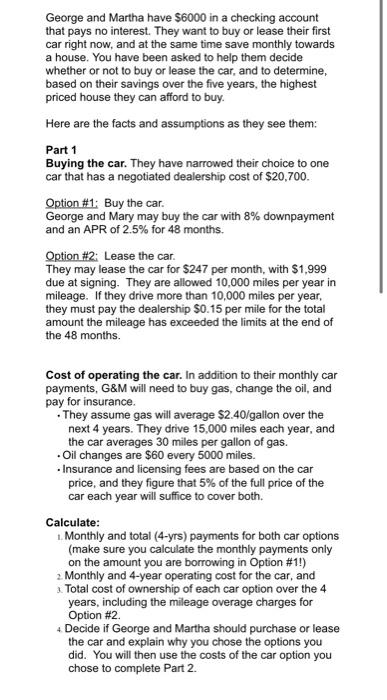

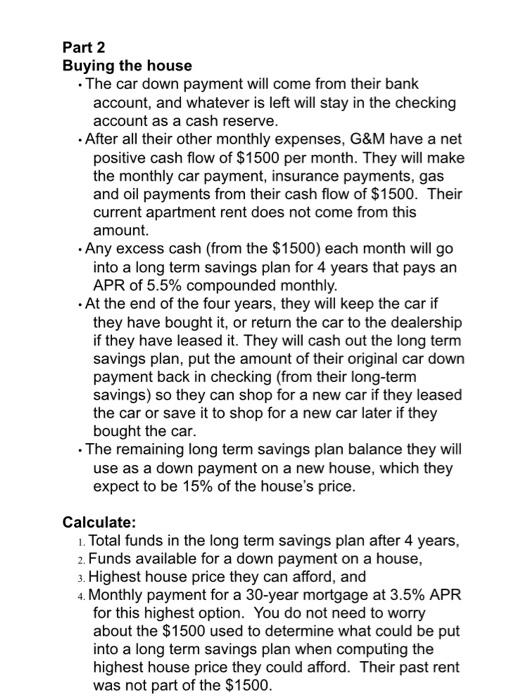

George and Martha have $6000 in a checking account that pays no interest. They want to buy or lease their first car right now, and at the same time save monthly towards a house. You have been asked to help them decide whether or not to buy or lease the car, and to determine, based on their savings over the five years, the highest priced house they can afford to buy. Here are the facts and assumptions as they see them: Part 1 Buying the car. They have narrowed their choice to one car that has a negotiated dealership cost of $20,700. Option #1: Buy the car. George and Mary may buy the car with 8% downpayment and an APR of 2.5% for 48 months. Option #2: Lease the car. They may lease the car for $247 per month, with $1,999 due at signing. They are allowed 10,000 miles per year in mileage. If they drive more than 10,000 miles per year, they must pay the dealership $0.15 per mile for the total amount the mileage has exceeded the limits at the end of the 48 months. Cost of operating the car. In addition to their monthly car payments, G&M will need to buy gas, change the oil, and pay for insurance They assume gas will average $2.40/gallon over the next 4 years. They drive 15,000 miles each year, and the car averages 30 miles per gallon of gas. Oil changes are $60 every 5000 miles. Insurance and licensing fees are based on the car price, and they figure that 5% of the full price of the car each year will suffice to cover both. Calculate: 1. Monthly and total (4-yrs) payments for both car options (make sure you calculate the monthly payments only on the amount you are borrowing in Option #1!) 2. Monthly and 4-year operating cost for the car, and Total cost of ownership of each car option over the 4 years, including the mileage overage charges for Option #2 Decide if George and Martha should purchase or lease the car and explain why you chose the options you did. You will then use the costs of the car option you chose to complete Part 2. Part 2 Buying the house The car down payment will come from their bank account, and whatever is left will stay in the checking account as a cash reserve. . After all their other monthly expenses, G&M have a net positive cash flow of $1500 per month. They will make the monthly car payment, insurance payments, gas and oil payments from their cash flow of $1500. Their current apartment rent does not come from this amount. Any excess cash (from the $1500) each month will go into a long term savings plan for 4 years that pays an APR of 5.5% compounded monthly. At the end of the four years, they will keep the car if they have bought it, or return the car to the dealership if they have leased it. They will cash out the long term savings plan, put the amount of their original car down payment back in checking (from their long-term savings) so they can shop for a new car if they leased the car or save it to shop for a new car later if they bought the car. The remaining long term savings plan balance they will use as a down payment on a new house, which they expect to be 15% of the house's price. Calculate: 2. Total funds in the long term savings plan after 4 years, 2. Funds available for a down payment on a house, 3. Highest house price they can afford, and 4. Monthly payment for a 30-year mortgage at 3.5% APR for this highest option. You do not need to worry about the $1500 used to determine what could be put into a long term savings plan when computing the highest house price they could afford. Their past rent was not part of the $1500. George and Martha have $6000 in a checking account that pays no interest. They want to buy or lease their first car right now, and at the same time save monthly towards a house. You have been asked to help them decide whether or not to buy or lease the car, and to determine, based on their savings over the five years, the highest priced house they can afford to buy. Here are the facts and assumptions as they see them: Part 1 Buying the car. They have narrowed their choice to one car that has a negotiated dealership cost of $20,700. Option #1: Buy the car. George and Mary may buy the car with 8% downpayment and an APR of 2.5% for 48 months. Option #2: Lease the car. They may lease the car for $247 per month, with $1,999 due at signing. They are allowed 10,000 miles per year in mileage. If they drive more than 10,000 miles per year, they must pay the dealership $0.15 per mile for the total amount the mileage has exceeded the limits at the end of the 48 months. Cost of operating the car. In addition to their monthly car payments, G&M will need to buy gas, change the oil, and pay for insurance They assume gas will average $2.40/gallon over the next 4 years. They drive 15,000 miles each year, and the car averages 30 miles per gallon of gas. Oil changes are $60 every 5000 miles. Insurance and licensing fees are based on the car price, and they figure that 5% of the full price of the car each year will suffice to cover both. Calculate: 1. Monthly and total (4-yrs) payments for both car options (make sure you calculate the monthly payments only on the amount you are borrowing in Option #1!) 2. Monthly and 4-year operating cost for the car, and Total cost of ownership of each car option over the 4 years, including the mileage overage charges for Option #2 Decide if George and Martha should purchase or lease the car and explain why you chose the options you did. You will then use the costs of the car option you chose to complete Part 2. Part 2 Buying the house The car down payment will come from their bank account, and whatever is left will stay in the checking account as a cash reserve. . After all their other monthly expenses, G&M have a net positive cash flow of $1500 per month. They will make the monthly car payment, insurance payments, gas and oil payments from their cash flow of $1500. Their current apartment rent does not come from this amount. Any excess cash (from the $1500) each month will go into a long term savings plan for 4 years that pays an APR of 5.5% compounded monthly. At the end of the four years, they will keep the car if they have bought it, or return the car to the dealership if they have leased it. They will cash out the long term savings plan, put the amount of their original car down payment back in checking (from their long-term savings) so they can shop for a new car if they leased the car or save it to shop for a new car later if they bought the car. The remaining long term savings plan balance they will use as a down payment on a new house, which they expect to be 15% of the house's price. Calculate: 2. Total funds in the long term savings plan after 4 years, 2. Funds available for a down payment on a house, 3. Highest house price they can afford, and 4. Monthly payment for a 30-year mortgage at 3.5% APR for this highest option. You do not need to worry about the $1500 used to determine what could be put into a long term savings plan when computing the highest house price they could afford. Their past rent was not part of the $1500