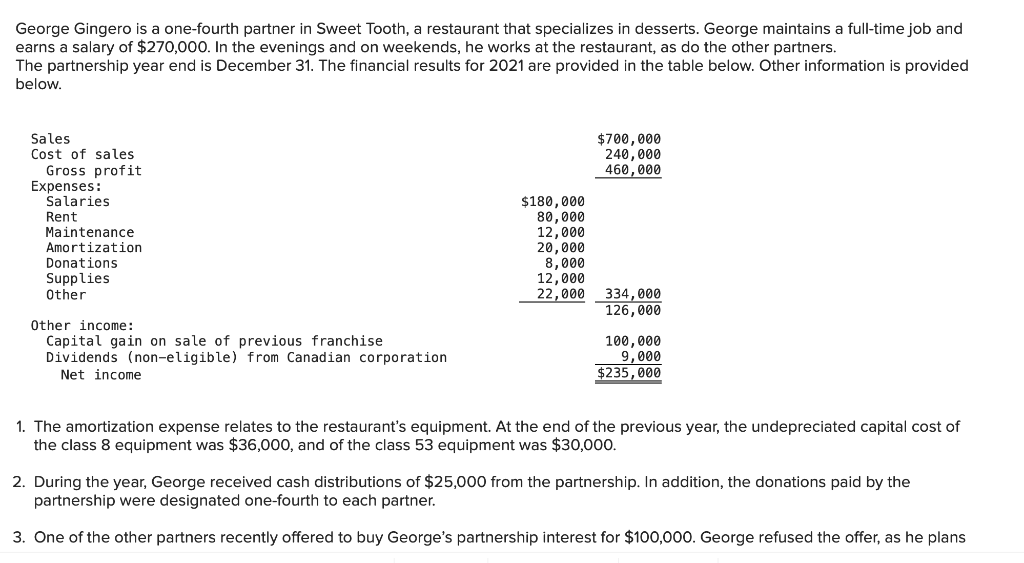

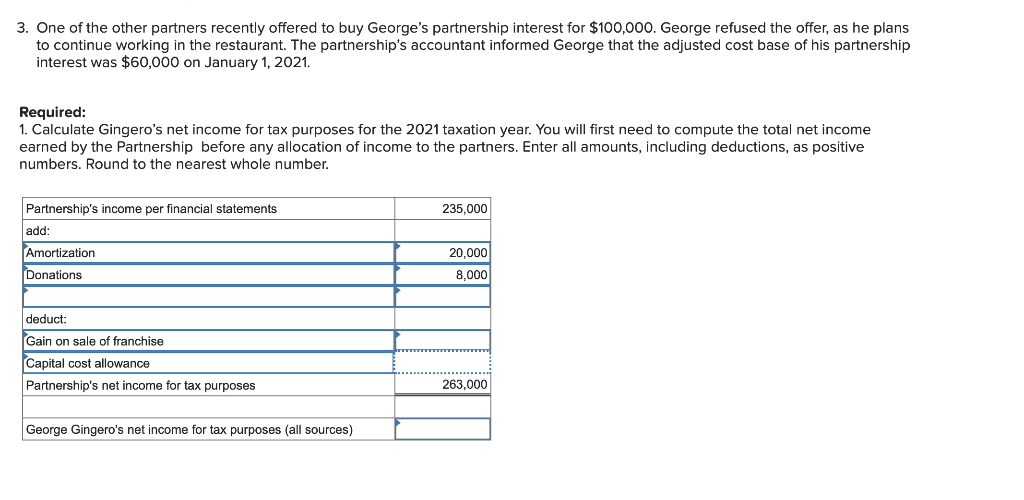

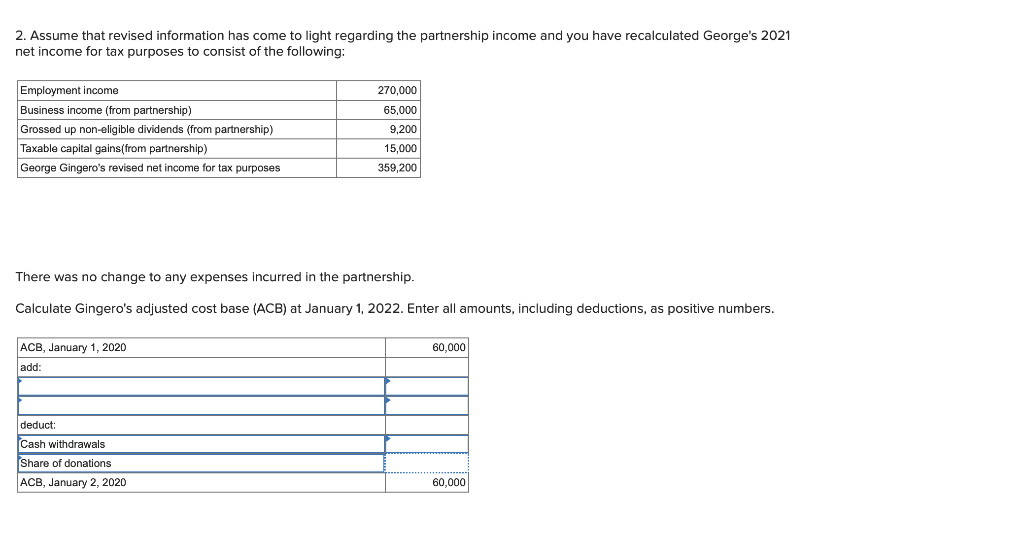

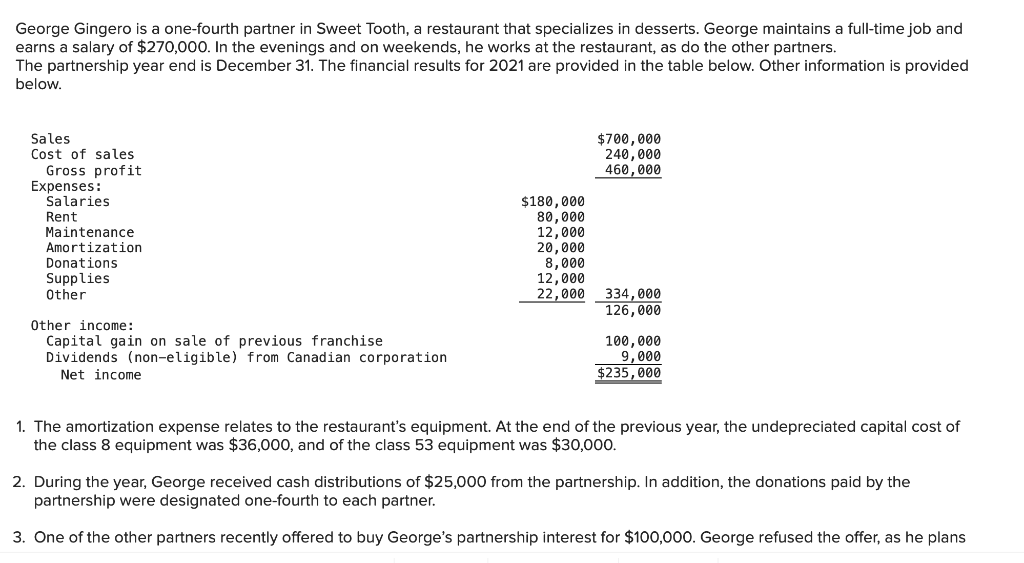

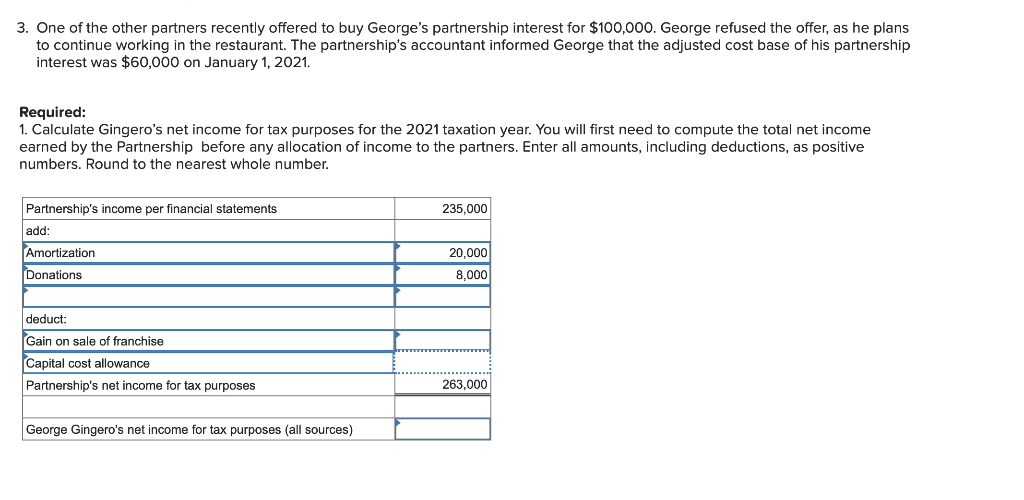

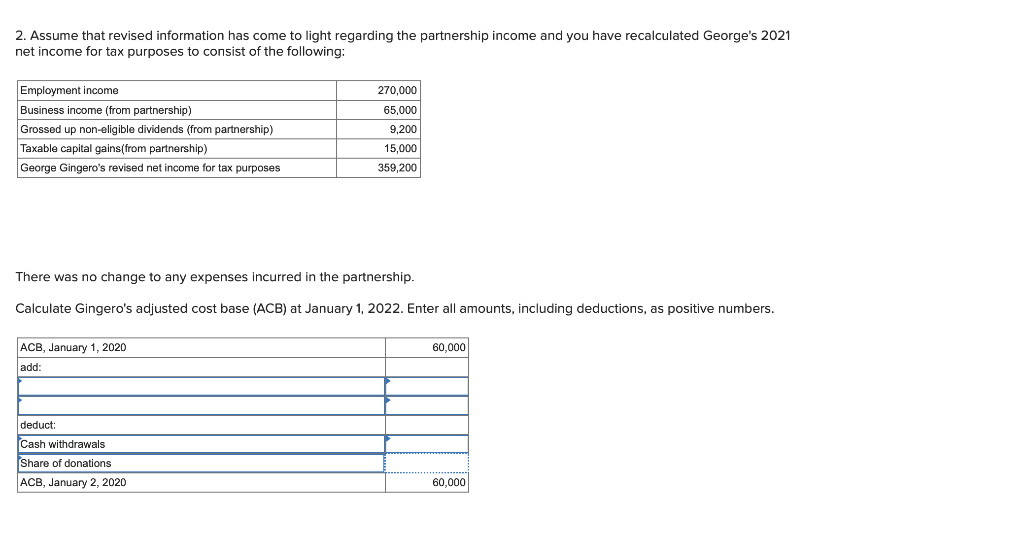

George Gingero is a one-fourth partner in Sweet Tooth, a restaurant that specializes in desserts. George maintains a full-time job and earns a salary of $270,000. In the evenings and on weekends, he works at the restaurant, as do the other partners. The partnership year end is December 31. The financial results for 2021 are provided in the table below. Other information is provided below. $700,000 240,000 460,000 Sales Cost of sales Gross profit Expenses: Salaries Rent Maintenance Amortization Donations Supplies Other $180,000 80,000 12,000 20,000 8,000 12,000 22,000 334,000 126,000 Other income: Capital gain on sale of previous franchise Dividends (non-eligible) from Canadian corporation Net income 100,000 9,000 $235,000 1. The amortization expense relates to the restaurant's equipment. At the end of the previous year, the undepreciated capital cost of the class 8 equipment was $36,000, and of the class 53 equipment was $30,000. 2. During the year, George received cash distributions of $25,000 from the partnership. In addition, the donations paid by the partnership were designated one-fourth to each partner. 3. One of the other partners recently offered to buy George's partnership interest for $100,000. George refused the offer, as he plans 3. One of the other partners recently offered to buy George's partnership interest for $100,000. George refused the offer, as he plans to continue working in the restaurant. The partnership's accountant informed George that the adjusted cost base of his partnership interest was $60,000 on January 1, 2021. Required: 1. Calculate Gingero's net income for tax purposes for the 2021 taxation year. You will first need to compute the total net income earned by the Partnership before any allocation of income to the partners. Enter all amounts, including deductions, as positive numbers. Round to the nearest whole number. 235,000 Partnership's income per financial statements add: Amortization Donations 20,000 8,000 deduct: Gain on sale of franchise Capital cost allowance Partnership's net income for tax purposes 263,000 George Gingero's net income for tax purposes (all sources) 2. Assume that revised information has come to light regarding the partnership income and you have recalculated George's 2021 net income for tax purposes to consist of the following: Employment income Business income (from partnership) Grossed up non-eligible dividends (from partnership) Taxable capital gains(from partnership) George Gingero's revised net income for tax purposes 270,000 65,000 9,200 15,000 359,200 There was no change to any expenses incurred in the partnership. Calculate Gingero's adjusted cost base (ACB) at January 1, 2022. Enter all amounts, including deductions, as positive numbers. 60,000 ACB, January 1, 2020 add: deduct: Cash withdrawals Share donations ACB, January 2, 2020 60,000