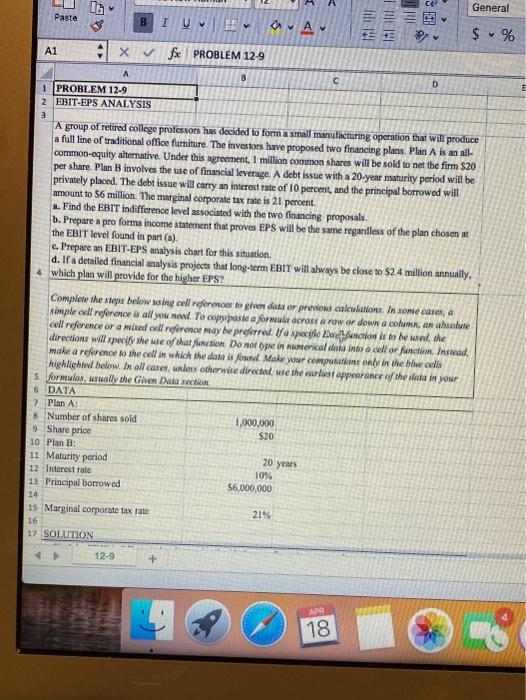

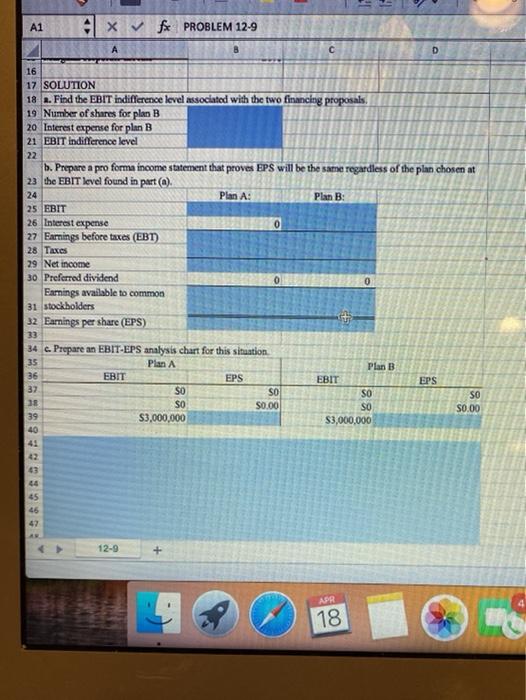

General Paste B IUBE ANAY $ % A1 1 x fx PROBLEM 12-9 A D 1 PROBLEM 12-9 2 EBIT-EPS ANALYSIS 3 A group of retired college professors has decided to form a small manufacturing operation that will produce a full line of traditional office furniture. The investors have proposed two financing plans. Plan A is an all- common-equity alternative. Under this agreement, 1 million common shares will be sold to get the firm $20 per share. Plan B involves the use of financial leverage. A debt issue with a 20-year maturity period will be privately placed. The debt issue will carry an interest rate of 10 percent, and the principal borrowed will amount to $6 million. The marginal corporate tax rate is 21 percent a. Find the EBIT indifference level associated with the two financing proposals. b. Prepare a pro forma income statement that proves EPS will be the same regardless of the plan chosen at the EBIT level found in part(a) e. Prepare an EBIT-EPS analysis chart for this situation, d. If a detailed financial analysis projects that long-term EBIT will always be close 10 $2.4 million annually, 4 which plan will provide for the higher EPS? Complete the steps below asing cell references to give data or previous calculations. In some cases, a simple cell reference is all you need to copy paste a formal across a row or down a cohen, an absolute cell reference or a mured cell reference may be preferred. Ifa specie function is to be used the directions will specify the we of that function. Do nor penerical data into a color function. Instead, make a reference to the cell in which the data is found Make your computations only in the blue colis Highlighted below. In all cases, unless otherwise directed we the earliest appearance of the data in your s formulas, wally the Given Dalection 6 DATA 7 Plan A: # Number of shares sold 1,000,000 9 Share price $20 10 Plan B : 11 Maturity period 12 Interest rate 10% 13. Principal borrowed $6,000,000 14 15 Marginal corporate tax rate 21% 16 17 SOLUTION 20 years 12-9 + 18 21 11 A1 4 x fx PROBLEM 12-9 C D 16 17 SOLUTION 18 . Find the EBIT indifference level associated with the two financing proposals, 19 Number of shares for plan B 20 Interest expense for plan B 21 EBIT indifference level 22 b. Prepare a pro forma income statement that proves EPS will be the same regardless of the plan chosen at 23 the EBIT level found in part @). 24 Plan A: Plan B: 25 EBIT 26 Interest expense 27 Earnings before taxes (EBT) 28 Taxes 29 Net income 30 Preferred dividend 0 Earnings available to common 31 stockholders 32 Earnings per share (EPS) t 33 34 c. Prepare an EBIT-EPS analysis chart for this situation 35 Plan A Plan B 36 EBIT EPS EBIT EPS 37 SO SO SO SO S0.00 SO S0.00 39 $3,000,000 $3,000,000 40 41 45 42 12-9 + ASR 18