Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Georgia and Mike own a beach house that they rent out on Airbnb. In 2023 they rented the house for 12 days and used the

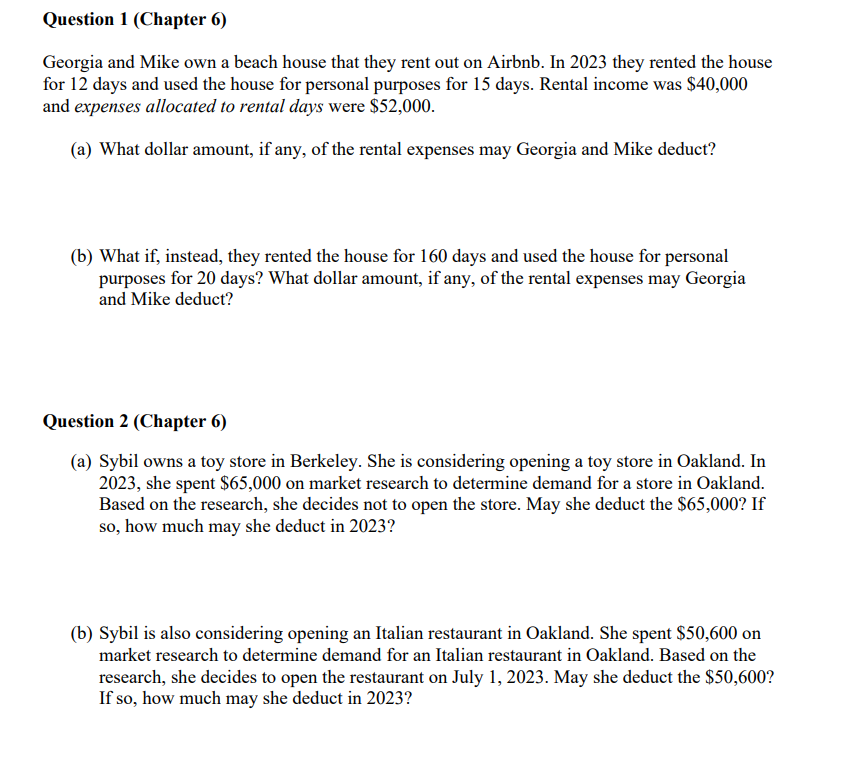

Georgia and Mike own a beach house that they rent out on Airbnb. In 2023 they rented the house for 12 days and used the house for personal purposes for 15 days. Rental income was $40,000 and expenses allocated to rental days were $52,000. (a) What dollar amount, if any, of the rental expenses may Georgia and Mike deduct? (b) What if, instead, they rented the house for 160 days and used the house for personal purposes for 20 days? What dollar amount, if any, of the rental expenses may Georgia and Mike deduct? Question 2 (Chapter 6) (a) Sybil owns a toy store in Berkeley. She is considering opening a toy store in Oakland. In 2023 , she spent $65,000 on market research to determine demand for a store in Oakland. Based on the research, she decides not to open the store. May she deduct the $65,000 ? If so, how much may she deduct in 2023 ? (b) Sybil is also considering opening an Italian restaurant in Oakland. She spent $50,600 on market research to determine demand for an Italian restaurant in Oakland. Based on the research, she decides to open the restaurant on July 1, 2023. May she deduct the $50,600 ? If so, how much may she deduct in 2023

Georgia and Mike own a beach house that they rent out on Airbnb. In 2023 they rented the house for 12 days and used the house for personal purposes for 15 days. Rental income was $40,000 and expenses allocated to rental days were $52,000. (a) What dollar amount, if any, of the rental expenses may Georgia and Mike deduct? (b) What if, instead, they rented the house for 160 days and used the house for personal purposes for 20 days? What dollar amount, if any, of the rental expenses may Georgia and Mike deduct? Question 2 (Chapter 6) (a) Sybil owns a toy store in Berkeley. She is considering opening a toy store in Oakland. In 2023 , she spent $65,000 on market research to determine demand for a store in Oakland. Based on the research, she decides not to open the store. May she deduct the $65,000 ? If so, how much may she deduct in 2023 ? (b) Sybil is also considering opening an Italian restaurant in Oakland. She spent $50,600 on market research to determine demand for an Italian restaurant in Oakland. Based on the research, she decides to open the restaurant on July 1, 2023. May she deduct the $50,600 ? If so, how much may she deduct in 2023 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started