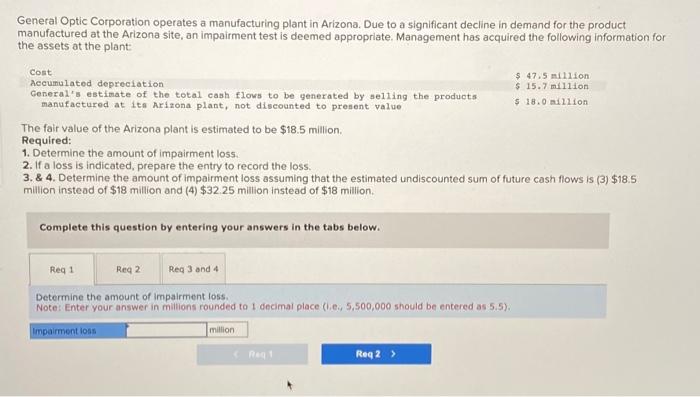

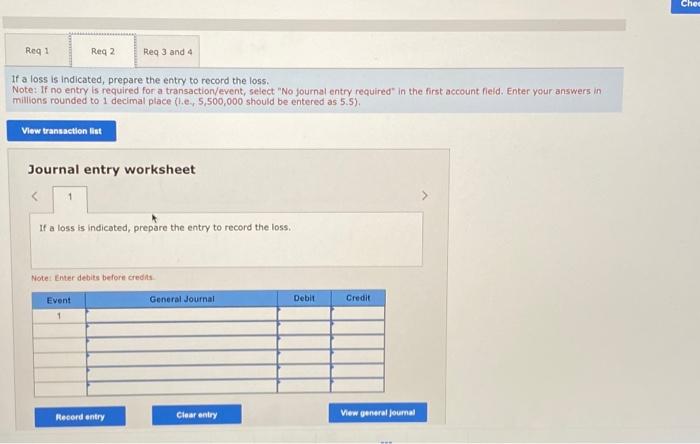

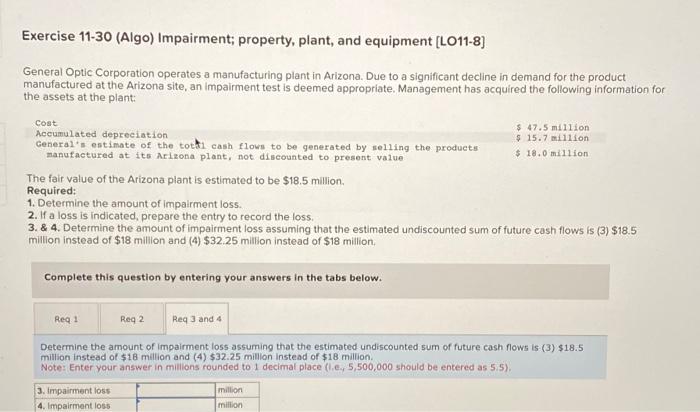

General Optic Corporation operates a manufacturing plant in Arizona. Due to a significant decline in demand for the product manufactured at the Arizona site, an impairment test is deemed appropriate. Management has acquired the following information fo the assets at the plant: cost Aceumulated depreciation General's estimate of the total cash flovs to be 5 \$ 15.7million manufactured at its Arizona plant, not discounted to present value The fair value of the Arizona plant is estimated to be $18.5 million. Required: 1. Determine the amount of impairment loss. 2. If a loss is indicated, prepare the entry to record the loss. 3. \& 4. Determine the amount of impairment loss assuming that the estimated undiscounted sum of future cash flows is (3) $18.5 million instead of $18 million and (4) $32.25 million instead of $18 million. Complete this question by entering your answers in the tabs below. Determine the amount of impairment loss. Note: Enter your answer in milions rounded to 1 decimai place (i.e, 5,500,000 should be entered as 5.5). if a loss is indicated, prepare the entry to record the loss. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account fiedd. Enter your answers in millions rounded to 1 decimal place (1.e., 5,500,000 should be entered as 5.5). Journal entry worksheet If a loss is indicated, prepare the entry to record the loss. Note Enter debits before credits Exercise 11-30 (Algo) Impairment; property, plant, and equipment [LO11-8] General Optic Corporation operates a manufacturing plant in Arizona. Due to a significant decline in demand for the product manufactured at the Arizona site, an impairment test is deemed appropriate. Management has acquired the following information fo the assets at the plant: cost Accumulated depreciation General's entimate of the totk cash flowi to be manufactured at its Arizona plant, not discounted to present value The fair value of the Arizona plant is estimated to be $18.5 million. Required: 1. Determine the amount of impalrment loss. 2. If a loss is indicated, prepare the entry to record the loss. 3. \& 4. Determine the amount of impairment loss assuming that the estimated undiscounted sum of future cash flows is (3) $18.5 million instead of $18 million and (4) $32.25 million instead of $18 million. Complete this question by entering your answers in the tabs below. Determine the amount of impairment loss assuming that the estimated undiscounted sum of future cash flows is (3) \$18.5 million instead of $18 million and (4) $32.25 million instead of $18 million. Note: Enter your answer in millions rounded to 1 decimal place (i.e, 5,500,000 should be entered as 5.5)