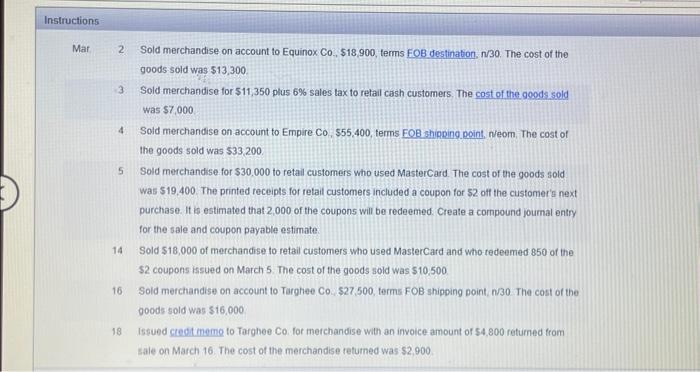

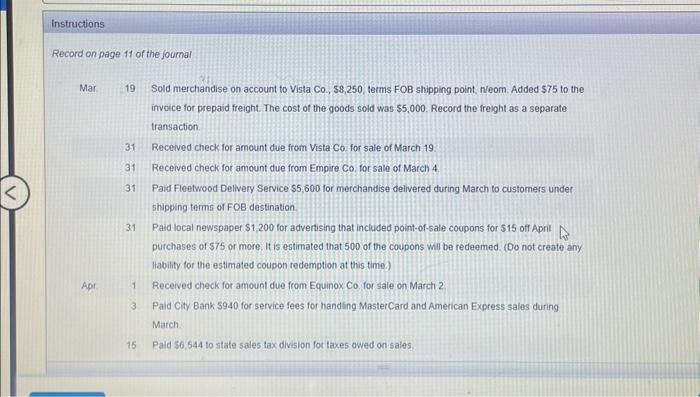

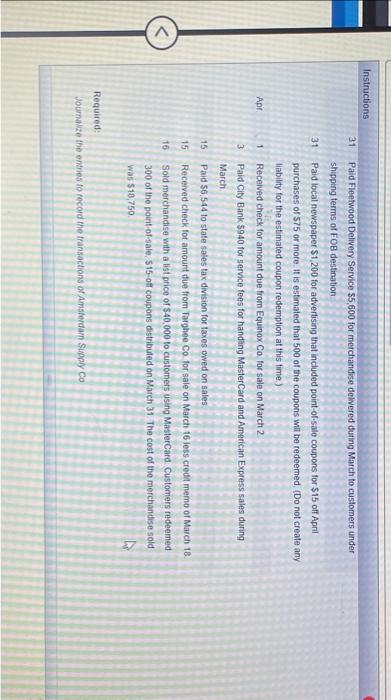

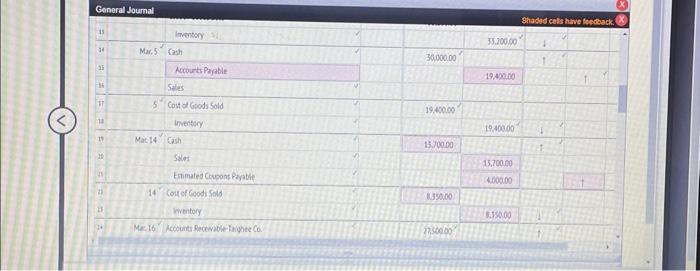

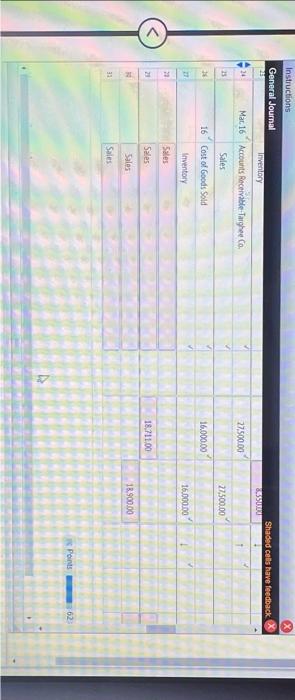

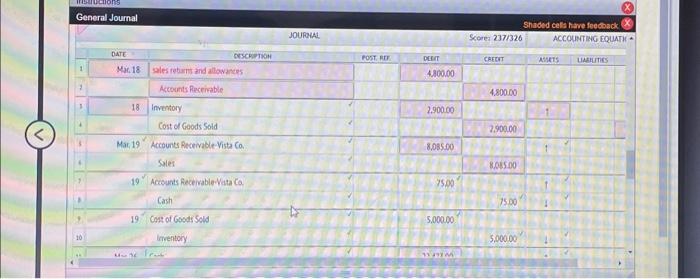

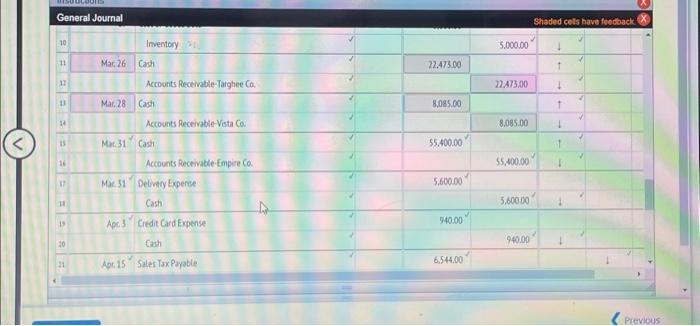

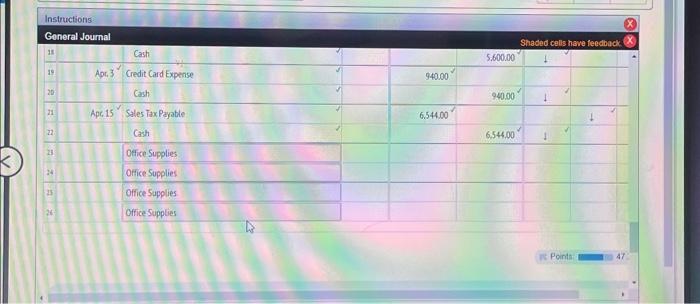

General Journal Shaded cels have feoctoack Mar. 19 Sold merchandise on account to Vista Co, $8,250, terms FOB shipping point, neom. Added $75 to the invoice for prepaid freight. The cost of the goods sold was $5,000. Record the freight as a separate transaction. 31 Received check for amount due from Vista Co for sale of March 19 31 Received check for amount due from Empire Co. for sale of March 4 31 Paid Fleotwood Delivery Service $5,600 tor merchandise delivered during March to customers under: shipping terms of FOB destination 31 Paid local newspaper $1,200 for advertising that included point-of-sale coupons for $15 off April purchases of $75 or more. It is estimated that 500 of the coupons will be redeemed. (Do not create any llability for the estimated coupon redemption at this time) Apr. 1 Received check for amount due from Equinox Co for sale on March 2 3 Paid City Bank $940 for service fees for handing MasterCard and American Express sales duing March 15 Paid \$6,544 to state 5ales tax division for taxes owed on sales. 2 Sold merchandise on account to Equinox Co., $18,900, terms FOB destination, n/30. The cost of the goods sold was $13,300 3. Sold merchandise for $11,350 plus 6% sales tax to relail cash customers. The cost of the 9000 s. sold was $7,000 4. Sold merchandise on account to Empire Co, $55,400, terms FOB shipping point, neom, The cost of the goods sold was $33,200 5 Sold merchandise for $30,000 to retal customers who used MasterCard. The cost of the goods sold was $19,400. The printed receipts for retail customers included a coupon for $2 off the customer's next purchase. It is estimated that 2,000 of the coupons will be redeemed. Create a compound joumal entry for the sale and coupon payable estimate. 14 Sold $18,000 of merchandise to retail customers who used Mastercard and who redeemed 850 of the $2 coupons issued on March 5 . The cost of the goods sold was $10,500 16 Sold merchandise on account to Targhee Co $27,500, terms FOB shipping point, n/30. The cost of the goods sold was $16,000 18 Issued ctedt memo to Targhee Co. for merchandise with an invoice amount of $4,800 returned from sale on March 16. The cost of the merchandise returned was $2,900 31 Paid Fleetwood Delivery Service 55,600 for merchandise delvered duting March to customers under shipping terms of FOB destination 31 Paid local newspaper $1,200 for advertising that included point-of-sale coupons for $15 off April purchases of $75 or more. It is estimated that 500 of the coupons will be redeemed (Do not create any liability for the estimated coupon redemption at this time.) Apt. 1 Received check for amount due from Equinox Co. for sale on March 2 3 Paid City Bank $940 for servce fees for handeng MasterCard and American Express sales during March 15. Paid 56.544 to state sales tax division for taxes owed on sales 15 Received check for amount due from Targhee Co for sale on Narch 16 less cred/ memo of March 18. 16 Sold merchandise with a hist price of $40,000 to customers using MasterCard. Customers redeemed 300 of the point-of sale, \$15-off coupons distributed on March 31 . The cost of the merchandise sold was $18,750 Required: Joumalize the entries to record the transactions or Amsterdam Supaly co