Answered step by step

Verified Expert Solution

Question

1 Approved Answer

General Optic Corporation operates a manufacturing plant in Arizona. Due to a significant decline in demand for the product manufactured at the Arizona site,

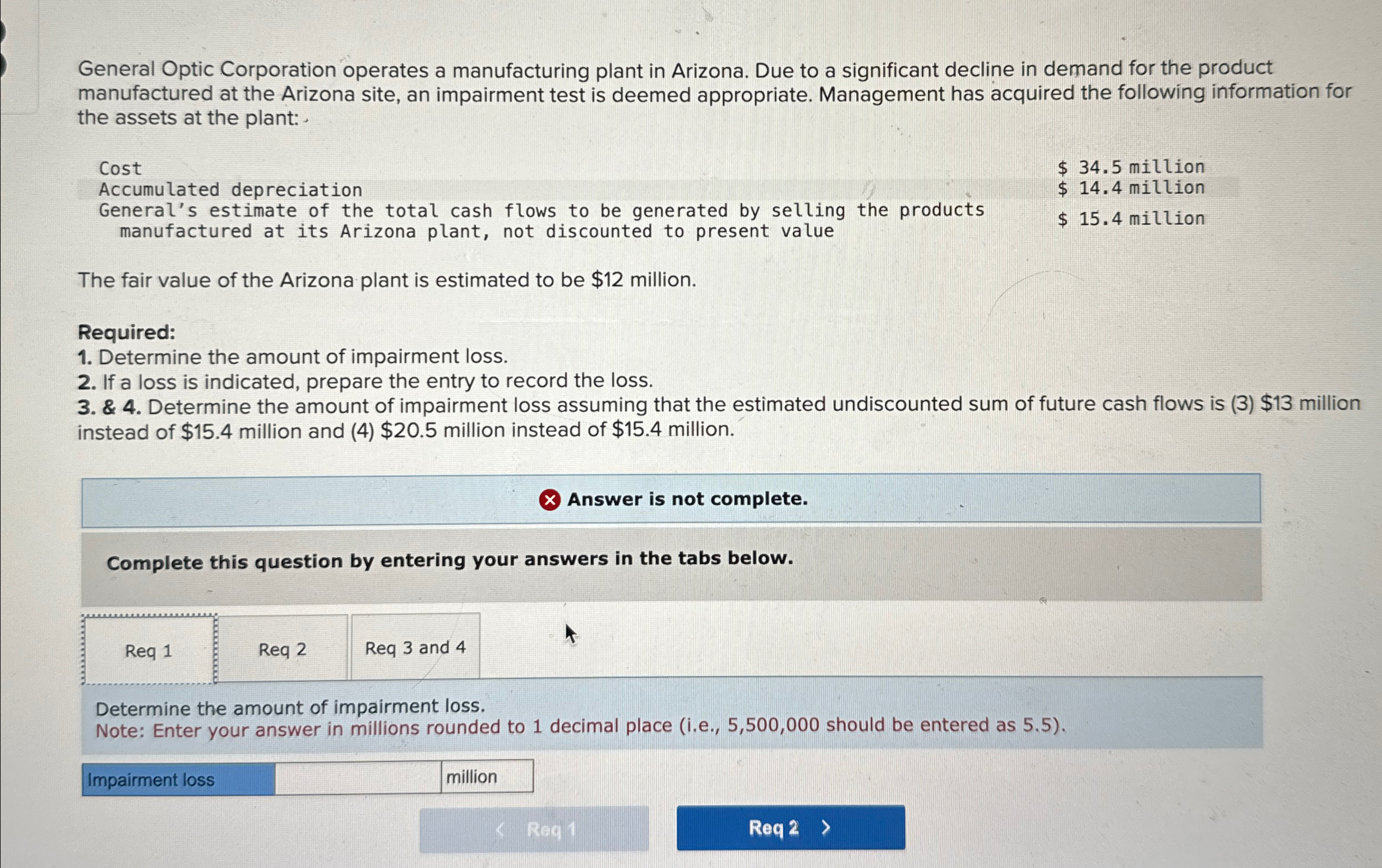

General Optic Corporation operates a manufacturing plant in Arizona. Due to a significant decline in demand for the product manufactured at the Arizona site, an impairment test is deemed appropriate. Management has acquired the following information for the assets at the plant: Cost Accumulated depreciation $ 34.5 million $ 14.4 million General's estimate of the total cash flows to be generated by selling the products manufactured at its Arizona plant, not discounted to present value $ 15.4 million The fair value of the Arizona plant is estimated to be $12 million. Required: 1. Determine the amount of impairment loss. 2. If a loss is indicated, prepare the entry to record the loss. 3. & 4. Determine the amount of impairment loss assuming that the estimated undiscounted sum of future cash flows is (3) $13 million instead of $15.4 million and (4) $20.5 million instead of $15.4 million. Answer is not complete. Complete this question by entering your answers in the tabs below. Req 1 Req 2 Req 3 and 4 Determine the amount of impairment loss. Note: Enter your answer in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5). Impairment loss million Req 1 Req 2 >

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer Req 3 To determine the amount of impairment loss when the estimated undiscounted sum of fut...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663d4a4351245_968414.pdf

180 KBs PDF File

663d4a4351245_968414.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started