Answered step by step

Verified Expert Solution

Question

1 Approved Answer

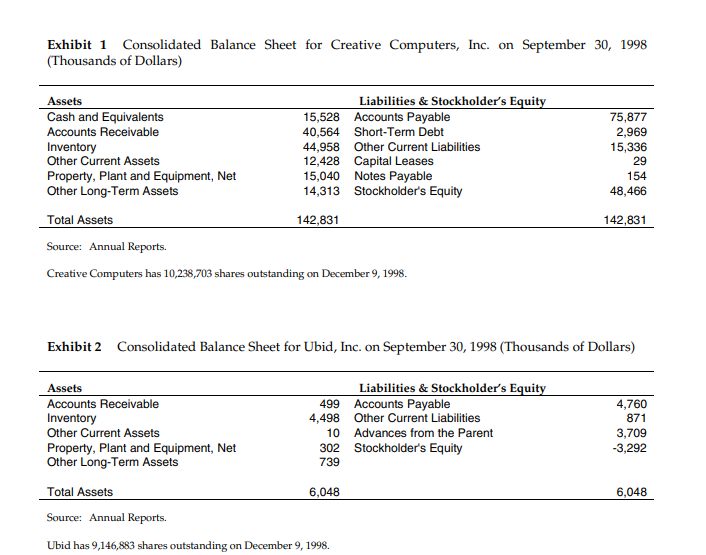

Generate the market value balance sheet for Creative Computers and calculate the stub value for Ubid. Exhibit 1 Consolidated Balance Sheet for Creative Computers, Inc.

Generate the market value balance sheet for Creative Computers and calculate the "stub" value for Ubid.

Exhibit 1 Consolidated Balance Sheet for Creative Computers, Inc. on September 30, 1998 (Thousands of Dollars) Assets Cash and Equivalents Accounts Receivable Inventory Other Current Assets Property, Plant and Equipment, Net Other Long-Term Assets Total Assets Source: Annual Reports. Creative Computers has 10,238,703 shares outstanding on December 9, 1998. Assets Accounts Receivable Inventory 15,528 40,564 Other Current Assets Property, Plant and Equipment, Net Other Long-Term Assets Liabilities & Stockholder's Equity Accounts Payable Short-Term Debt 44,958 Other Current Liabilities 12,428 Capital Leases 15,040 Notes Payable 14,313 Stockholder's Equity 142,831 Exhibit 2 Consolidated Balance Sheet for Ubid, Inc. on September 30, 1998 (Thousands of Dollars) 499 4,498 Total Assets Source: Annual Reports. Ubid has 9,146,883 shares outstanding on December 9, 1998. Liabilities & Stockholder's Equity Accounts Payable Other Current Liabilities 10 Advances from the Parent 302 Stockholder's Equity 739 6,048 75,877 2,969 15,336 29 154 48,466 142,831 4,760 871 3,709 -3,292 6,048

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the stub value for Ubid we need to determine the market value balance sheet for Creativ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started