Question

GENERAL NOTE 1: Assume that all months have 30 days. have 30 days. GENERAL NOTE 2: For purposes of working with interest rates with interest

GENERAL NOTE 1: Assume that all months have 30 days. have 30 days. GENERAL NOTE 2: For purposes of working with interest rates with interest rates, you can work with all decimals (easy in Excel), or you can work with all decimals (easy in Excel). decimals (it is easy in Excel), or you can work with two decimals in the two decimal places in the percentage and four decimal places in the factor (i.e. 12.5). factor (i.e. 12.78% or 0.1278).

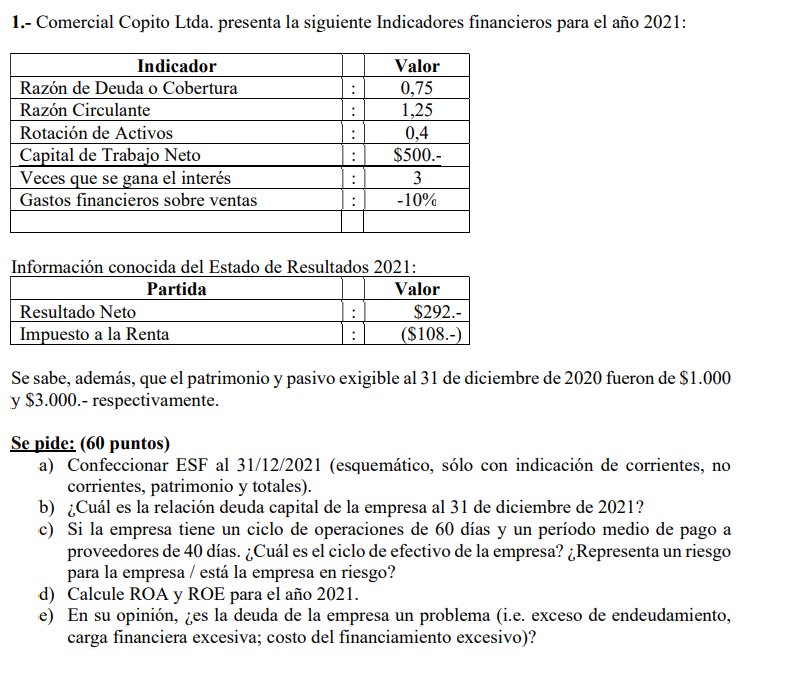

Comercial Copito Ltda. presents the following financial indicators for the year 2021: Indicator Value Debt or Coverage Ratio : 0.75 Current Ratio: 1.25 Assets Turnover: 0.4 Net Working Capital: $500. Times interest earned : 3 Financial expenses on sales : -10%. Information known from the Income Statement 2021: Item Value Net Income : $292.- Income Tax : ($108.-) It is also known that the shareholders' equity and liabilities due at December 31, 2020 were $1,000 and $3,000, respectively. 1,000 and $3,000.- respectively. It is requested: (60 points) a) Prepare the ESF as of 12/31/2021 (schematic, only with indication of current, non-current, equity and total). current, non-current, equity and total). b) What is the company's debt-equity ratio at December 31, 2021? c) If the company has an operating cycle of 60 days and an average supplier payment period of 40 days, what is the company's debt to equity ratio at December 31, 2021? What is the company's cash cycle? Does it represent a risk for the company/is the company in a to the company / is the company at risk? d) Calculate ROA and ROE for the year 2021. e) In your opinion, is the company's debt a problem (i.e. excessive indebtedness; excessive financial burden; cost of financing)? excessive financial burden; excessive cost of financing)?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started