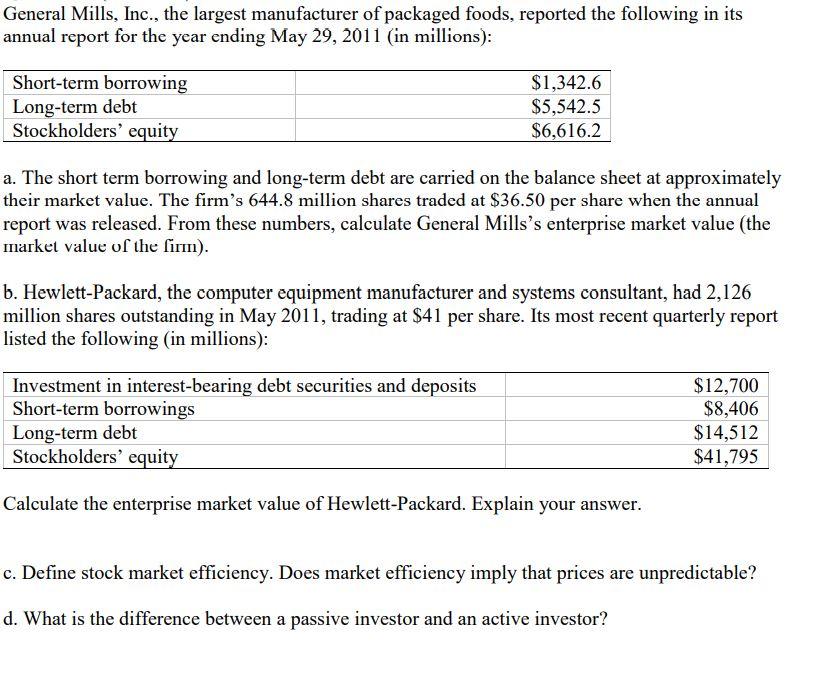

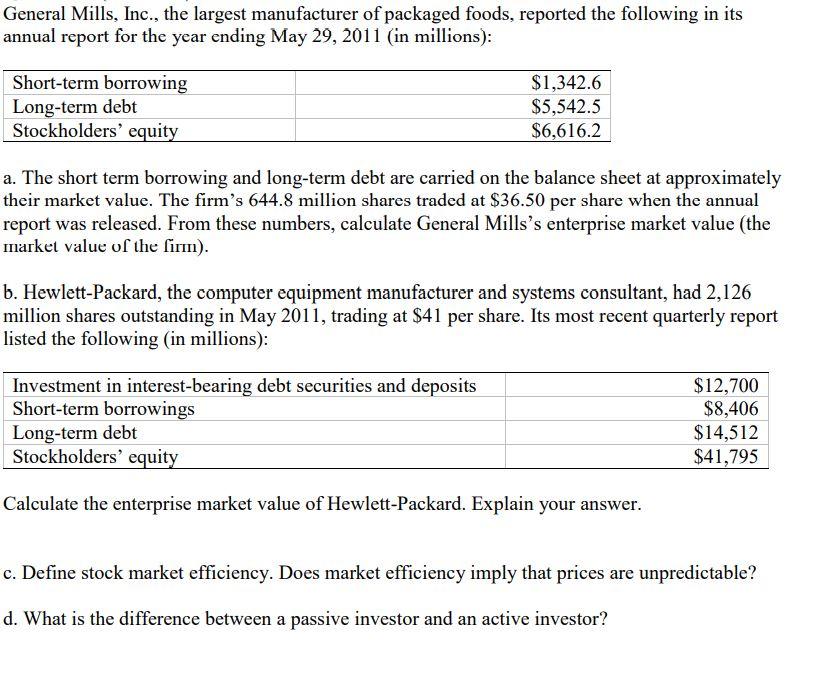

General Mills, Inc., the largest manufacturer of packaged foods, reported the following in its annual report for the year ending May 29, 2011 (in millions): Short-term borrowing Long-term debt Stockholders' equity $1,342.6 $5,542.5 $6,616.2 a. The short term borrowing and long-term debt are carried on the balance sheet at approximately their market value. The firm's 644.8 million shares traded at $36.50 per share when the annual report was released. From these numbers, calculate General Mills's enterprise market value (the market value of the firm). b. Hewlett-Packard, the computer equipment manufacturer and systems consultant, had 2,126 million shares outstanding in May 2011, trading at $41 per share. Its most recent quarterly report listed the following (in millions): Investment in interest-bearing debt securities and deposits Short-term borrowings Long-term debt Stockholders' equity $12,700 $8,406 $14,512 $41,795 Calculate the enterprise market value of Hewlett-Packard. Explain your answer. c. Define stock market efficiency. Does market efficiency imply that prices are unpredictable? d. What is the difference between a passive investor and an active investor? General Mills, Inc., the largest manufacturer of packaged foods, reported the following in its annual report for the year ending May 29, 2011 (in millions): Short-term borrowing Long-term debt Stockholders' equity $1,342.6 $5,542.5 $6,616.2 a. The short term borrowing and long-term debt are carried on the balance sheet at approximately their market value. The firm's 644.8 million shares traded at $36.50 per share when the annual report was released. From these numbers, calculate General Mills's enterprise market value (the market value of the firm). b. Hewlett-Packard, the computer equipment manufacturer and systems consultant, had 2,126 million shares outstanding in May 2011, trading at $41 per share. Its most recent quarterly report listed the following (in millions): Investment in interest-bearing debt securities and deposits Short-term borrowings Long-term debt Stockholders' equity $12,700 $8,406 $14,512 $41,795 Calculate the enterprise market value of Hewlett-Packard. Explain your answer. c. Define stock market efficiency. Does market efficiency imply that prices are unpredictable? d. What is the difference between a passive investor and an active investor