Answered step by step

Verified Expert Solution

Question

1 Approved Answer

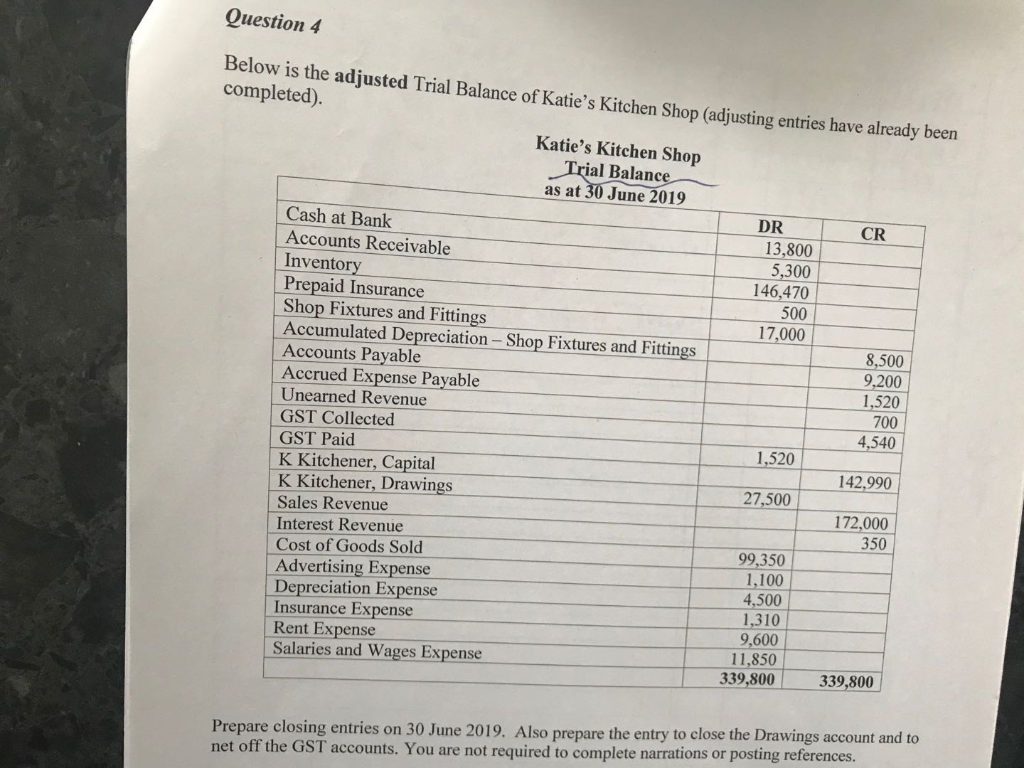

General Journal Question 4 Below is the adjusted Trial Balance of Katie's Kitchen Shop (adjusting entries have already been completed). Katie's Kitchen Shop Trial Balance

General Journal

Question 4 Below is the adjusted Trial Balance of Katie's Kitchen Shop (adjusting entries have already been completed). Katie's Kitchen Shop Trial Balance as at 30 June 2019 Cash at Bank DR CR Accounts Receivable 13,800 Inventory 5,300 146,470 Prepaid Insurance 500 Shop Fixtures and Fittings 17,000 Accumulated Depreciation - Shop Fixtures and Fittings 8,500 Accounts Payable 9,200 Accrued Expense Payable 1,520 Unearned Revenue 700 GST Collected 4,540 GST Paid 1,520 K Kitchener, Capital 142,990 K Kitchener, Drawings 27,500 Sales Revenue 172,000 Interest Revenue 350 Cost of Goods Sold 99,350 Advertising Expense 1,100 Depreciation Expense 4,500 Insurance Expense 1,310 Rent Expense 9,600 Salaries and Wages Expense 11,850 339,800 339,800 Prepare closing entries on 30 June 2019. Also prepare the entry to close the Drawings account and to net off the GST accounts. You are not required to complete narrations or posting referencesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started