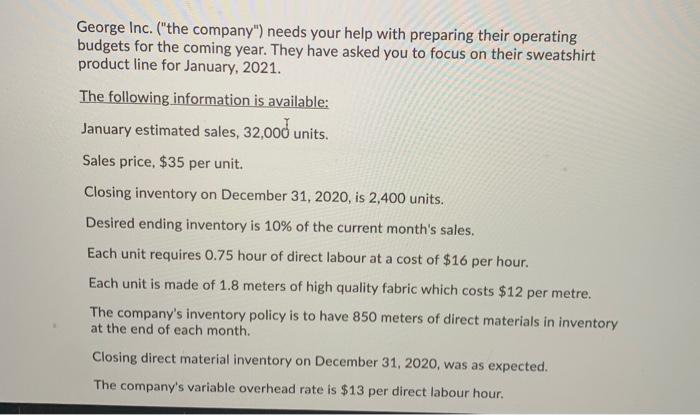

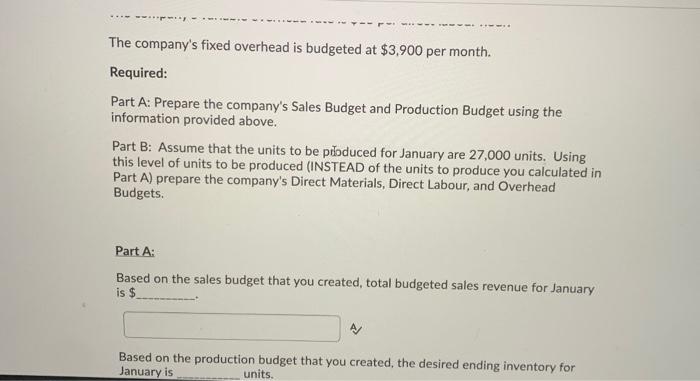

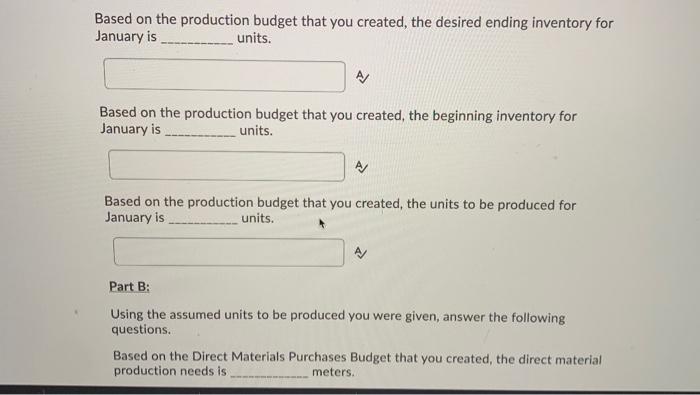

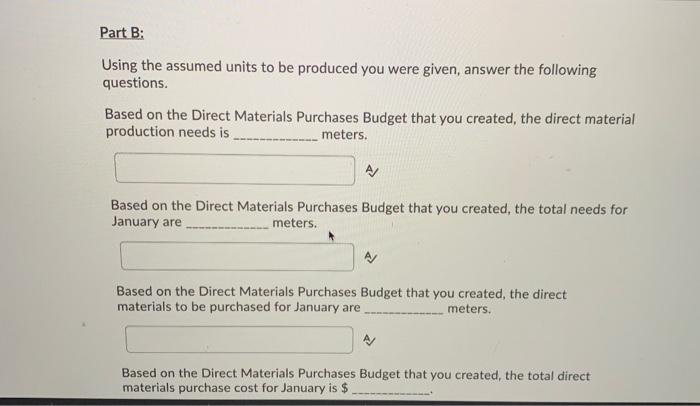

George Inc. ("the company") needs your help with preparing their operating budgets for the coming year. They have asked you to focus on their sweatshirt product line for January, 2021. The following information is available: January estimated sales, 32,000 units. Sales price, $35 per unit. Closing inventory on December 31, 2020, is 2,400 units. Desired ending inventory is 10% of the current month's sales. Each unit requires 0.75 hour of direct labour at a cost of $16 per hour. Each unit is made of 1.8 meters of high quality fabric which costs $12 per metre. The company's inventory policy is to have 850 meters of direct materials in inventory at the end of each month. Closing direct material inventory on December 31, 2020, was as expected. The company's variable overhead rate is $13 per direct labour hour. The company's fixed overhead is budgeted at $3,900 per month. Required: Part A: Prepare the company's Sales Budget and Production Budget using the information provided above. Part B: Assume that the units to be produced for January are 27,000 units. Using this level of units to be produced (INSTEAD of the units to produce you calculated in Part A) prepare the company's Direct Materials, Direct Labour, and Overhead Budgets. Part A: Based on the sales budget that you created, total budgeted sales revenue for January is $ A/ Based on the production budget that you created, the desired ending inventory for January is units. Based on the production budget that you created, the desired ending inventory for January is units. Based on the production budget that you created, the beginning inventory for January is units. A Based on the production budget that you created, the units to be produced for January is units. Part B: Using the assumed units to be produced you were given, answer the following questions. Based on the Direct Materials Purchases Budget that you created, the direct material production needs is meters. Part B: Using the assumed units to be produced you were given, answer the following questions. Based on the Direct Materials Purchases Budget that you created, the direct material production needs is meters. Based on the Direct Materials Purchases Budget that you created, the total needs for January are meters. Based on the Direct Materials Purchases Budget that you created, the direct materials to be purchased for January are meters. Based on the Direct Materials Purchases Budget that you created, the total direct materials purchase cost for January is $ Based on the Direct Materials Purchases Budget that you created, the total direct materials purchase cost for January is $ Based on the Direct Labour Budget that you created, total hours needed for January hours. are Based on the Direct Labour Budget that you created, total direct labour cost for January is $ Based on the Overhead Budget that you created, total budgeted variable overhead for January is $ A Based on the Overhead Budget that you created, total budgeted fixed overhead for A/ Based on the Overhead Budget that you created, total budgeted variable overhead for January is $ Based on the Overhead Budget that you created, total budgeted fixed overhead for January is $ I A Based on the Overhead Budget that you created, total overhead for January is $ A/ The total budgeted PRIME COSTS for the month of January is $