Answered step by step

Verified Expert Solution

Question

1 Approved Answer

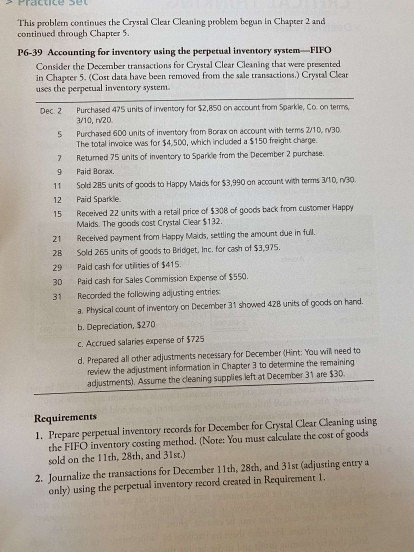

Practice set This problem continues the Crystal Clear Cleaning problem begun in Chapter 2 and continued through Chapter 5. P6-39 Accounting for inventory using the

Practice set This problem continues the Crystal Clear Cleaning problem begun in Chapter 2 and continued through Chapter 5. P6-39 Accounting for inventory using the perpetual inventory system-FIFO Consider the December transactions for Crystal Clear Cleaning that were presented in Chapter 5. (Cost data have been removed from the sale transactions.) Crystal Clear uses the perpetual inventory system. Dec 2 9 12 21 28 29 30 31 Purchased 475 units of Irwentory for $2.850 on account from Sparkle, Co on tems 3/10, 1/20 Purchased 600 units of inventory from Borax on account with terms 2/10,30 The total invoice was for $4,500, which included a $150 freight charge Returned 75 units of inventory to Sparkle from the December 2 purchase. Paid Borax. Sold 285 units of goods to Happy Maids for $3,990 on account with terms 3/10, 1/30 Paid Sparkle Received 22 units with a retail price of 5308 of goods back from customer Happy Maids. The goods cost Crystal Clear $132. Received payment from Happy Maids, settling the amount due in full. Sold 265 units of goods to Bridget, Inc. for cash of $3,975. Pald cash for utilities of $415. Paid cash for Sales Commission Experse of $550. Recorded the following adjusting entries a. Physical count of inventory on December 31 showed 428 units of goods on hand. b. Depreciation, 5270 c. Accrued salaries expense of 5725 d. Prepared all other adjustments necessary for December (Hint: You will need to review the adjustment information in Chapter 3 to determine the remaining adjustments). Assume the deaning supplies left at December 31 are $30 Requirements 1. Prepare perpetual inventory records for December for Crystal Clear Cleaning using the FIFO inventory costing method. (Note: You must calculate the cost of goods sold on the 11th, 28th, and 31st.) 2. Journalize the transactions for December 11th, 28th, and 31st (adjusting entry a only) using the perpetual inventory record created in Requirement 1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started