Answered step by step

Verified Expert Solution

Question

1 Approved Answer

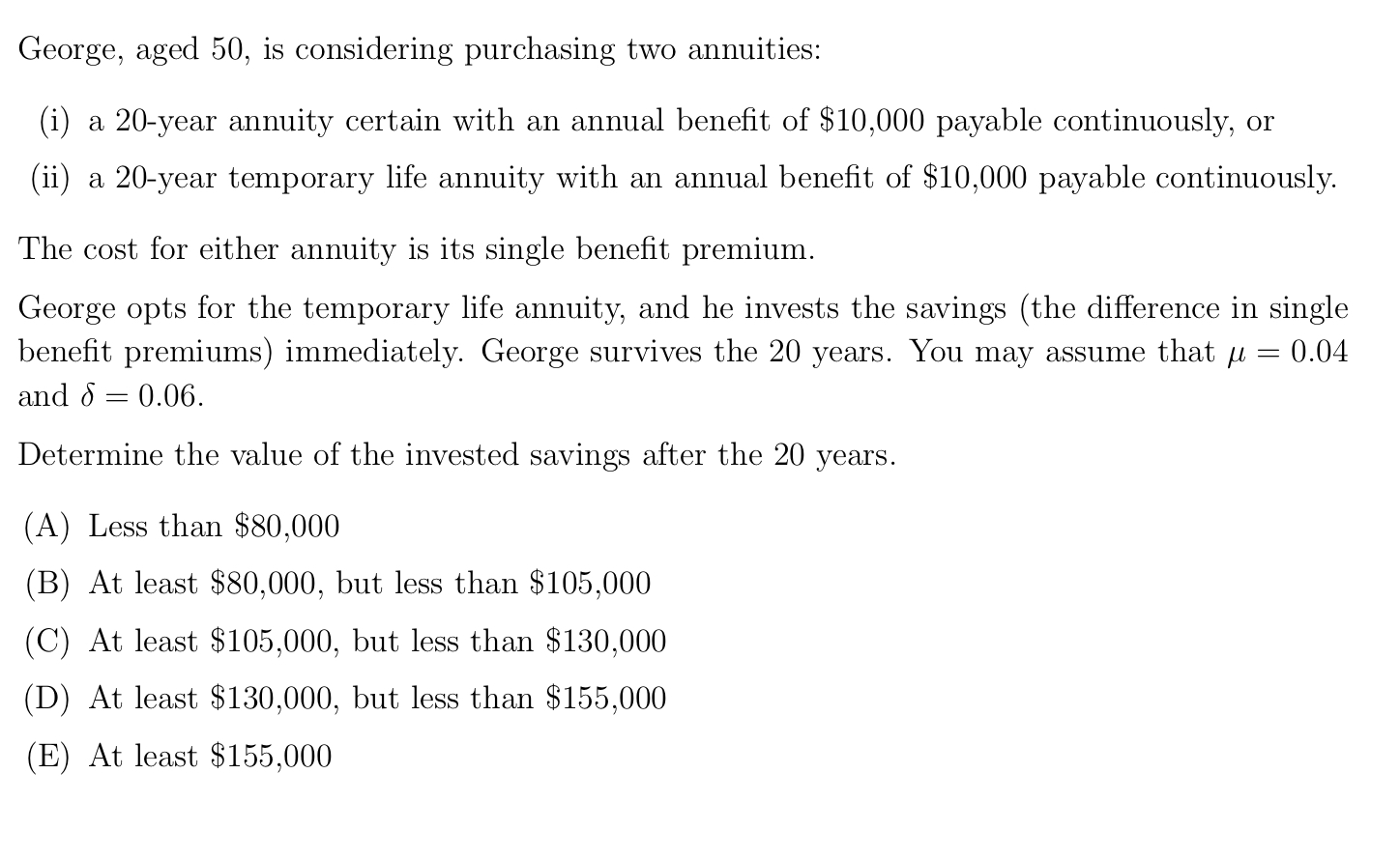

George, aged 5 0 , is considering purchasing two annuities: ( i ) a 2 0 - year annuity certain with an annual benefit of

George, aged is considering purchasing two annuities:

i a year annuity certain with an annual benefit of $ payable continuously, or

ii a year temporary life annuity with an annual benefit of $ payable continuously.

The cost for either annuity is its single benefit premium.

George opts for the temporary life annuity, and he invests the savings the difference in single benefit premiums immediately. George survives the years. You may assume that and

Determine the value of the invested savings after the years.

A Less than $

B At least $ but less than $

C At least $ but less than $

D At least $ but less than $

E At least $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started