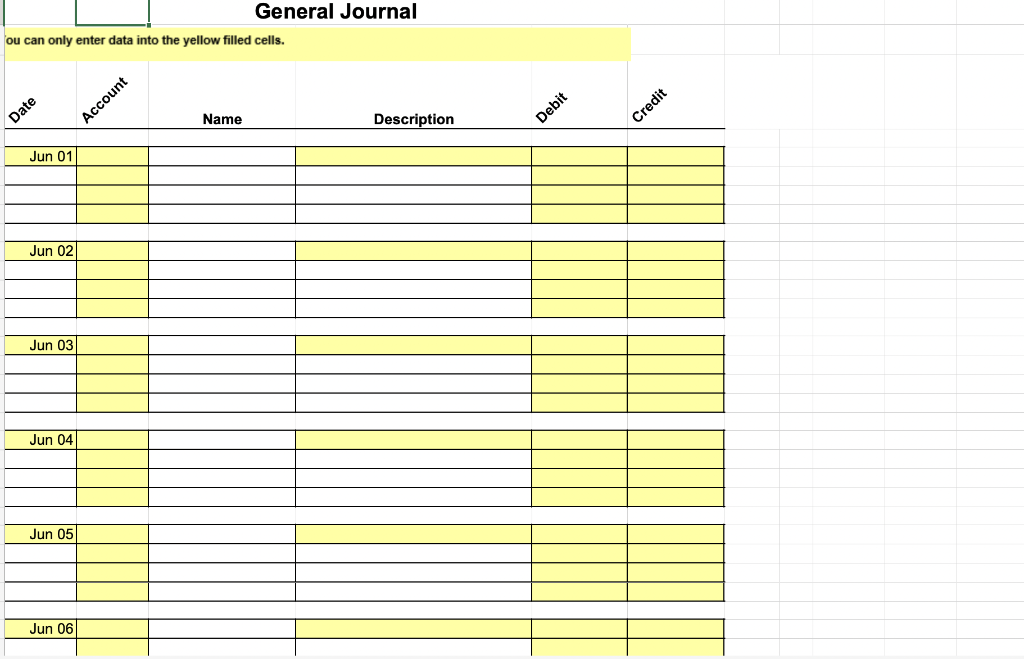

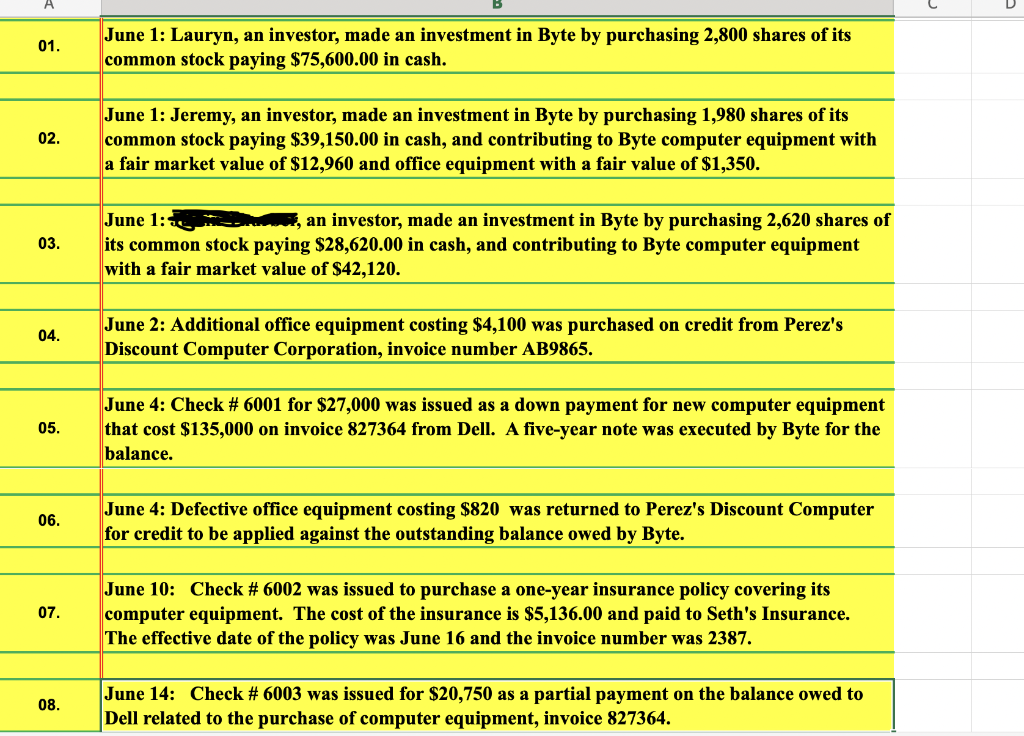

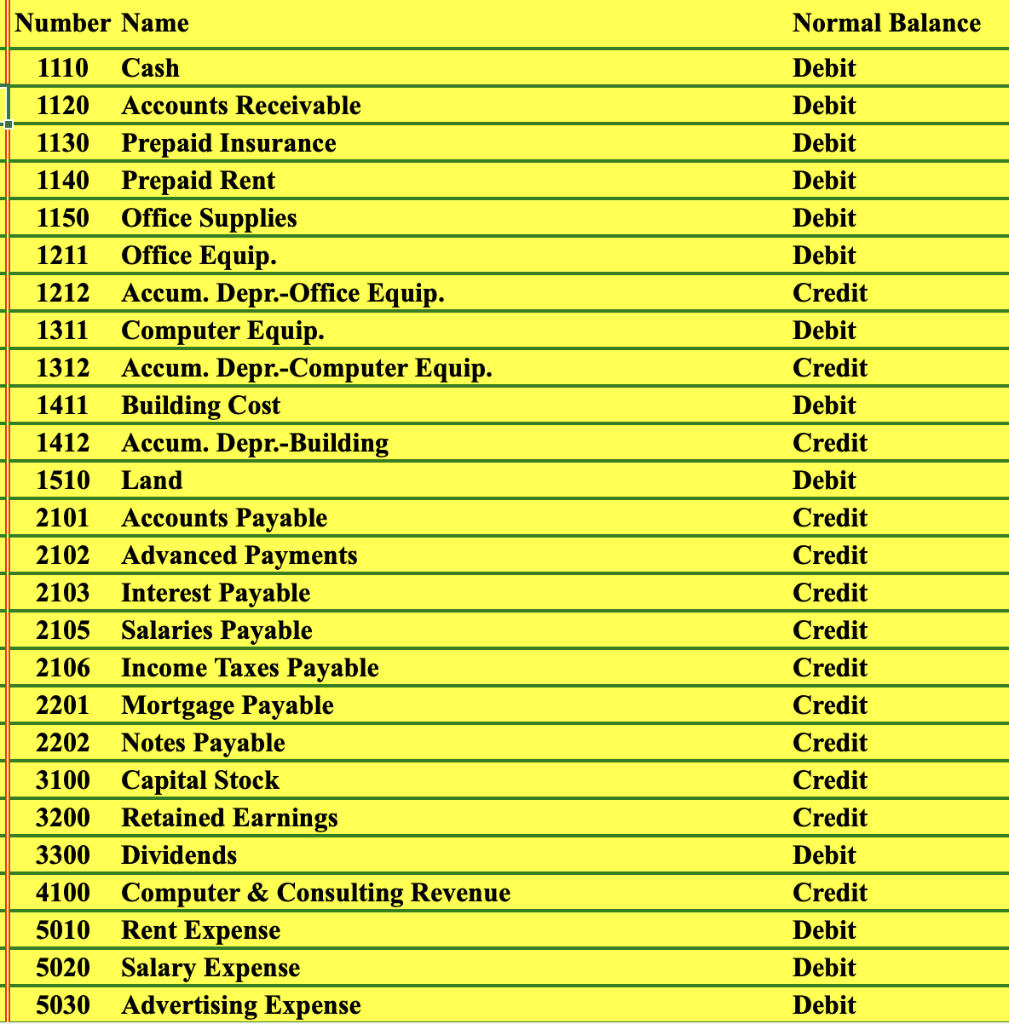

General Journal ou can only enter data into the yellow filled cells. Credit Date Name Account Description Debit Jun 01 Jun 02 Jun 03 Jun 04 Jun 05 Jun 06 01. June 1: Lauryn, an investor, made an investment in Byte by purchasing 2,800 shares of its common stock paying $75,600.00 in cash. 02. June 1: Jeremy, an investor, made an investment in Byte by purchasing 1,980 shares of its common stock paying $39,150.00 in cash, and contributing to Byte computer equipment with a fair market value of $12,960 and office equipment with a fair value of $1,350. 03. June 1: an investor, made an investment in Byte by purchasing 2,620 shares of its common stock paying $28,620.00 in cash, and contributing to Byte computer equipment with a fair market value of $42,120. 04. June 2: Additional office equipment costing $4,100 was purchased on credit from Perez's Discount Computer Corporation, invoice number AB9865. 05. June 4: Check # 6001 for $27,000 was issued as a down payment for new computer equipment that cost $135,000 on invoice 827364 from Dell. A five-year note was executed by Byte for the balance. 06. June 4: Defective office equipment costing $820 was returned to Perez's Discount Computer for credit to be applied against the outstanding balance owed by Byte. 07. June 10: Check # 6002 was issued to purchase a one-year insurance policy covering its computer equipment. The cost of the insurance is $5,136.00 and paid to Seth's Insurance. The effective date of the policy was June 16 and the invoice number was 2387. 08. June 14: Check # 6003 was issued for $20,750 as a partial payment on the balance owed to Dell related to the purchase of computer equipment, invoice 827364. Number Name Normal Balance Debit Debit Debit Debit Debit Debit Credit Debit Credit 1110 Cash 1120 Accounts Receivable 1130 Prepaid Insurance 1140 Prepaid Rent 1150 Office Supplies 1211 Office Equip. 1212 Accum. Depr.-Office Equip. 1311 Computer Equip. 1312 Accum. Depr.-Computer Equip. 1411 Building Cost 1412 Accum. Depr.-Building 1510 Land 2101 Accounts Payable 2102 Advanced Payments 2103 Interest Payable 2105 Salaries Payable 2106 Income Taxes Payable 2201 Mortgage Payable 2202 Notes Payable 3100 Capital Stock 3200 Retained Earnings 3300 Dividends 4100 Computer & Consulting Revenue 5010 Rent Expense 5020 Salary Expense 5030 Advertising Expense Debit Credit Debit Credit Credit Credit Credit Credit Credit Credit Credit Credit Debit Credit Debit Debit Debit