Answered step by step

Verified Expert Solution

Question

1 Approved Answer

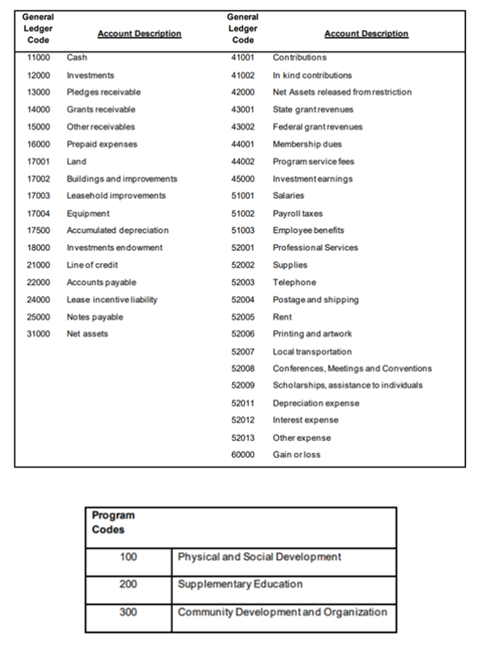

General Ledger General Ledger Account Description Code Code 11000 Cash 41001 12000 Investments 41002 Contributions Account Description In kind contributions 13000 Pledges receivable 42000

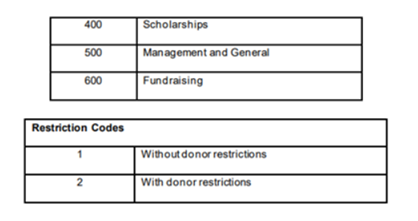

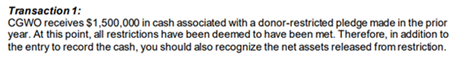

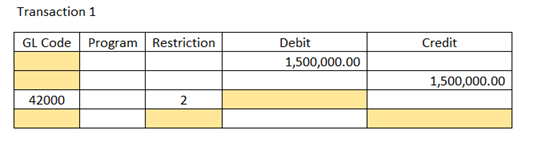

General Ledger General Ledger Account Description Code Code 11000 Cash 41001 12000 Investments 41002 Contributions Account Description In kind contributions 13000 Pledges receivable 42000 Net Assets released from restriction 14000 Grants receivable 43001 State grant revenues 15000 Other receivables 43002 Federal grant revenues 16000 Prepaid expenses 44001 Membership dues 17001 Land 44002 Program service fees 17002 Buildings and improvements 45000 Investment earnings 17003 Leasehold improvements 51001 Salaries 17004 Equipment 51002 Payroll taxes 17500 Accumulated depreciation 51003 Employee benefits 18000 Investments endowment 52001 Professional Services 21000 Line of credit 52002 Supplies 22000 Accounts payable 52003 Telephone 24000 Lease incentive liability 52004 Postage and shipping 25000 Notes payable 52005 Rent 31000 Net assets 52006 Printing and artwork 52007 Local transportation 52008 Conferences, Meetings and Conventions Program Codes 52009 Scholarships, assistance to individuals 52011 Depreciation expense 52012 Interest expense 52013 Other expense 60000 Gain or loss 100 Physical and Social Development 200 Supplementary Education 300 Community Development and Organization 400 Scholarships 500 Management and General 600 Fundraising Restriction Codes Without donor restrictions 2 With donor restrictions Transaction 1: CGWO receives $1,500,000 in cash associated with a donor-restricted pledge made in the prior year. At this point, all restrictions have been deemed to have been met. Therefore, in addition to the entry to record the cash, you should also recognize the net assets released from restriction. Transaction 1 GL Code Program Restriction 42000 2 Debit Credit 1,500,000.00 1,500,000.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started