Question

Gentle Ben Corp decides they want to invest in a new equipment to expand their production of cleaning products. Here are the cashflows for the

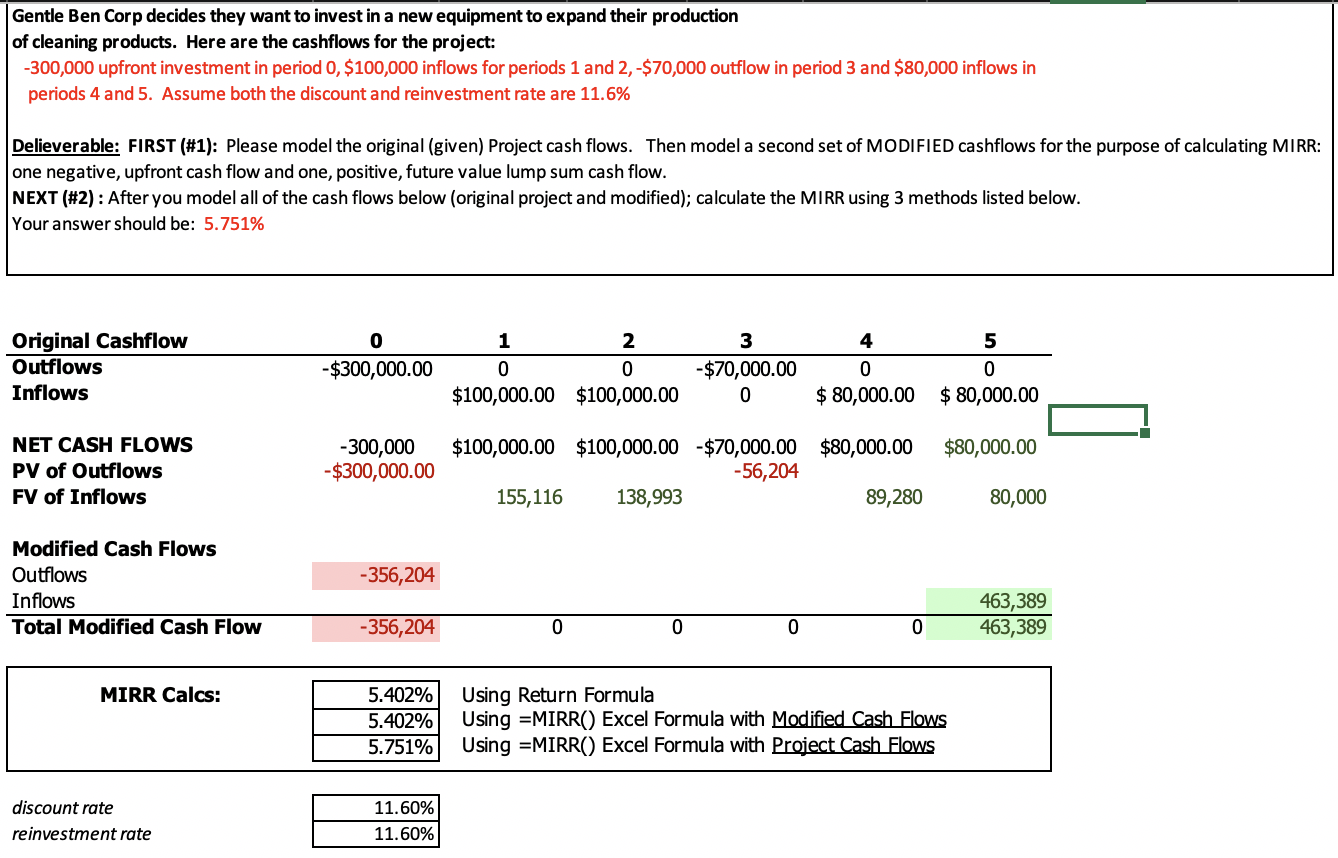

Gentle Ben Corp decides they want to invest in a new equipment to expand their production of cleaning products. Here are the cashflows for the project: -300,000 upfront investment in period 0, $100,000 inflows for periods 1 and 2, -$70,000 outflow in period 3 and $80,000 inflows in periods 4 and 5. Assume both the discount and reinvestment rate are 11.6%

Delieverable: FIRST (#1): Please model the original (given) Project cash flows. Then model a second set of MODIFIED cashflows for the purpose of calculating MIRR: one negative, upfront cash flow and one, positive, future value lump sum cash flow. NEXT (#2) : After you model all of the cash flows below (original project and modified); calculate the MIRR using 3 methods listed below. Your answer should be: 5.751%

CALCULATE THE MIRR using the

- Return Formula

- = MIRR ( ) Excel formula with Modified Cash Flows

- = MRR ( ) Excel Formula Projected Cash Flows

NNot sure what I did wrong for the first two MIRR Calcs

NNot sure what I did wrong for the first two MIRR Calcs

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started