Answered step by step

Verified Expert Solution

Question

1 Approved Answer

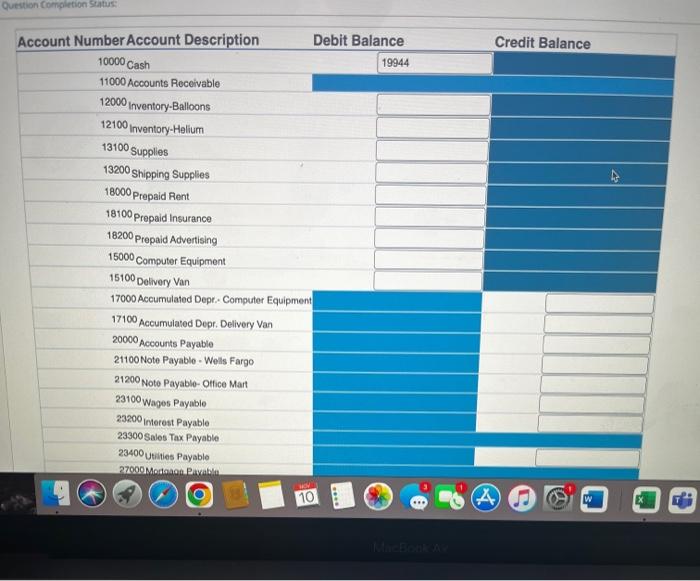

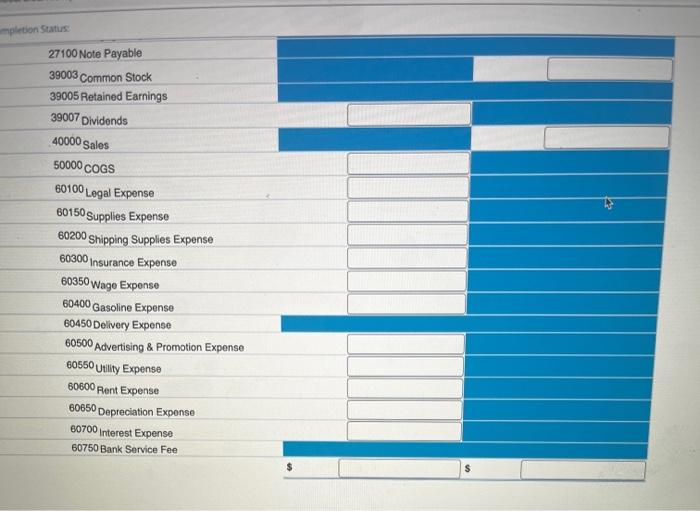

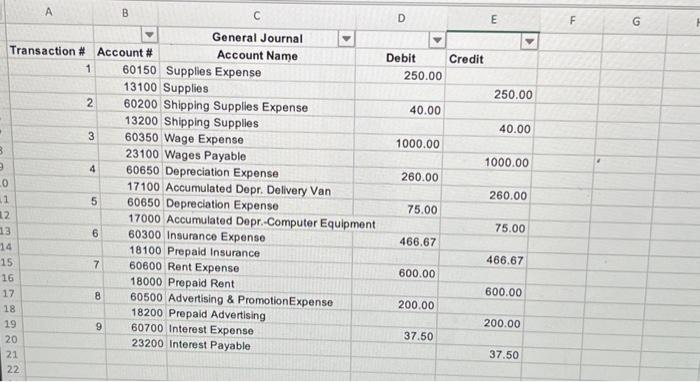

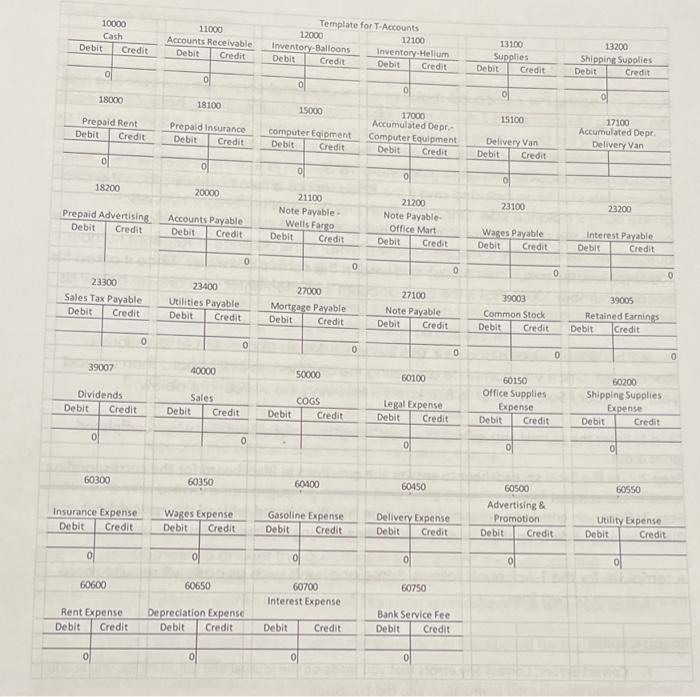

General Journal Transaction # Account # Account Name Debit Credit 1 NO JE 2 10000 Cash 20000.00 39003 Common Stock 20000.00 3 18000 Prepaid Rent

General Journal

Transaction #

Account #

Account Name

Debit

Credit

1

NO JE

2

10000

Cash

20000.00

39003

Common Stock

20000.00

3

18000

Prepaid Rent

2400.00

10000

Cash

2400.00

4

18100

Prepaid Insurance

2800.00

10000

Cash

2800.00

5

15000

computer Eqipment

3600.00

21200

Note Payable-

Office Mart

3600.00

6

10000

Cash

5000.00

21100

Note Payable -

Wells Fargo

5000.00

7

15100

Delivery Van

16000.00

10000

Cash

16000.00

8

15100

Delivery Van

600.00

10000

Cash

600.00

9

18200

Prepaid Advertising

500.00

10000

Cash

500.00

10

12100

Inventory-Helium

900.00

20000

Accounts Payable

900.00

11

12000

Inventory-Balloons

6200.00

20000

Accounts Payable

6200.00

12

60100

Legal Expense

800.00

10000

Cash

800.00

13

NO JE

14

11000

Accounts Receivable

4000.00

40000

Sales

4000.00

50000

COGS

2200.00

12000

Inventory-Balloons

1700.00

12100

Inventory-Helium

500.00

15

13100

Supplies

300.00

20000

Accounts Payable

300.00

16

12000

Inventory-Balloons

7500.00

20000

Accounts Payable

7500.00

17

10000

Cash

6495.00

23300

Sales Tax Payable

495.00

40000

Sales

6000.00

50000

COGS

4200.00

12000

Inventory-Balloons

3900.00

12100

Inventory-Helium

300.00

18

20000

Accounts Payable

300.00

10000

Cash

300.00

19

20000

Accounts Payable

900.00

10000

Cash

882.00

12100

Inventory-Helium

18.00

20

12100

Inventory-Helium

700.00

20000

Accounts Payable

700.00

21

60500

Advertising & Promotion

Expense

700.00

12000

Inventory-Balloons

600.00

12100

Inventory-Helium

100.00

22

10000

Cash

4000.00

11000

Accounts Receivable

4000.00

23

60400

Gasoline Expense

300.00

60150

Supplies

Expense

50.00

10000

Cash

350.00

24

13200

Shipping Supplies

50.00

10000

Cash

50.00

25

10000

Cash

7560.00

23300

Sales Tax Payable

560.00

40000

Sales

7000.00

50000

COGS

4500.00

12000

Inventory-Balloons

4000.00

12100

Inventory-Helium

500.00

26

20000

Accounts Payable

13700.00

10000

Cash

13426.00

12000

Inventory-Balloons

274.00

27

10000

Cash

2489.75

23300

Sales Tax Payable

189.75

40000

Sales

2300.00

50000

COGS

1050.00

12000

Inventory-Balloons

1000.00

12100

Inventory-Helium

50.00

28

60550

Utility Expense

120.00

23400

Utilities Payable

120.00

29

21200

Note Payable-

Office Mart

600.00

60700

Interest Expense

36.00

10000

Cash

636.00

30

10000

Cash

3680.50

23300

Sales Tax Payable

280.50

40000

Sales

3400.00

50000

COGS

1250.00

12000

Inventory-Balloons

1200.00

12100

Inventory-Helium

50.00

31

23300

Sales Tax Payable

1525.25

10000

Cash

1525.25

32

39007

Dividends

100.00

10000

Cash

100.00

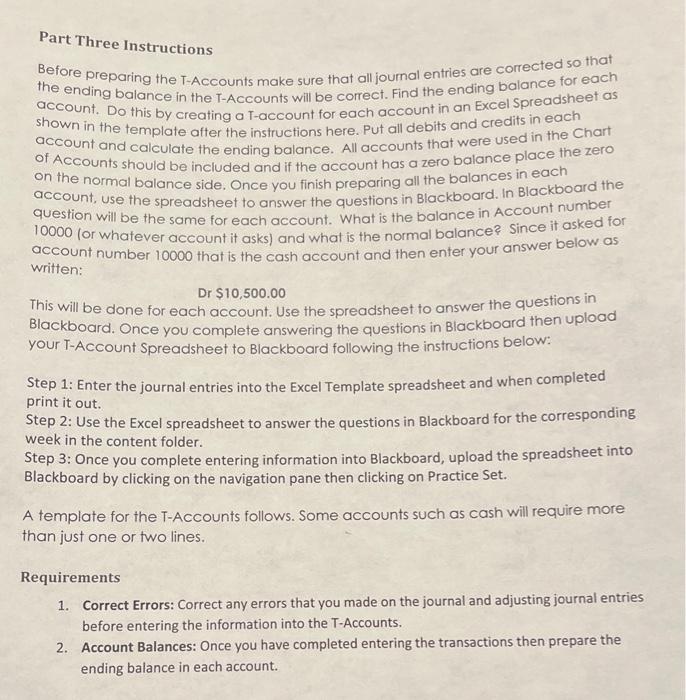

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started