Answered step by step

Verified Expert Solution

Question

1 Approved Answer

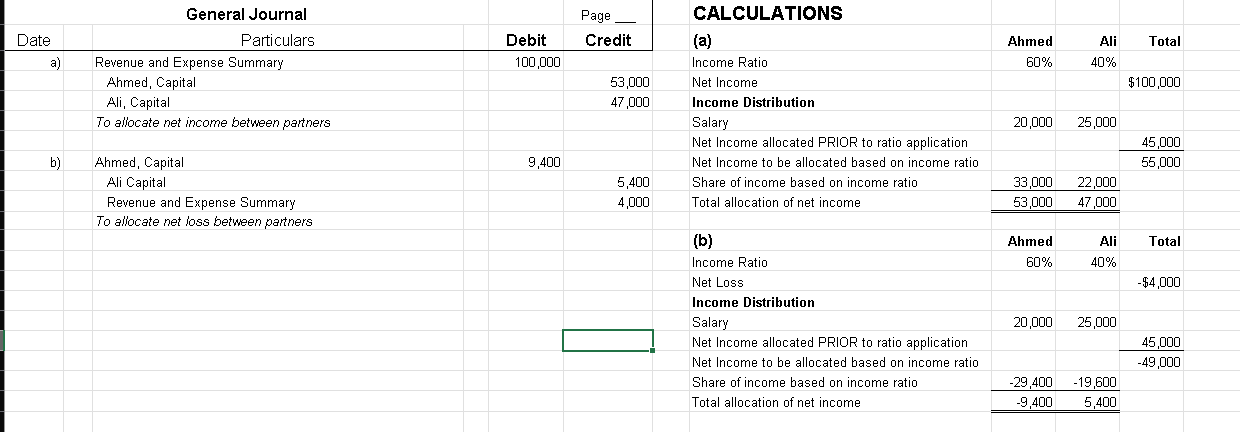

General Journal Page CALCULATIONS Date Particulars Debit Credit (a) Ahmed Ali Total a) Revenue and Expense Summary 100,000 Income Ratio 60% 40% Ahmed, Capital

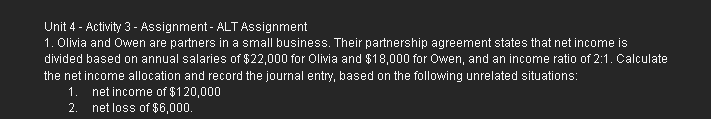

General Journal Page CALCULATIONS Date Particulars Debit Credit (a) Ahmed Ali Total a) Revenue and Expense Summary 100,000 Income Ratio 60% 40% Ahmed, Capital 53,000 Net Income $100,000 Ali, Capital 47,000 Income Distribution To allocate net income between partners Salary 20,000 25,000 Net Income allocated PRIOR to ratio application 45,000 b) Ahmed, Capital 9,400 Net Income to be allocated based on income ratio 55,000 Ali Capital Revenue and Expense Summary To allocate net loss between partners 5,400 Share of income based on income ratio 33,000 22,000 4,000 Total allocation of net income 53,000 47,000 (b) Ahmed Ali Total Income Ratio 60% 40% Net Loss Income Distribution -$4,000 Salary Net Income allocated PRIOR to ratio application 20,000 25,000 45,000 Net Income to be allocated based on income ratio Share of income based on income ratio -49,000 -29,400 -19,600 Total allocation of net income -9,400 5,400 Unit 4 - Activity 3 - Assignment - ALT Assignment 1. Olivia and Owen are partners in a small business. Their partnership agreement states that net income is divided based on annual salaries of $22,000 for Olivia and $18,000 for Owen, and an income ratio of 2:1. Calculate the net income allocation and record the journal entry, based on the following unrelated situations: 1. net income of $120,000 2. net loss of $6,000.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started