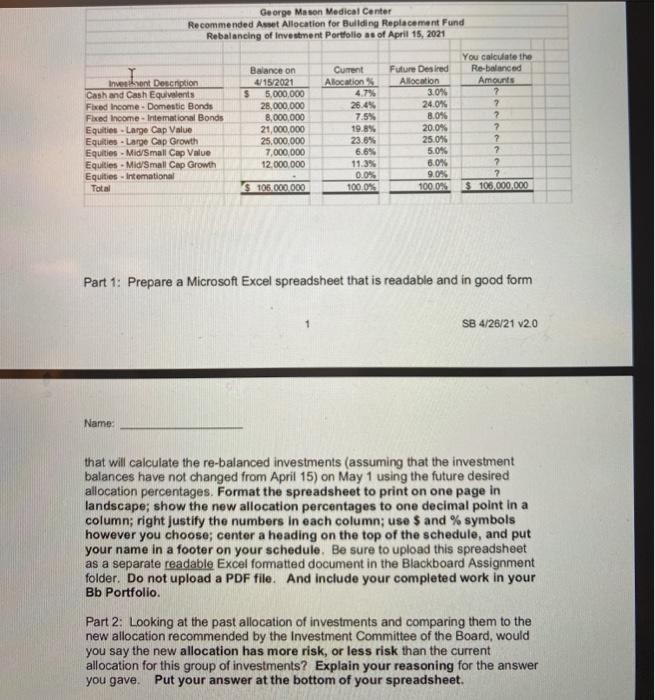

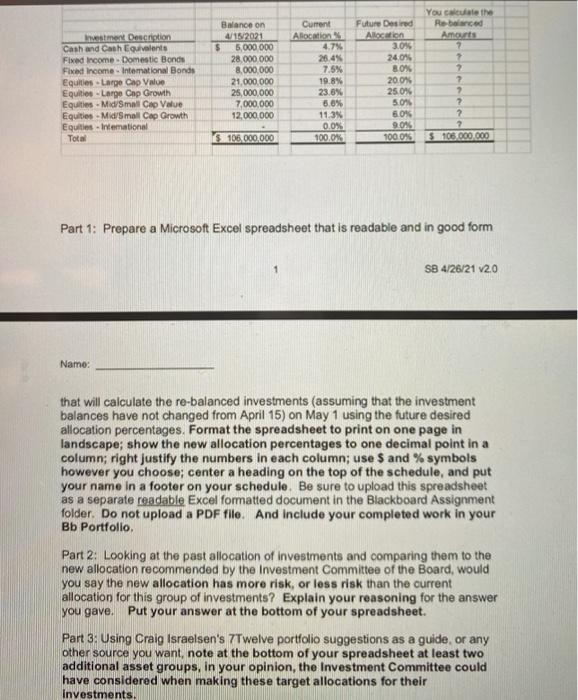

George Mason Medical Center Recommended Asset Allocation for Building Replacement Fund Rebalancing of investment Portfolio as of April 15, 2021 Investment Description Cash and Cash Equivalents Fixed Income. Domestic Bonds Fixed Income - Interational Bonds Equities - Large Cap Value Equities - Large Cap Growth Equities - Mid/Small Cap Value Equities - Mid/Small Cap Growth Equities. Interational Total Balance on 4/15/2021 5 5,000,000 28,000,000 8,000,000 21,000,000 25,000,000 7,000,000 12.000.000 Current Allocation 4.1% 26.4% 7.5% 19.8% 23.6% 6.6% 11.3% 0.0% 100.0% Future Desired Allocation 3.096 24.0% 8.04 20.0% 25.0% 5.0% 6.0% 9.09 100.0 You calculate the Re-balanced Amounts ? 7 ? ? ? ? 2 ? $ 100,000,000 $ 105.000.000 Part 1: Prepare a Microsoft Excel spreadsheet that is readable and in good form SB 4/26/21 v2.0 Name: that will calculate the re-balanced investments (assuming that the investment balances have not changed from April 15) on May 1 using the future desired allocation percentages. Format the spreadsheet to print on one page in landscape; show the new allocation percentages to one decimal point in a column; right justify the numbers in each column; use $ and % symbols however you choose; center a heading on the top of the schedule, and put your name in a footer on your schedule. Be sure to upload this spreadsheet as a separate readable Excel fomatted document in the Blackboard Assignment folder. Do not upload a PDF file. And include your completed work in your Bb Portfolio Part 2: Looking at the past allocation of investments and comparing them to the new allocation recommended by the Investment Committee of the Board, would you say the new allocation has more risk, or less risk than the current allocation for this group of investments? Explain your reasoning for the answer you gave. Put your answer at the bottom of your spreadsheet. Investment Decision Cash and Cash Equivalente Fixed Income. Domestic Bonds Fixed Income. International Bonds Equities - Large Cap Value Equities Large Cap Growth Equities - MidSmall Cap Value Equities - Midsmall Cap Growth Equities - Interational Total Balance on 4/12021 $ 5,000 000 28.000.000 8.000.000 21,000,000 25,000,000 7,000,000 12,000,000 Current Allocations 4.7% 26.4% 7.5% 19.8% 23.8% 5.8% 11.3 0.0% 100.0% Future Desired Allocation 3.0% 240 80% 20.0% 25.0% 50 60% 9.09 1000% You calculate the Rebalanced Amounts 2 2 2 7 2 2 ? 7 $ 105.000.000 S 106.000.000 Part 1: Prepare a Microsoft Excel spreadsheet that is readable and in good form SB 4/26/21 V2.0 Name: that will calculate the re-balanced investments (assuming that the investment balances have not changed from April 15) on May 1 using the future desired allocation percentages. Format the spreadsheet to print on one page in landscape; show the new allocation percentages to one decimal point in a column; right justify the numbers in each column; use $ and % symbols however you choose; center a heading on the top of the schedule, and put your name in a footer on your schedule. Be sure to upload this spreadsheet as a separate readable Excel formatted document in the Blackboard Assignment folder. Do not upload a PDF file. And include your completed work in your Bb Portfolio Part 2: Looking at the past allocation of investments and comparing them to the new allocation recommended by the Investment Committee of the Board, would you say the new allocation has more risk, or less risk than the current allocation for this group of investments? Explain your reasoning for the answer you gave. Put your answer at the bottom of your spreadsheet. Part 3: Using Craig Israelsen's 7Twelve portfolio suggestions as a guide, or any other source you want, note at the bottom of your spreadsheet at least two additional asset groups, in your opinion, the Investment Committee could have considered when making these target allocations for their Investments