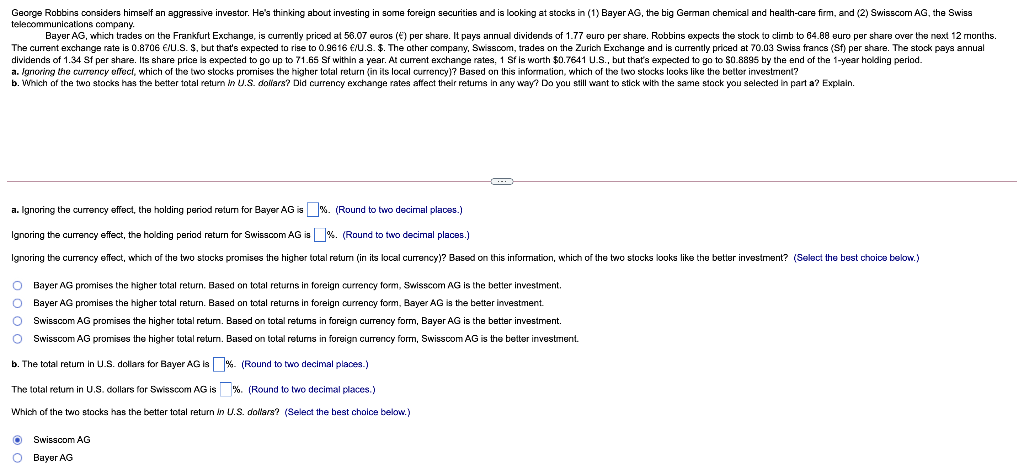

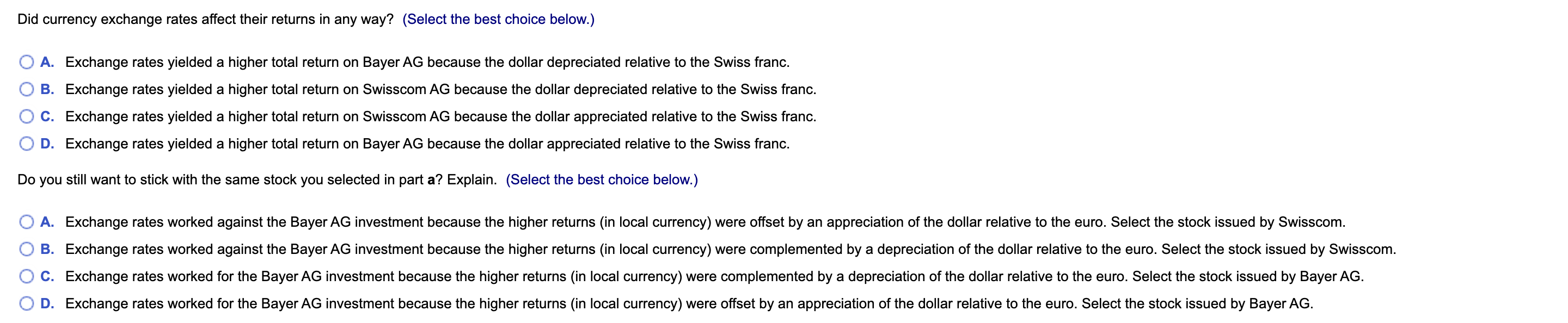

George Robbins considers himself an aggressive investor. He's thinking about investing in some foreign securities and is looking at stocks in (1) Bayer AG, the big German chemical and health-care firm, and (2) Swisscom AG, the Swiss telecommunications company. Bayer AG, which trades on the Frankfurt Exchange, is currently priced at 58.07 euros () per share. It pays annual dividends of 1.77 euro per share. Robbins expects the stock to climb to 64.88 euro per share over the next 12 months. The current exchange rate is 0.8706 /U.S. S, but that's expected to rise to 0.9616 /U.S. $. The other company, Swisscom, trades on the Zurich Exchange and is currently priced at 70.03 Swiss francs (Sf) per share. The stock pays annual dividends of 1.34 Sf per share. Its share price is expected to go up to 71.65 Sf within a year. At current exchange rates, 1 sf is worth $0.7641 U.S., but that's expected to go to $0.8895 by the end of the 1-year holding period. a. Ignoring the currency effect, which of the two stocks promises the higher total return (in its local currency)? Based on this information, which of the two stocks looks like the better investrient? b. Which of the two stocks has the better total return in U.S. dollars? Did currency exchange rates affect their retums in any way? Do you still want to stick with the same stock you selected in part a? Explain. a. Ignoring the currency effect, the holding period return for Bayer AG is %. (Round to two decimal places.) Ignoring the currency effect, the holding period return for Swisscom AG is %. (Round to two decimal places.) Ignoring the currency effect, which of the two stocks promises the higher total retum its local currency)? Based on this information, which of the two stocks looks like the better investment? (Select the best choice below.) O Bayer AG promises the higher total return. Based on total returns in foreign currency form, Swisscom AG is the better investment, O Bayer AG promises the higher total return. Based on total returns in foreign currency form, Bayer AG is the better investment. O Swisscom AG promises the higher total return. Based on total retums in foreign currency form, Bayer AG is the better investment. O Swisscom AG promises the higher total retum. Based on total returis in foreign currency form, Swisscom AG is the better investment. b. The total retum In U.S. dollars for Bayer AG I % (Round to two decimal places.) The total relum in U.S. dollars for Swisscom AG is %. (Round to two decimal places.) Which of the two stocks has the better total return in U.S. dollars? (Select the best choice below.) Swisscom AG O Bayor AG Did currency exchange rates affect their returns in any way? (Select the best choice below.) O A. Exchange rates yielded a higher total return on Bayer AG because the dollar depreciated relative to the Swiss franc. B. Exchange rates yielded a higher total return on Swisscom AG because the dollar depreciated relative to the Swiss franc. C. Exchange rates yielded a higher total return on Swisscom AG because the dollar appreciated relative to the Swiss franc. D. Exchange rates yielded a higher total return on Bayer AG because the dollar appreciated relative to the Swiss franc. Do you still want to stick with the same stock you selected in part a? Explain. (Select the best choice below.) A. Exchange rates worked against the Bayer AG investment because the higher returns (in local currency) were offset by an appreciation of the dollar relative to the euro. Select the stock issued by Swisscom. B. Exchange rates worked against the Bayer AG investment because the higher returns (in local currency) were complemented by a depreciation of the dollar relative to the euro. Select the stock issued by Swisscom. C. Exchange rates worked for the Bayer AG investment because the higher returns (in local currency) were complemented by a depreciation of the dollar relative to the euro. Select the stock issued by Bayer AG. OD. Exchange rates worked for the Bayer AG investment because the higher returns (in local currency) were offset by an appreciation of the dollar relative to the euro. Select the stock issued by Bayer AG