Answered step by step

Verified Expert Solution

Question

1 Approved Answer

George Farron, a Canadian resident, owns all the outstanding shares of Farron Industries Limited (FIL), a Canadian furniture manufacturer. George's health has been poor

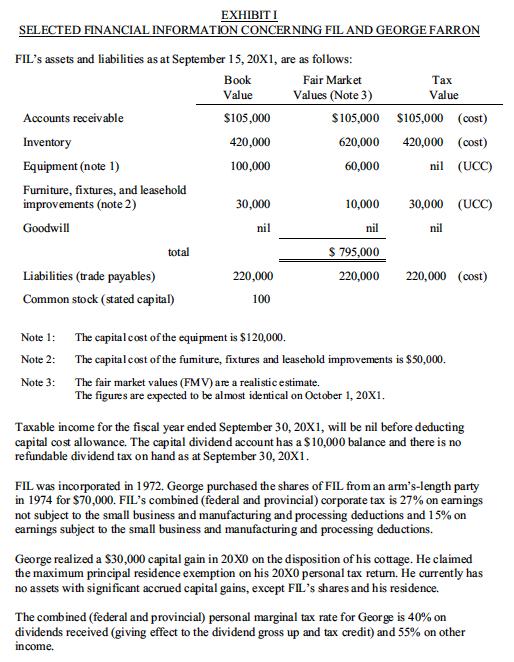

George Farron, a Canadian resident, owns all the outstanding shares of Farron Industries Limited (FIL), a Canadian furniture manufacturer. George's health has been poor in recent years, and his doctor has urged him to slow down and take life a little easier. George has decided that he no longer wants to be in business and, at age 76, is planning to retire. George is a widower and has two children aged 38 and 39, both of whom are working and are also part-time students. Elite Limited, a public corporation, has approached George to see whether he would be interested in selling FIL and has presented an offer, extracts from which are as follows: EXTRACTS FROM OFFER TO PURCHASE Date of closing is October 1, 20X1 Purchase price will be paid entirely in cash. The purchase price will be $795,000, if the assets are purchased. The purchase price will be $500,000, if the shares are purchased. Selected financial information concerning FIL and George is presented in Exhibit I. Having accepted the offer in principle, George Farron asks you, Charles Alfredsson, CPA, whether he will be better off selling his shares or selling FIL's assets. In addition, he wants information on tax-planning opportunities related to the disposition of his business. Required: Prepare a report to George Farron. SELECTED FINANCIAL INFORMATION CONCERNING FIL AND GEORGE FARRON FIL's assets and liabilities as at September 15, 20X1, are as follows: Book Value Accounts receivable Inventory Equipment (note 1) Furniture, fixtures, and leasehold improvements (note 2) Goodwill total Liabilities (trade payables) Common stock (stated capital) Note 1: Note 2: Note 3: EXHIBITI $105,000 420,000 100,000 30,000 nil 220,000 100 Fair Market Values (Note 3) $105,000 620,000 60,000 10,000 nil Tax Value $105,000 (cost) 420,000 (cost) nil (UCC) 30,000 (UCC) nil $ 795,000 220,000 220,000 (cost) The capital cost of the equipment is $120,000. The capital cost of the fumiture, fixtures and leasehold improvements is $50,000. The fair market values (FMV) are a realistic estimate. The figures are expected to be almost identical on October 1, 20X1. Taxable income for the fiscal year ended September 30, 20X1, will be nil before deducting capital cost allowance. The capital dividend account has a $10,000 balance and there is no refundable dividend tax on hand as at September 30, 20X1. FIL was incorporated in 1972. George purchased the shares of FIL from an arm's-length party in 1974 for $70,000. FIL's combined (federal and provincial) corporate tax is 27% on earnings not subject to the small business and manufacturing and processing deductions and 15% on earnings subject to the small business and manufacturing and processing deductions. George realized a $30,000 capital gain in 20X0 on the disposition of his cottage. He claimed the maximum principal residence exemption on his 20X0 personal tax return. He currently has no assets with significant accrued capital gains, except FIL's shares and his residence. The combined (federal and provincial) personal marginal tax rate for George is 40% on dividends received (giving effect to the dividend gross up and tax credit) and 55% on other income.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started