Answered step by step

Verified Expert Solution

Question

1 Approved Answer

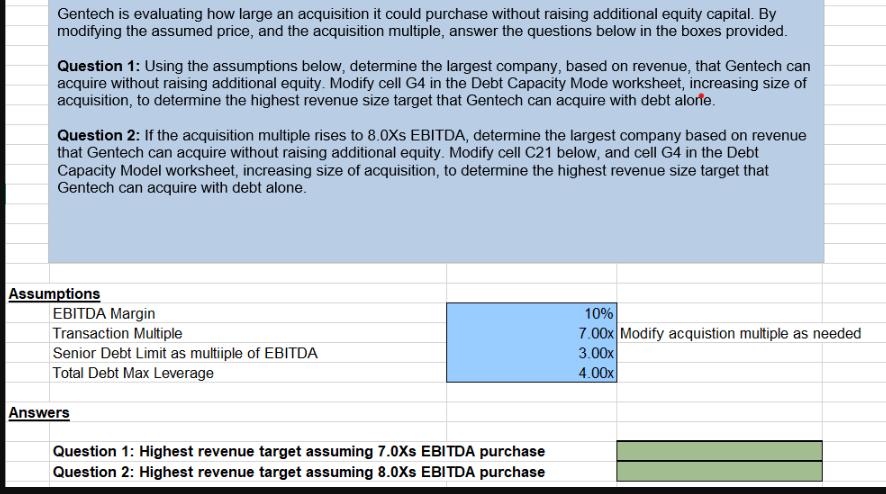

Gentech is evaluating how large an acquisition it could purchase without raising additional equity capital. By modifying the assumed price, and the acquisition multiple,

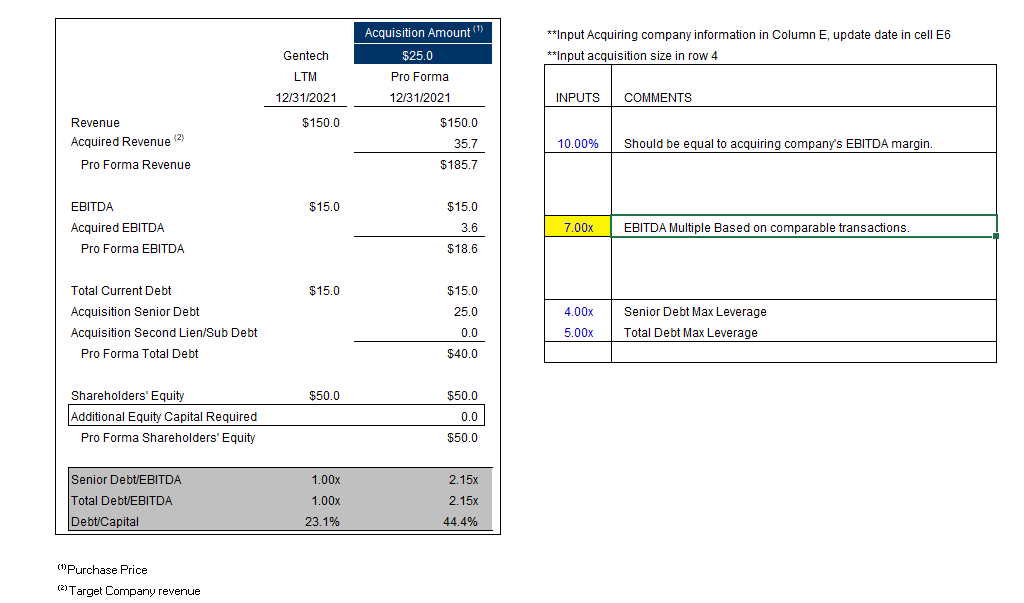

Gentech is evaluating how large an acquisition it could purchase without raising additional equity capital. By modifying the assumed price, and the acquisition multiple, answer the questions below in the boxes provided. Question 1: Using the assumptions below, determine the largest company, based on revenue, that Gentech can acquire without raising additional equity. Modify cell G4 in the Debt Capacity Mode worksheet, increasing size of acquisition, to determine the highest revenue size target that Gentech can acquire with debt alorie. Question 2: If the acquisition multiple rises to 8.0XS EBITDA, determine the largest company based on revenue that Gentech can acquire without raising additional equity. Modify cell C21 below, and cell G4 in the Debt Capacity Model worksheet, increasing size of acquisition, to determine the highest revenue size target that Gentech can acquire with debt alone. Assumptions EBITDA Margin Transaction Multiple Senior Debt Limit as multiiple of EBITDA Total Debt Max Leverage Answers Question 1: Highest revenue target assuming 7.0Xs EBITDA purchase Question 2: Highest revenue target assuming 8.0Xs EBITDA purchase 10% 7.00x Modify acquistion multiple as needed 3.00x 4.00x Revenue Acquired Revenue (2) Pro Forma Revenue EBITDA Acquired EBITDA Pro Forma EBITDA Total Current Debt Acquisition Senior Debt Acquisition Second Lien/Sub Debt Pro Forma Total Debt Gentech Acquisition Amount (1) $25.0 **Input Acquiring company information in Column E, update date in cell E6 **Input acquisition size in row 4 LTM Pro Forma 12/31/2021 12/31/2021 INPUTS COMMENTS $150.0 $150.0 35.7 $185.7 10.00% Should be equal to acquiring company's EBITDA margin. $15.0 $15.0 3.6 7.00x EBITDA Multiple Based on comparable transactions. $18.6 $15.0 150 $15.0 25.0 4.00x Senior Debt Max Leverage 0.0 5.00x Total Debt Max Leverage $40.0 Shareholders' Equity $50.0 $50.0 Additional Equity Capital Required 0.0 Pro Forma Shareholders' Equity $50.0 Senior Debt/EBITDA Total Debt/EBITDA Debt/Capital 1.00x 2.15x 1.00x 2.15x 23.1% 44.4% (Purchase Price (2) Target Company revenue

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started