Question

George Black lives in Manitoba, a non-participating province that has an 7% provincial sales tax. During the current year, he purchases a new Lexus

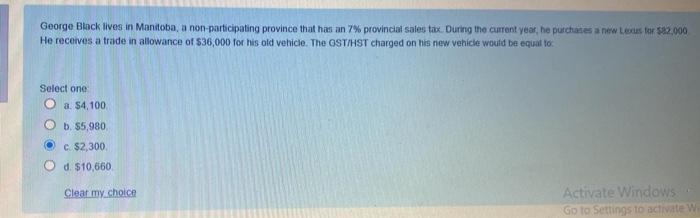

George Black lives in Manitoba, a non-participating province that has an 7% provincial sales tax. During the current year, he purchases a new Lexus for $82,000 He receives a trade in allowance of $36,000 for his old vehicle. The GST/HST charged on his new vehicle would be equal to: Select one a. $4,100. b. $5,980, c. $2,300. d. $10,660 Clear my choice Activate Windows Go to Settings to activate We

Step by Step Solution

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

New Vehicle purchase price 82000 Trade in allowance 36000 PST rate 7 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Concepts In Federal Taxation 2017

Authors: Kevin E. Murphy, Mark Higgins

24th Edition

978-1337345811, 1337345814, 978-1337365758, 1337365750, 978-1305950207, 1305950208, 978-1305965119

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App